-

Ethereum (ETH) exhibits promising bullish signals amid a significant surge in stablecoin supply, indicating rising network utility and investor interest.

-

Despite the positive indicators, spot traders continue to offload ETH, creating short-term downward pressure on its price.

-

According to COINOTAG analysis, the contrasting behaviors between long-term holders and spot traders highlight a complex market dynamic for ETH.

Ethereum’s stablecoin inflow surge boosts bullish sentiment, but spot selling pressures keep ETH price volatile amid growing investor interest.

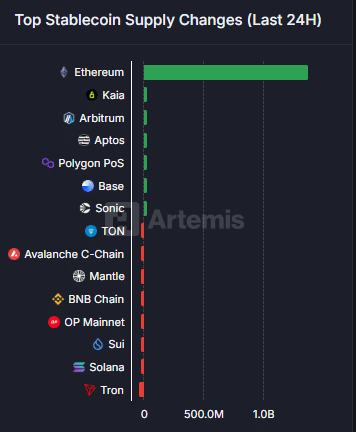

Significant Stablecoin Inflows Signal Increased Ethereum Network Activity

Ethereum has recently experienced a remarkable influx of stablecoins, with approximately $1.4 billion added to its network within 24 hours. This substantial increase suggests heightened demand for stablecoins by ETH users, often a precursor to increased transactional activity and utility on the blockchain.

Such a surge typically reflects growing engagement with decentralized finance (DeFi) protocols and other Ethereum-based applications, which rely heavily on stablecoin liquidity. The influx may also indicate that investors are positioning themselves to capitalize on upcoming network developments or market movements.

Source: Artemis

Additionally, the Bridged Netflow metric, which tracks assets moving into Ethereum from other blockchains, spiked to $114,000, predominantly from SOL holders divesting their positions. This cross-chain capital movement underscores Ethereum’s perceived strength relative to other major cryptocurrencies and may contribute to sustained price appreciation if the trend persists.

Long-Term Investor Confidence Reflected in TVL Growth

The surge in stablecoin supply aligns with a notable increase in Ethereum’s Total Value Locked (TVL), which climbed by 3.46% to reach $86.558 billion. TVL is a critical indicator of liquidity and investor commitment within the Ethereum ecosystem, representing assets locked in smart contracts across DeFi platforms.

Source: DeFiLlama

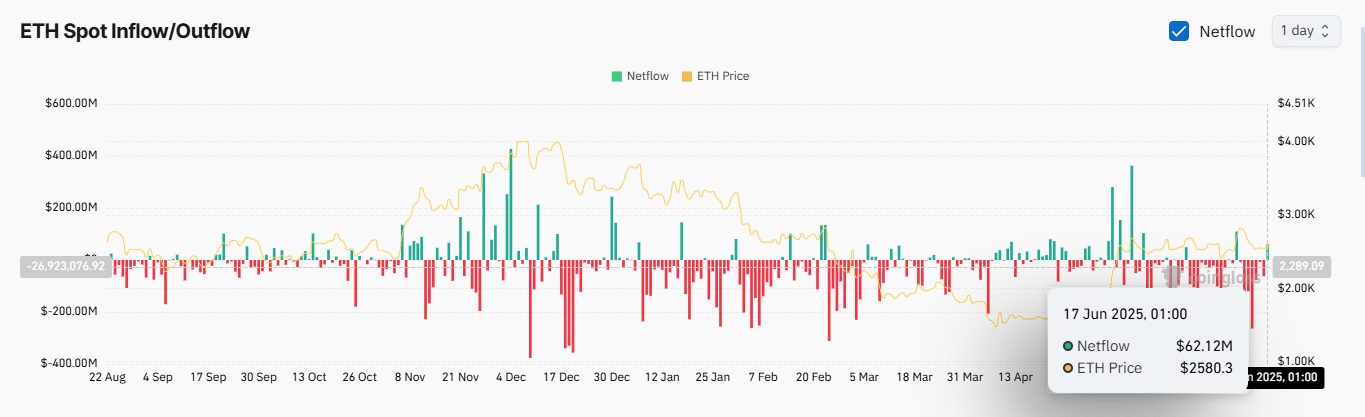

This growth indicates that investors are increasingly locking their ETH in protocols, effectively reducing circulating supply and signaling confidence in Ethereum’s long-term prospects. However, this positive trend contrasts with ongoing spot market selling, where traders have offloaded $61 million worth of ETH recently, contributing to short-term price volatility.

