Bitdeer Completes $330 Million Convertible Bond Issuance to Fund SEALMINER Miner Development and Data Center Expansion

Foresight News reports that Bitdeer has completed a $330 million convertible bond issuance with a coupon rate of 4.875%, maturing in 2031. This marks Bitdeer’s third convertible bond financing in the past year, with proceeds earmarked for SEALMINER mining machine R&D and data center expansion. The private placement was offered to qualified institutional investors, exceeding the original $300 million target and including a $45 million overallotment option. According to Wednesday’s announcement, $129.6 million of the raised funds will be used for zero-strike call option hedging, and $36.1 million in cash will be used to replace previously issued 8.5% high-yield convertible bonds. As part of the debt restructuring, Bitdeer has repurchased $75.7 million of convertible bonds issued in August 2024 (which had set a record for the highest interest rate among listed mining companies), completing the swap through a combination of cash payment and the issuance of 8.1 million shares at an implied price of about $5 per share—representing a 57% discount to the current market price of $11.80. This arrangement allowed bondholders to exit profitably while significantly reducing the company’s interest burden. As a result, Bitdeer’s share price opened down 13% on Wednesday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

American Federation of Teachers: Senate cryptocurrency bill will endanger pensions and the overall economy

U.S. stock market opens with the Dow Jones flat

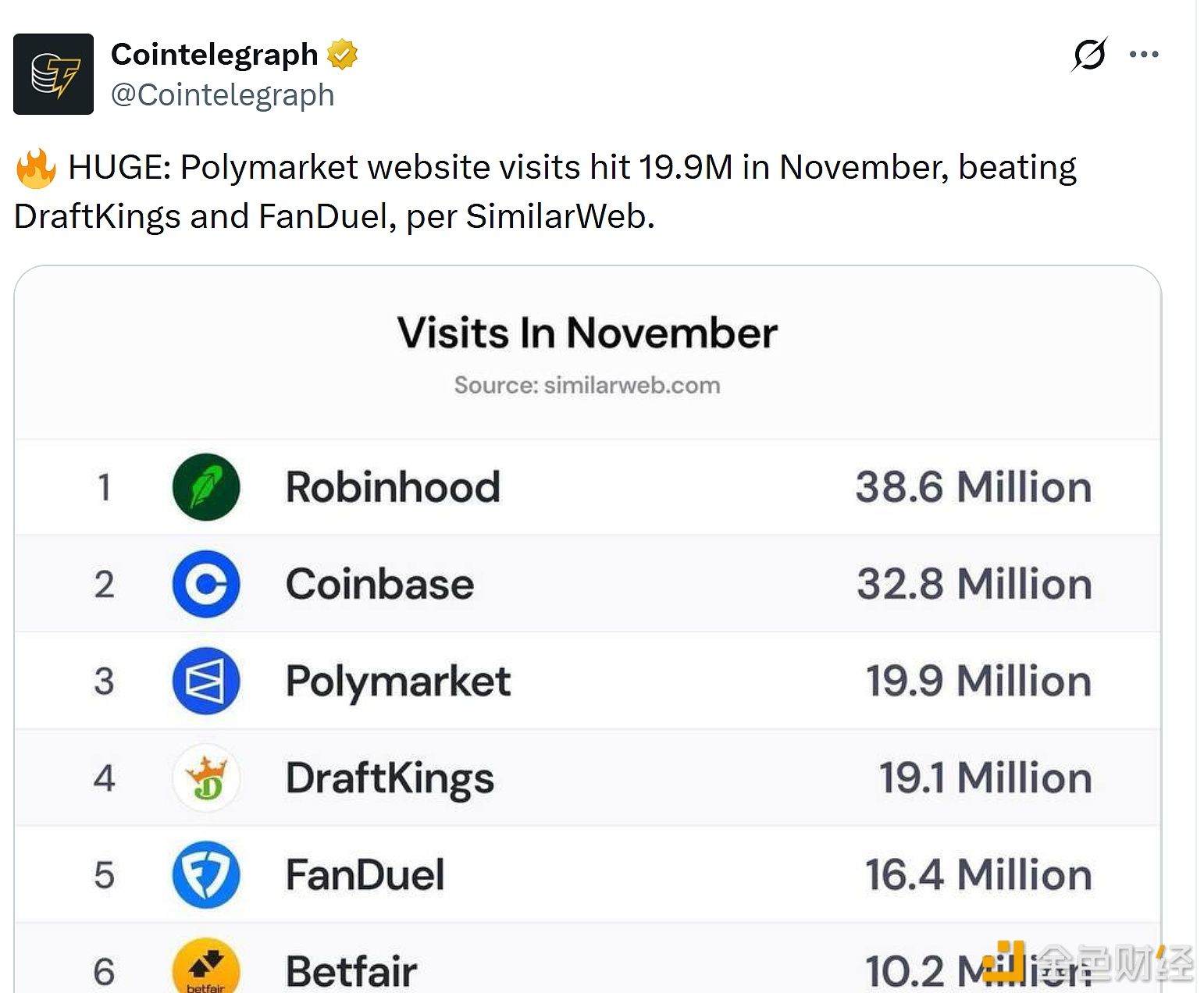

Polymarket website received 19.9 million visits in November