How Will Bitcoin Price React if the US Enters the Iran-Israel War

If the United States formally joins the Israel–Iran war, Bitcoin and the broader crypto market may see sharp short-term losses.Based on President Trump’s recent posts and geopolitical rumors, the US might make a decision to enter this conflict. Market analysts expect risk-off sentiment to dominate global assets, pulling liquidity away from volatile sectors like cryptocurrencies. …

If the United States formally joins the Israel–Iran war, Bitcoin and the broader crypto market may see sharp short-term losses.Based on President Trump’s recent posts and geopolitical rumors, the US might make a decision to enter this conflict. Market analysts expect risk-off sentiment to dominate global assets, pulling liquidity away from volatile sectors like cryptocurrencies.

Bitcoin Faces Immediate Downside if US Enters the Conflict

Bitcoin, currently trading near $104,500, could drop 10–20% in a matter of days, based on patterns from previous geopolitical shocks.

In the early stages of large-scale conflicts, investors typically flee to traditional safe havens—such as US Treasuries, the dollar, and gold.

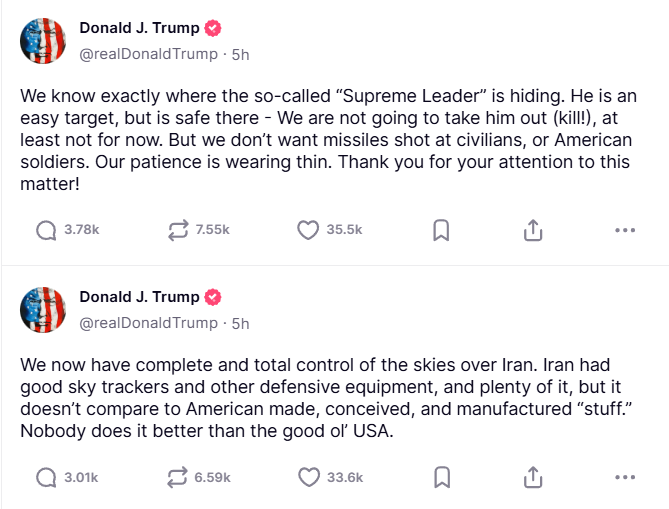

US President Donald Trump’s Warning Regarding the Conflict, From June 17, 2025. Source:

Truth Social

US President Donald Trump’s Warning Regarding the Conflict, From June 17, 2025. Source:

Truth Social

Crypto, despite some claims of being a hedge, has consistently behaved like a high-risk asset during such episodes.

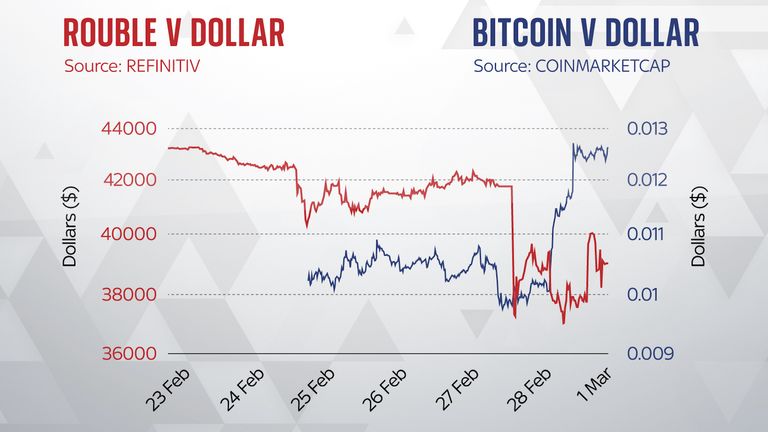

For example, during the Russia–Ukraine war in 2022, Bitcoin dropped over 12% within a week of the initial invasion. It later recovered partially but tracked equity markets closely throughout the escalation.

On-chain activity often reflects this risk aversion. Leverage tends to fall, exchange inflows rise, and trading volumes drop during periods of geopolitical stress.

