Analyst: Bitcoin’s 50-day SMA Becomes a Key Level, Breakout Above $110,000 With Strong Volume Needed to Revive Short-Term Bullish Outlook

CoinDesk analyst and Chartered Market Technician Omkar Godbole noted that the current Bitcoin price has retreated to the 50-day Simple Moving Average (SMA), a level that has provided support and triggered rebounds twice this month.

Therefore, this renewed test of the moving average offers bulls an opportunity to establish a trend—potentially turning the 50-day SMA into a springboard for a new rally. Conversely, if the 50-day SMA fails to hold as support, it could trigger stronger selling pressure and push the price below the $100,000 mark.

From a technical perspective, bearish forces appear to be gaining the upper hand. The strength of recent rebounds from the 50-day SMA has been waning: on June 5, the first test saw Bitcoin rebound more than $10,000 from $100,500; on June 17, the second test resulted in a more modest bounce from $103,000 to $109,000.

The doji candlestick pattern formed over the past week also indicates that bullish momentum above $100,000 is fading. To revive the short-term bullish outlook, Bitcoin needs to break above the key resistance level at $110,000 with strong volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

QCP: BTC ETF sees large inflows for five consecutive days, altcoin market cap hits 90-day high

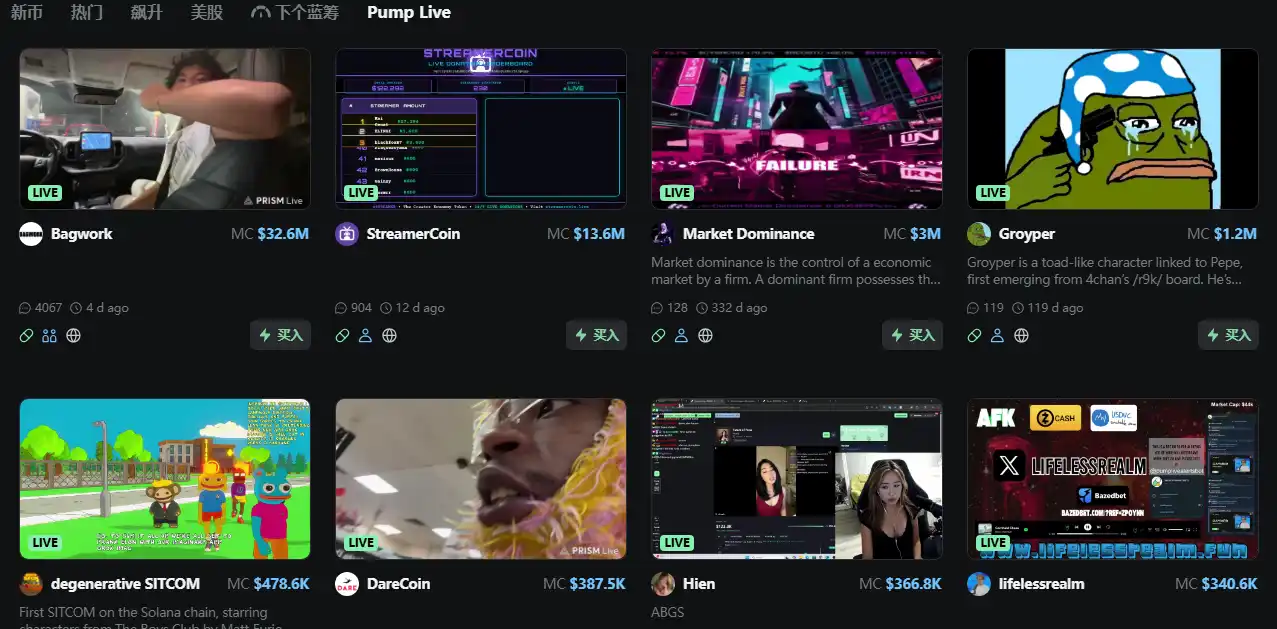

Pump Live Top 3 by Market Cap: Bagwork, STREAMER, MD, Sparking Another Solana Meme Craze

Bitcoin Officially Integrated into Starknet Staking Mechanism