Goldman Sachs Flips Bullish on Ten Stocks – Bank Says These Companies Could Be China’s ‘Magnificent 7’

Banking giant Goldman Sachs is reportedly turning bullish on ten China-based companies.

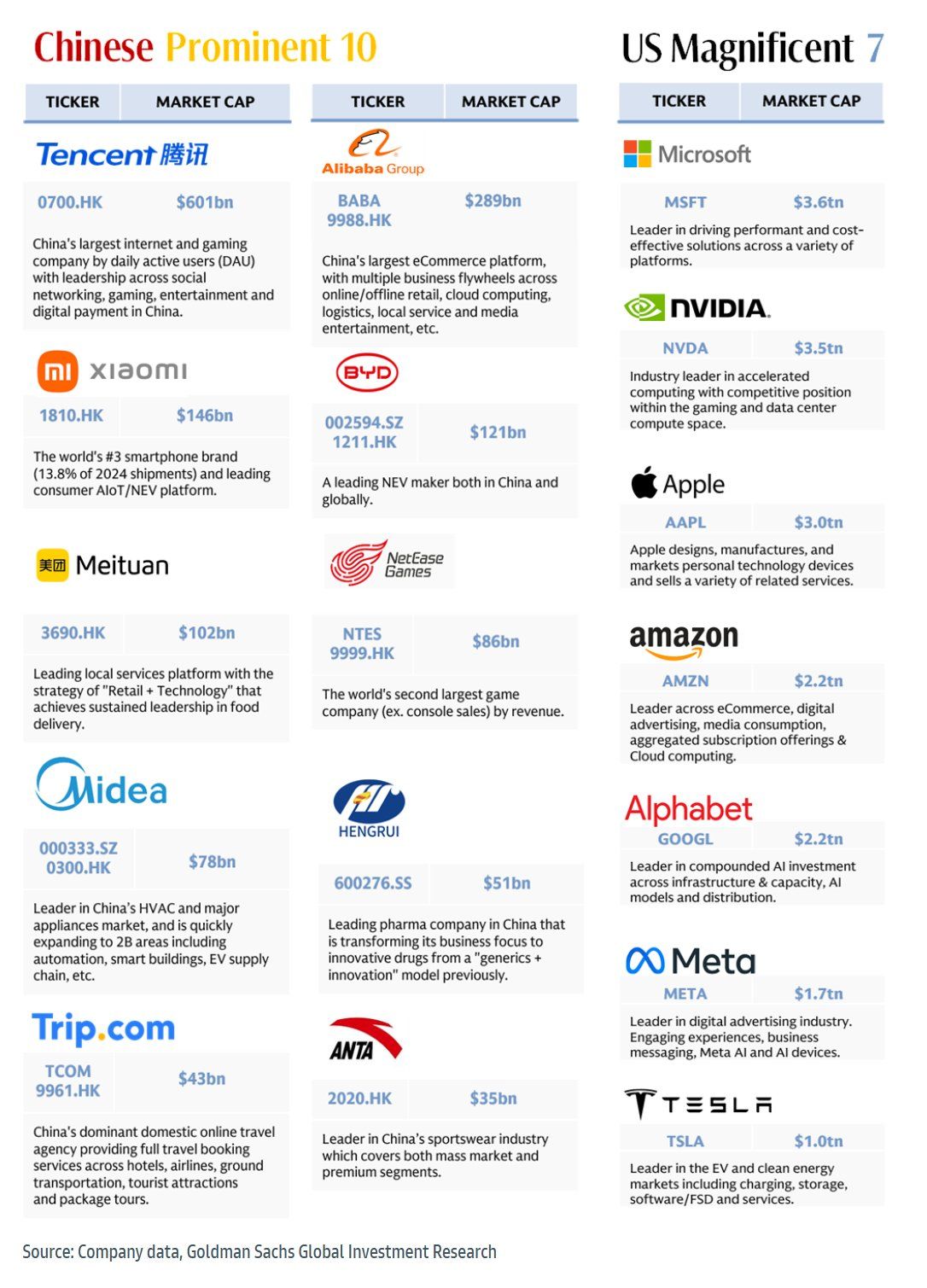

Goldman Sachs says in a note to investors that the “Prominent 10” companies in China may be the country’s answer to the “Magnificent 7” companies in the US, reports Investopedia.

Says Goldman Sachs’ analysts,

“[The ten companies] embody the theme of AI/Tech development, self-sufficiency, ‘Going Global,’ services and new forms of consumption and China’s improving shareholder returns.”

The bank’s analysts say that a favorable regulatory environment and artificial intelligence investments may boost the earnings of the ten public-owned enterprises (POEs) by 13% in each of the next two years.

The companies include the gaming and multimedia giant Tencent, e-commerce firm Alibaba, smartphone maker Xiaomi, EV maker BYD, shopping platform Meituan, online gaming firm NetEase, home appliance maker Midea, pharmaceutical company Hengrui, online travel agency Trip.com and sports equipment company ANTA.

The Magnificent Seven companies include Tesla, Meta, Alphabet, Amazon, Apple, Microsoft and Nvidia.

Goldman Sachs’ bullish outlook also factors in the Chinese equity market’s relative segmentation and modest valuations.

Another consideration by the bank’s analysts is the Chinese government’s recent move to increase support for the private economy, as well as updated regulations to make mergers and acquisitions easier.

Say the bank’s analysts,

“All these should help revitalize POEs’ investment appetite (animal spirits), thereby supporting their organic and acquisitive growth down the road.”

Source: Kris/X

Follow us on X , Facebook and Telegram

Source: Kris/X

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!