-

XRP has experienced a 6.5% decline over three days despite strong bullish catalysts such as USDC integration and the upcoming XRPL EVM mainnet launch scheduled for Q2 2025.

-

Technical indicators reveal early signs of momentum reversal, yet bearish EMA trends keep XRP below the critical resistance level of $2.28.

-

Ripple’s final opportunity to settle its lawsuit with the SEC ends Monday; failure to reach an agreement could extend XRP’s legal challenges into 2026, according to COINOTAG sources.

XRP faces downward pressure despite positive developments like USDC integration and XRPL EVM launch, with legal uncertainties looming ahead of the SEC settlement deadline.

XRP Gains Utility, But Price Struggles Ahead of Legal Deadline

Despite a series of positive developments surrounding Ripple, XRP’s price has declined by 6.5% over the past three days. Ripple executives recently confirmed the XRPL EVM sidechain mainnet launch is set for Q2 2025, introducing Ethereum-compatible smart contracts to the XRP Ledger—a significant enhancement for the ecosystem. Additionally, several firms have increased their XRP reserves, signaling growing institutional interest.

Circle’s announcement of native USDC integration on the XRPL further strengthens XRP’s utility, fostering deeper institutional adoption and expanding use cases in decentralized finance, payments, and cross-border settlements.

Nevertheless, market participants remain cautious as Monday marks the final deadline for Ripple and the SEC to resolve their protracted legal dispute. Following a failed motion in May, Ripple submitted a revised appeal aimed at overturning a pivotal securities ruling. However, legal analysts remain skeptical about the motion’s prospects, citing a lack of substantive arguments to sway Judge Torres’ original decision.

If the motion is denied, Ripple could face an extended prohibition on retail securities sales, potentially prolonging the lawsuit into 2026. This legal uncertainty continues to weigh heavily on XRP’s short-term price dynamics despite favorable regulatory and infrastructural developments.

XRP Momentum Shifts: RSI and DMI Signal Potential Reversal

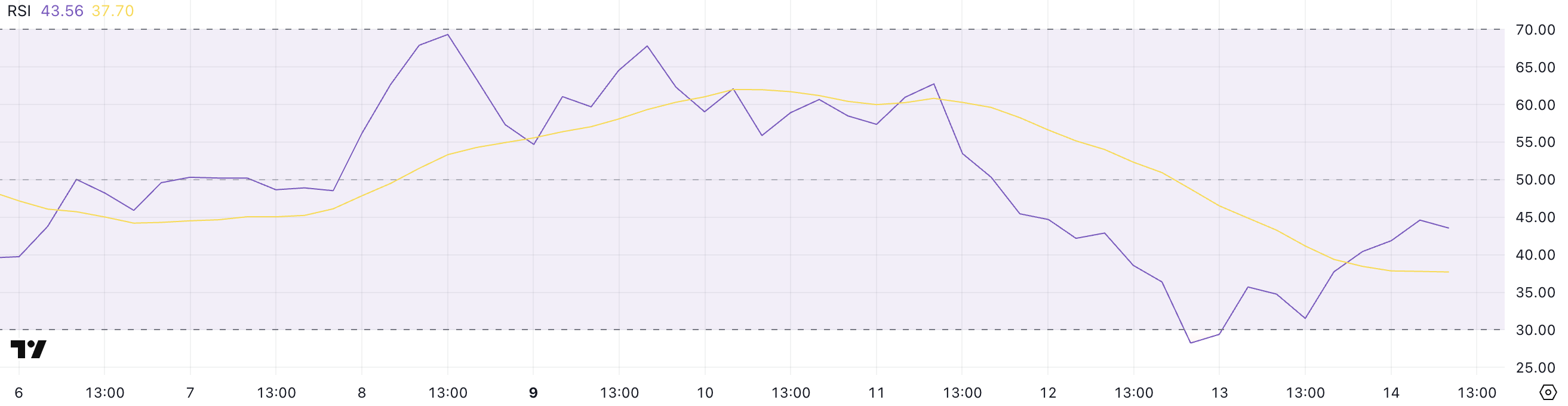

XRP’s Relative Strength Index (RSI) has climbed to 43.56 from a recent low of 28.24, signaling a move out of oversold conditions. The RSI, which measures price momentum on a scale from 0 to 100, typically indicates oversold conditions below 30 and overbought levels above 70.

