- Gold approaches resistance at $3,400 as investors seek safety amid global tensions.

- Altcoins lag as Bitcoin dominance holds at 64.1%, delaying the anticipated altcoin season.

- Softer US inflation data and Fed rate cut bets support gold while pressuring crypto markets.

Gold is nearing a critical technical threshold as macroeconomic uncertainties and geopolitical tensions drive investors to safer assets. Meanwhile, the pullback in altcoins has sparked inquiries about when the next crypto market rally might occur.

Analyst Michaël van de Poppe highlights the current struggle at critical gold resistance levels, indicating a potential shift in overall risk appetite should gold continue its upward movement.

Macroeconomic Events Drive Gold’s Strength, Pressure Risk Assets

Recent events around the world have strengthened the perception of gold as a safe haven. Constant geopolitical tensions, including new US tariff threats and conflicts in the Middle East and Ukraine, have prompted investors to avoid risk. The US Federal Reserve has adopted a dovish strategy, with the markets speculating a potential rate cut by September, further weakening the US Dollar. This has supported gold , which has held its ground following an initial correction of recent peaks.

Meanwhile, gold prices are also supported by the cooling of US inflation data. The lower-than-expected increase in consumer prices in May further supported expectations of reduced interest rates, which once again highlighted the attractions of gold as a non-yielding investment. All these macroeconomic drivers, combined with trade uncertainties, have contributed to containing downside movements in gold and keeping the metal in a favourable position.

Technical Analysis: Gold Battles Key Resistance, Altcoins Await Direction

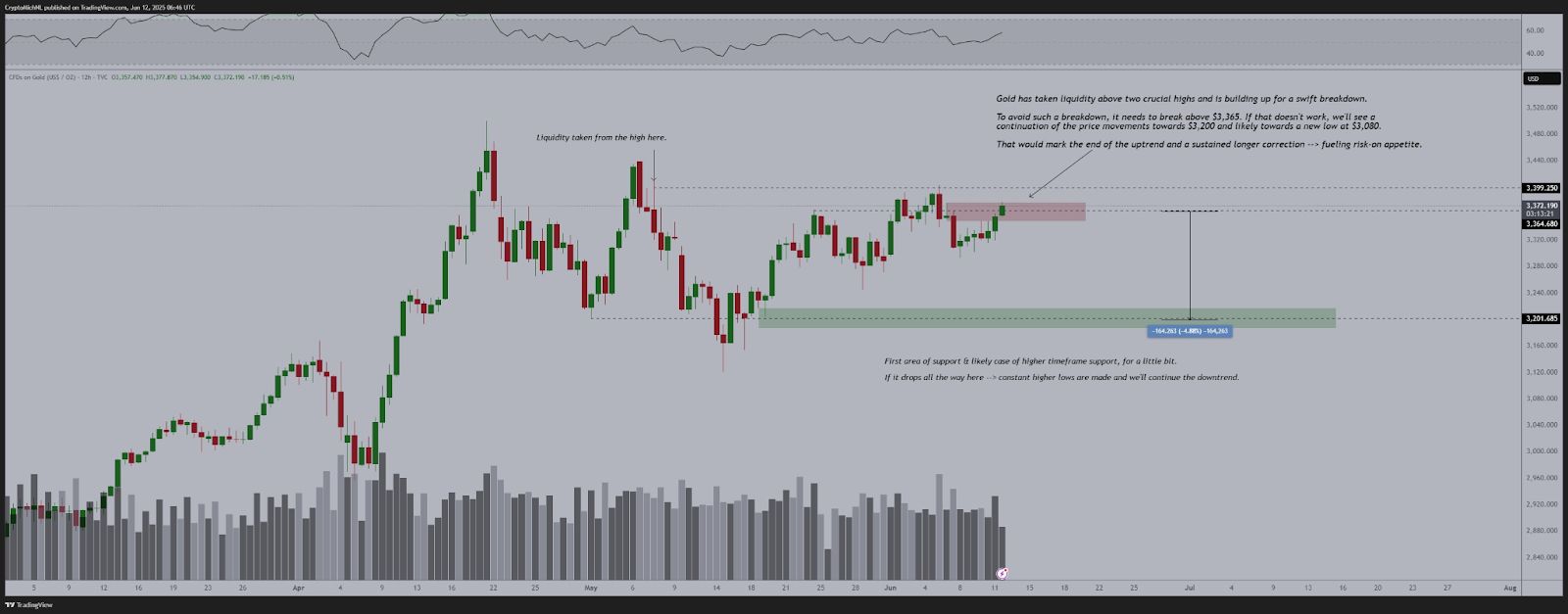

From a technical perspective, gold is consolidating just below a major resistance zone near $3,400. Michaël van de Poppe’s latest chart shows gold taking liquidity above recent highs and now building for a decisive move. Should the price move above this resistance, analysts expect another rally, which may result in gold reaching a new record high. That would represent a very risk-off type of environment, with investors still favouring safety over speculation.

Source: X

Source: X

However, if gold cannot maintain its current support around $3,200, it may face a deeper correction. This range has recently served as a demand zone. A drop below this level would probably reverse the short-term bullish trend, potentially allowing riskier assets to recover. Until this crucial technical situation clarifies, altcoins will continue to feel pressure, with many looking for more definitive signals from overall market sentiment.

Altcoin Season Delayed as Market Awaits Clearer Signals

Bitcoin’s dominance remains high at 64.1%, indicating that the altcoin season has yet to arrive in full force. Despite some altcoins outperforming Bitcoin over the past few weeks, overall liquidity remains limited, primarily due to investors’ caution and central banks’ ongoing restrictions.

Source: TradingView

Source: TradingView

Based on historical trends, major altcoin rallies tend to occur when Bitcoin’s dominance falls under 50%. Risk-on assets such as altcoins continue to face difficulties at this time, as capital continues to flow into traditional safe havens like gold.

Related: “Altcoin ETF Summer” Looms as Ethereum Breakout Signals a Market-Wide Rally

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.