These metrics signal investor flight and de-risking.

Dollar and Bitcoin Chart when the Russia-Ukraine War Started. Source:

Sky News

Dollar and Bitcoin Chart when the Russia-Ukraine War Started. Source:

Sky News

Macro Catalysts Will Compound Crypto Market Volatility

If US military action in Iran leads to a wider regional conflict, it may also spike oil prices and inflation expectations. That would pressure the Federal Reserve to delay rate cuts or even consider tightening again.

Higher energy prices could drive consumer inflation back above the Fed’s 2% target, especially with WTI crude already showing sensitivity to headlines from the Middle East.

War-driven supply shocks would likely disrupt shipping and increase input costs globally.

This is interesting:Israel and Iran are attacking each other, Trump is saying he knows where Iran’s Supreme Leader is hiding, and the US is deploying fighter jets to the Middle East.Yet, oil prices are -10% below last week’s high.What does the market know here? pic.twitter.com/R05NAKSb97

— The Kobeissi Letter (@KobeissiLetter) June 17, 2025

In that scenario, the Fed would face a difficult trade-off between economic stability and inflation control. A prolonged hawkish stance would drive up real yields and suppress crypto valuations.

US Treasury yields, already near 4.4% on the 10-year note, may rise further if war spending expands fiscal deficits. The US national debt has surpassed $36 trillion, raising long-term debt service risks.

Meanwhile, the US Dollar Index (DXY), now hovering around 98.3, could strengthen further as global investors seek dollar-denominated safety.

A rising dollar has historically been bearish for Bitcoin and altcoins, particularly in emerging markets where capital outflows follow dollar surges.

How did we arrive at a point in this country where 25% of all tax revenue goes to just paying the interest in $37 trillion in govt debt?Annually:US govt total reveneue = about $5 trillionUS govt interest on debt = about $1.2 trillionUS govt spending = about $7 trillion pic.twitter.com/d0te2sZ7is

— Wall Street Mav (@WallStreetMav) June 16, 2025

Crypto markets also tend to suffer when traditional equity volatility spikes.

The VIX, a benchmark fear gauge, usually climbs during war or crisis periods—further tightening risk budgets and triggering margin calls across crypto exchanges.

Longer-Term Path Depends on War Duration and Fed Response

If the US intervention is brief and leads to a quick ceasefire, markets may rebound. Bitcoin has historically recovered within 4–6 weeks after the initial shock, as seen in past conflict-related downturns.

However, if the war drags on or expands regionally, crypto could face an extended period of volatility, declining liquidity, and suppressed prices.

Investor appetite for speculative assets would likely remain low until geopolitical clarity returns.

That said, persistent inflation from war-related disruptions could revive the narrative of Bitcoin as a long-term hedge against fiat debasement.

But this bullish case competes directly with tighter monetary policy, which limits upside in risk-on assets.

Institutional inflows may pause or decline under such conditions. CME futures positioning, stablecoin supply, and L2 on-chain flows will be important indicators of sentiment shift in the weeks ahead.

Key levels to monitor include Bitcoin’s $100,000 psychological support and Ethereum’s $2,000 zone.

If broken, technical selling could accelerate downward pressure across all major tokens.

USD Index in the Past Six Months. Source:

Marketwatch

USD Index in the Past Six Months. Source:

Marketwatch

What to Watch Now

Investors should closely track:

- Oil price movements and forward contracts.

- Fed statements on inflation and rate policy.

- Treasury auction results and bond yield spreads.

- Exchange outflows and leverage usage in crypto.

- VIX and global risk indicators.

If the US joins the conflict, Bitcoin’s short-term future will likely be dictated by macro conditions—not crypto fundamentals.

Traders should prepare for volatility, stay hedged, and monitor geopolitical developments in real time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin infrastructure is ready, why is user experience the final bottleneck?

XRP Could See Pivotal Move in 24 Hours as Break Above $3.10–$3.15 May Open Path to $3.40