Hong Kong SFC to Bring Crypto OTC Trading and Custodians Under Regulatory Oversight

On June 13, Leung Fung-yee, CEO of the Hong Kong Securities and Futures Commission (SFC), stated that as early as 2018, the SFC had introduced a regulatory framework for virtual assets from the perspective of investor protection. Against the backdrop of multiple market cycles, geopolitical shifts, and digitalization, Bitcoin has become an alternative asset and a tool in the competition for financial supremacy. She emphasized that Hong Kong adopts a "same business, same risk, same rules" regulatory philosophy. In addition to already licensed exchanges, the next step will be to bring over-the-counter trading and custodial institutions under regulatory oversight.

In her keynote speech, she further noted that in the current macro environment, market volatility has become the new normal for capital markets. Therefore, as a regulator, the SFC must respond with a flexible yet robust regulatory approach to ensure the resilience of Hong Kong’s markets, while leveraging the city’s unique strengths to seize new opportunities. In simple terms, the SFC’s strategy consists of a "strong shield" and "three sharp arrows": the strong shield symbolizes the resilience of the market and financial institutions, while the arrows represent targeted growth strategies aimed at unlocking the market’s development potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Abracadabra attacked, hacker has transferred all $1.7 million stolen to Tornado Cash

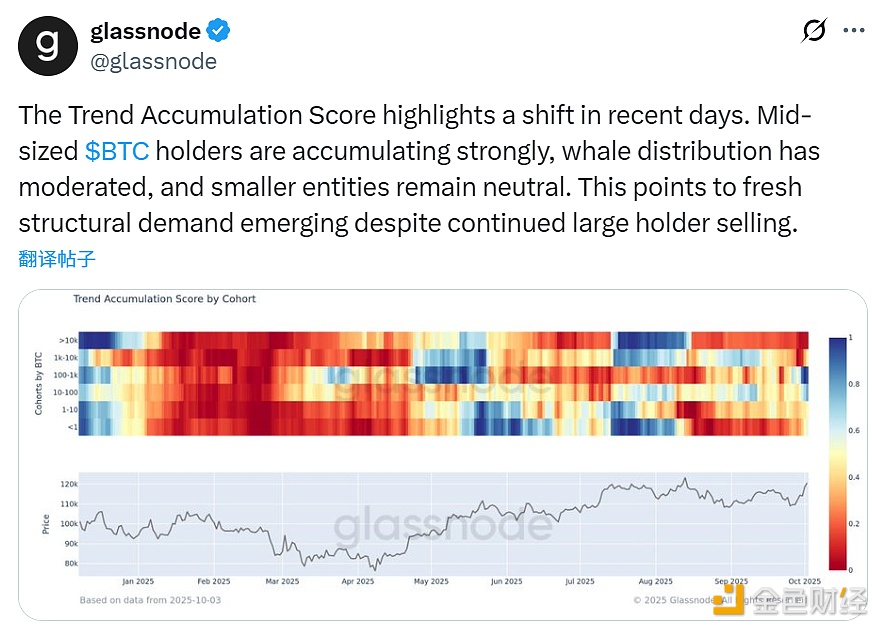

Opinion: Bitcoin Whale Sell-Off Slows Down, New Structural Demand Emerges

Data: Trend Research under Yilihua deposited 5,083.3 ETH to an exchange in the past 15 minutes

1,768,956,780 USDC transferred from a certain exchange to an unknown wallet