Dow Jones inches up, S&P 500, Nasdaq gain as Trump pressures Fed

U.S. stocks climbed higher as softer inflation data improved the prospects of a Fed rate cut.

U.S. stock indices erased early morning losses on hopes that a lower consumer price index reading might contribute to monetary easing. On Tuesday, June 12, the Dow Jones was up 0.17%, or 70 points, while the S&P 500 and the Nasdaq both gained 0.35%.

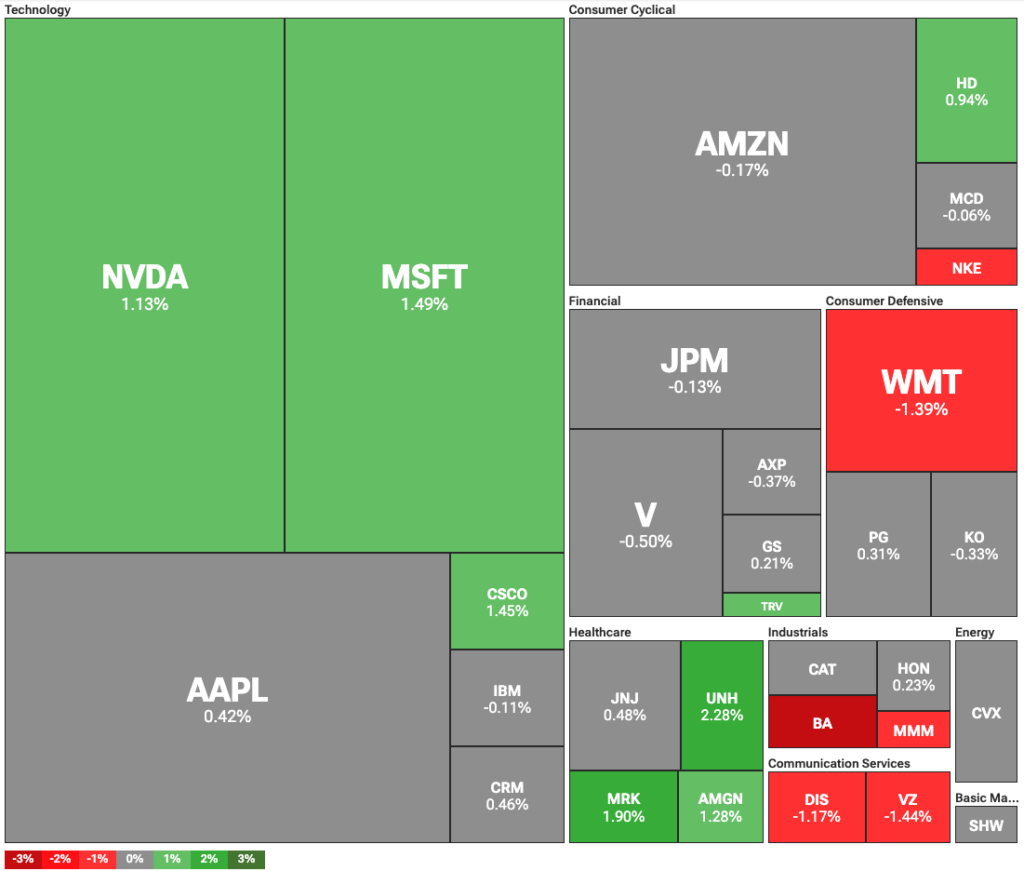

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Low inflation data is still influencing trader sentiment, with many anticipating potential rate cuts following last month’s soft CPI figures. Still, the Federal Reserve has remained hesitant to lower rates, citing the potential inflationary effects of U.S. tariffs on major trading partners.

This hesitation has been met with continued pressure from the White House. On Thursday, U.S. President Donald Trump reiterated that the Federal Reserve should cut rates by one point. While he clarified that he would not seek to fire Fed Chair Jerome Powell, he noted he might have to “force something” on rates.

Boeing loses 4.5%, Oracle hits ATH

Dow Jones was weighed down by Boeing stock, which saw a significant decline after the deadly Dreamliner crash in India. Shares of the aircraft manufacturer were down 4.5%, as the latest crash compounded recent scandals involving the company.

In 2024, the company faced a series of scandals , all starting with one plane that had its door ripped in mid-air. This led to whistleblowers exposing corner-cutting when it comes to safety, as well as attempted coverups.

On the other hand, Oracle stock jumped 14% to an all-time high after its earnings beat Wall Street expectations. The firm revised its expected revenue for 2026 to $67 billion, up from the previous estimate of $66 billion.

The reason for the revised forecast is the expected growing demand for its AI-powered cloud services. The revenue from its cloud service rose 14% quarterly, largely due to the built-in and integrated AI services the company provides.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!