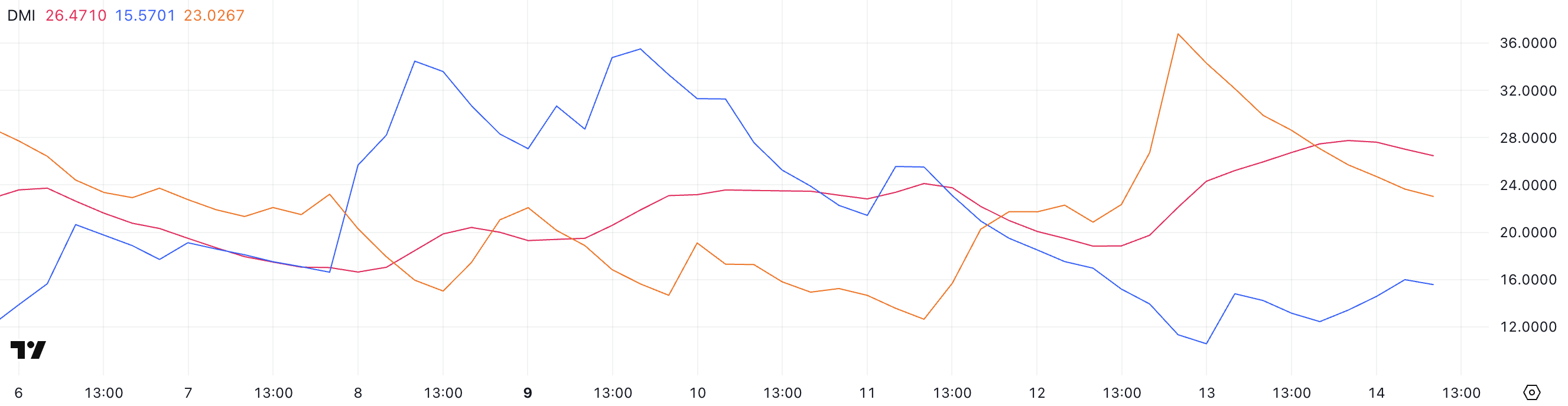

This upward shift in RSI suggests early buyer interest is returning, although XRP has yet to enter a fully bullish momentum phase. Concurrently, the Average Directional Index (ADX), which quantifies trend strength regardless of direction, has increased to 26.47 from 18.84, surpassing the 25 threshold that often marks the emergence of a strong trend.

The positive directional index (+DI) rose from 10.56 to 15.57, while the negative directional index (-DI) dropped sharply from 36.77 to 23. This crossover indicates growing bullish momentum as bearish pressure diminishes. Should this trend continue and the ADX maintain its upward trajectory, XRP may be poised for a technical trend reversal to the upside.