Source: CoinGlass

This divergence highlights a market where long-term holders demonstrate confidence by locking assets, while short-term traders engage in profit-taking or risk mitigation strategies.

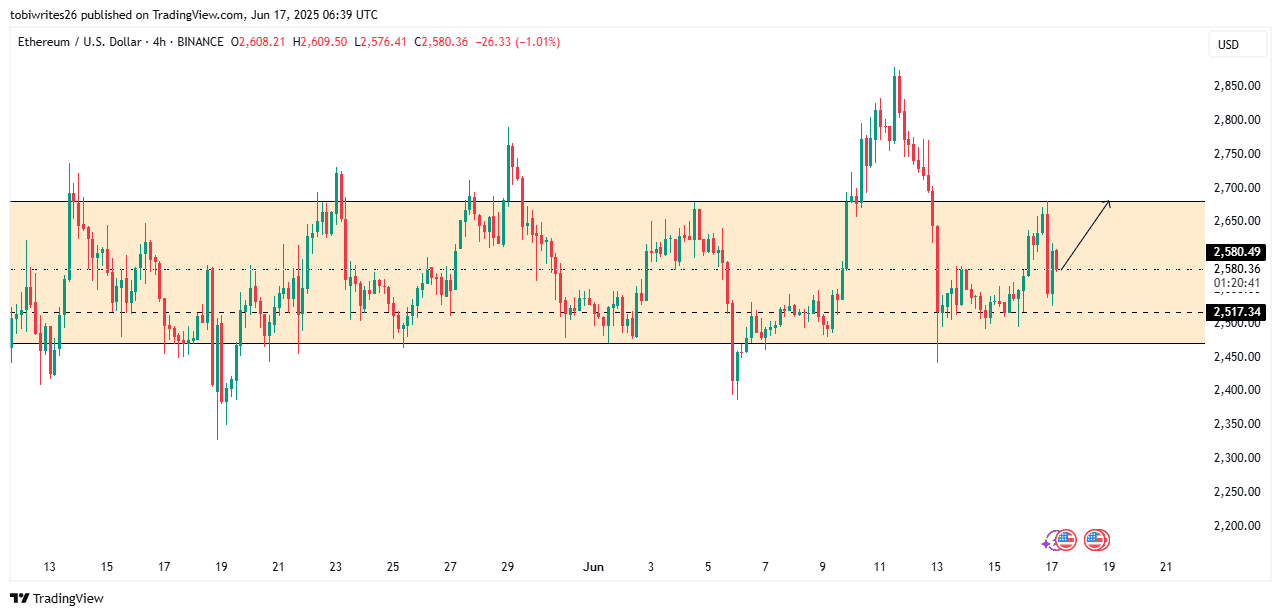

Technical Analysis: ETH Price Consolidation and Potential Scenarios

Since mid-May, ETH has been consolidating within a defined price channel, reflecting a period of indecision among market participants. This phase often precedes significant price movements, as accumulation builds momentum for a breakout or breakdown.

Source: Trading View

Two primary scenarios are plausible in the near term:

- Bullish breakout: ETH could leverage its current support level to rally toward the channel’s upper resistance, potentially triggering a sustained upward trend.

- Bearish correction: Alternatively, ETH might breach support levels, declining toward lower boundaries, which could signal further price weakness.

The ultimate direction will depend heavily on market momentum, investor sentiment, and external factors influencing the broader cryptocurrency landscape.

Conclusion

Ethereum’s recent surge in stablecoin supply and rising TVL underscore a strong long-term bullish outlook, reflecting increased network activity and investor confidence. However, persistent spot selling introduces short-term volatility, creating a complex market environment. Traders and investors should monitor key support and resistance levels closely, as ETH’s next price movement will hinge on the balance between accumulating long-term holders and active spot market participants. Staying informed and agile remains crucial in navigating Ethereum’s evolving landscape.