‘Bond King’ Jeffrey Gundlach Says US Dollar To Continue Going Down, Sees American Currency Entering Bear Market and Collapsing 25%

Billionaire Jeffrey Gundlach is warning that the US dollar is very close to triggering a collapse amid its sustained weakness this year.

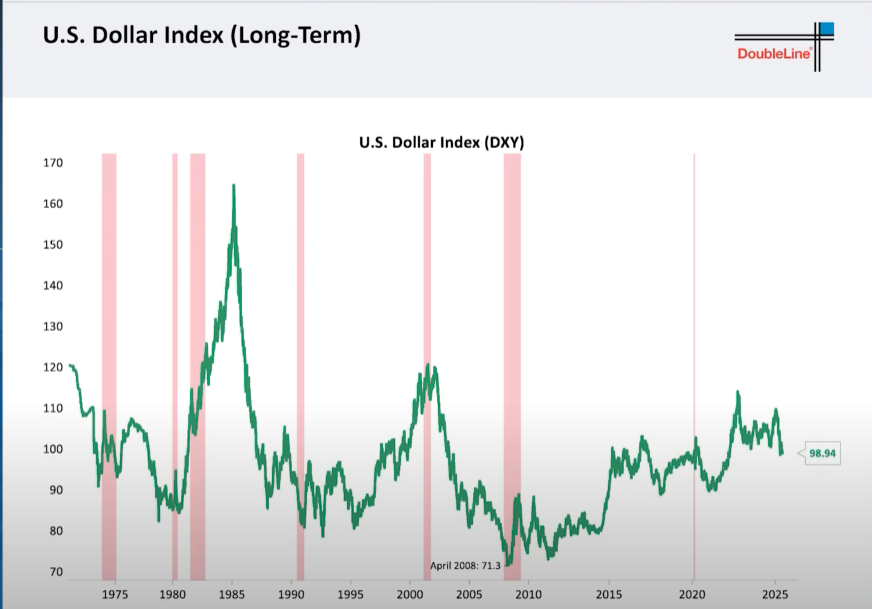

In a new video update, the DoubleLine Capital CEO says he’s keeping a close watch on the US dollar index (DXY), which tracks the performance of the USD against a basket of foreign currencies.

Gundlach points out that the DXY has been in a macro downtrend, and he expects the US dollar index to melt down if it loses a diagonal trendline that has held as support since 2011.

“The dollar has been in a pattern of lower highs going back to 1985 and lower lows, with the exception of 2020, perhaps. But I think the dollar is going to continue to go down.

I know I am not alone in this view… If it breaks down, if you can mentally draw a trendline between that low in 2011 (DXY at 72) and the low back in 2021 (DXY at 89), if we break down below that trendline, I think it’s truly a dollar bear market.

Should that happen, I would expect it to take out the low on this chart, so down below the level of around 72 or whatever. Now this is surreal.”

Source: DoubleLine Capital/YouTube

Source: DoubleLine Capital/YouTube

Based on Gundlach’s diagonal trendline, the DXY needs to stay above 97 to avoid a 25% crash toward 72. At time of writing, the DXY is hovering at 98.24.

Last week, the billionaire Bond King said that the stock market, the dollar and the Treasury market are not behaving as usual, hinting at deeper concerns that are unsettling investors in US assets. According to Gundlach, foreign investors holding trillions in US assets may begin pulling out of American markets as concerns mount over the government’s unsustainable fiscal path.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!