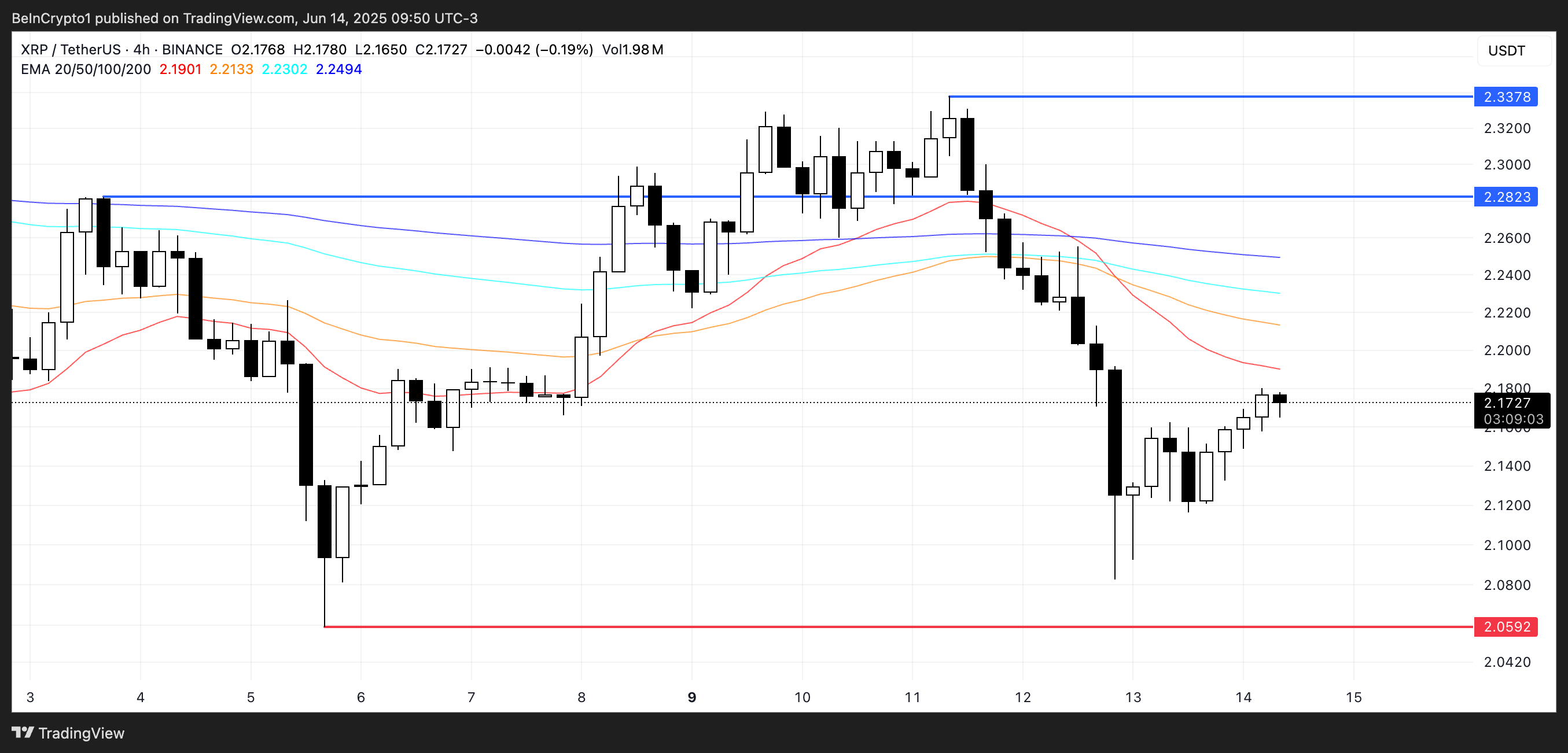

EMA Signals Still Bearish, But XRP Eyes Break Above $2.28

Despite encouraging momentum indicators, XRP’s Exponential Moving Averages (EMAs) remain bearish, with short-term averages positioned below longer-term ones, reflecting prevailing downward pressure.

However, recent price movements suggest a potential shift in market sentiment. A successful break above the key resistance level at $2.28 could pave the way for further gains toward the next resistance target near $2.33.

This breakout would represent a meaningful technical improvement and could signal renewed bullish strength. Conversely, failure to surpass this resistance may trigger a correction, potentially driving XRP back toward the $2.05 support zone.

Conclusion

XRP currently navigates a complex landscape, balancing promising utility enhancements and institutional adoption against bearish technical signals and looming legal uncertainties. While momentum indicators hint at a possible trend reversal, bearish EMA configurations and the unresolved SEC lawsuit continue to pressure the price. Investors should monitor XRP’s ability to break above $2.28 and the outcome of the SEC settlement deadline closely, as these factors will be critical in shaping XRP’s near-term trajectory.