Bitcoin ETFs Hold Momentum With 8th Straight Day of Inflows | ETF News

Bitcoin ETFs continue attracting significant institutional investment, with an eighth day of inflows and renewed bullish sentiment in the market. This surge highlights Bitcoin's role as a potential hedge in volatile times.

US-listed spot Bitcoin ETFs have continued to post steady inflows for the second consecutive week. This has happened despite escalating geopolitical tensions in the Middle East and persistent pressure on BTC’s spot price.

The trend, marked by occasional dips in daily inflow volume, suggests that institutional investors remain resilient in their conviction that BTC and its associated products serve as reliable hedges during volatile market conditions.

Bitcoin ETFs See $390 Million Inflows

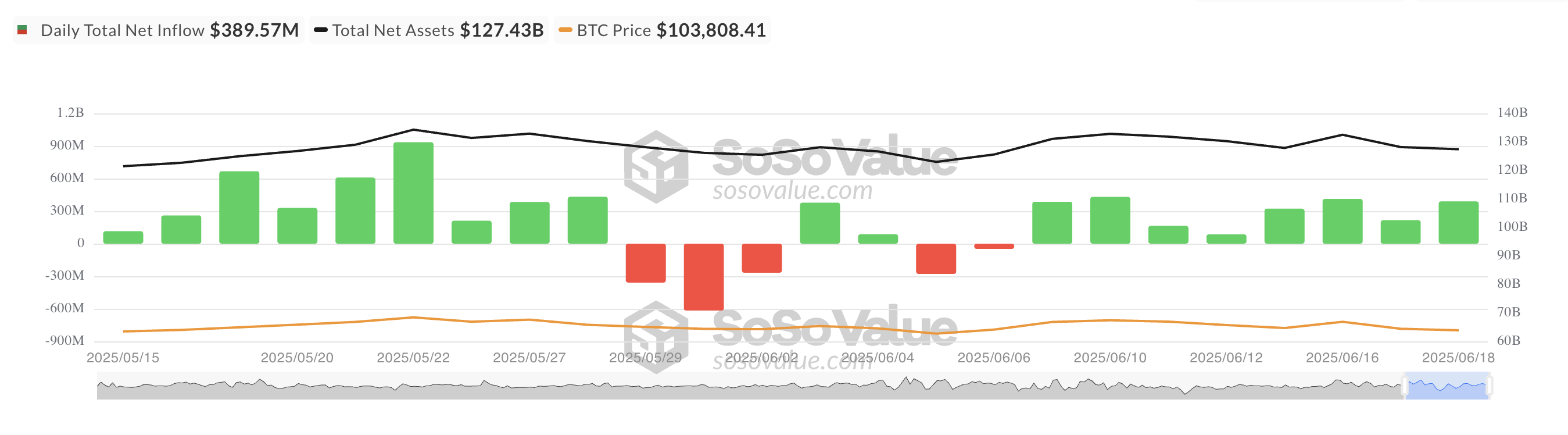

On Wednesday, BTC ETFs recorded net inflows of nearly $390 million, marking the eighth consecutive day of net positive movement into the asset class. The figure represents an 80% surge from the $216 million recorded just the day prior, highlighting a renewed wave of institutional investor interest.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

This uptick in inflows coincided with BTC briefly climbing above the key $105,000 mark during yesterday’s trading session. Although BTC has since retraced slightly, down around 0.44% at press time, it continues to hold within this price range, reflecting relative strength.

BlackRock’s spot BTC ETF IBIT recorded the highest net inflow among all BTC ETFs yesterday, with $279 million entering the fund. At press time, IBIT’s total historical net inflow is $51 billion.

Traders Turn Bullish on Bitcoin

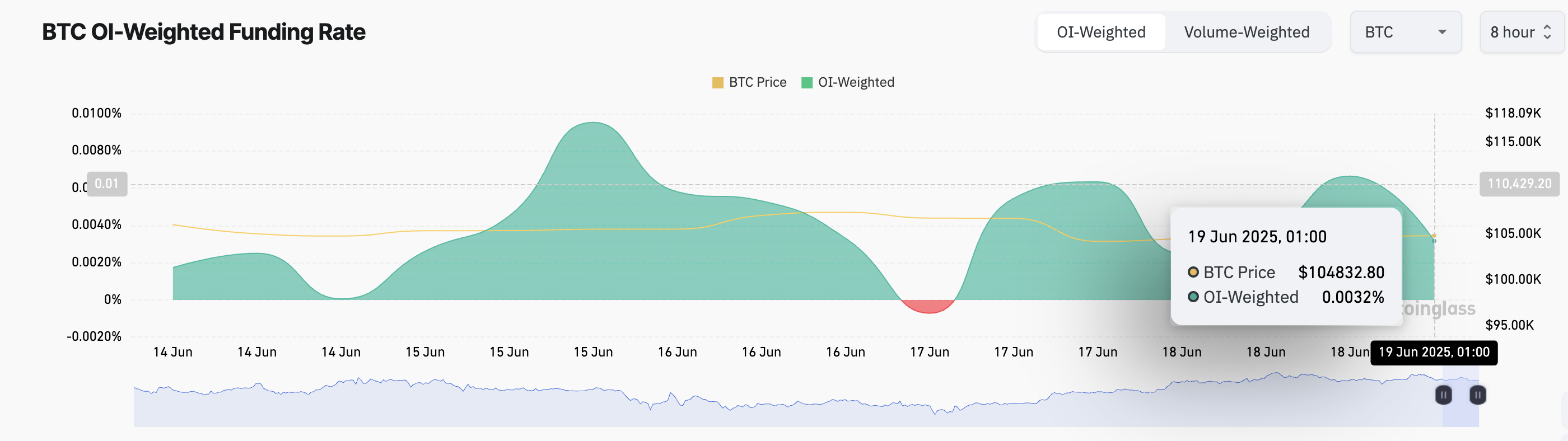

With BTC attempting to stabilize around the $105,000 price range today, derivatives data paints a cautiously optimistic picture. For example, the coin’s funding rate for perpetual futures remains positive, signaling bullish sentiment among traders. As of this writing, this is at 0.0032%.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

The funding rate is a periodic payment between traders in perpetual futures contracts. It keeps the contract price aligned with the spot price.

When an asset’s funding rate is positive like this, long-position holders are paying shorts, indicating that bullish sentiment dominates the market.

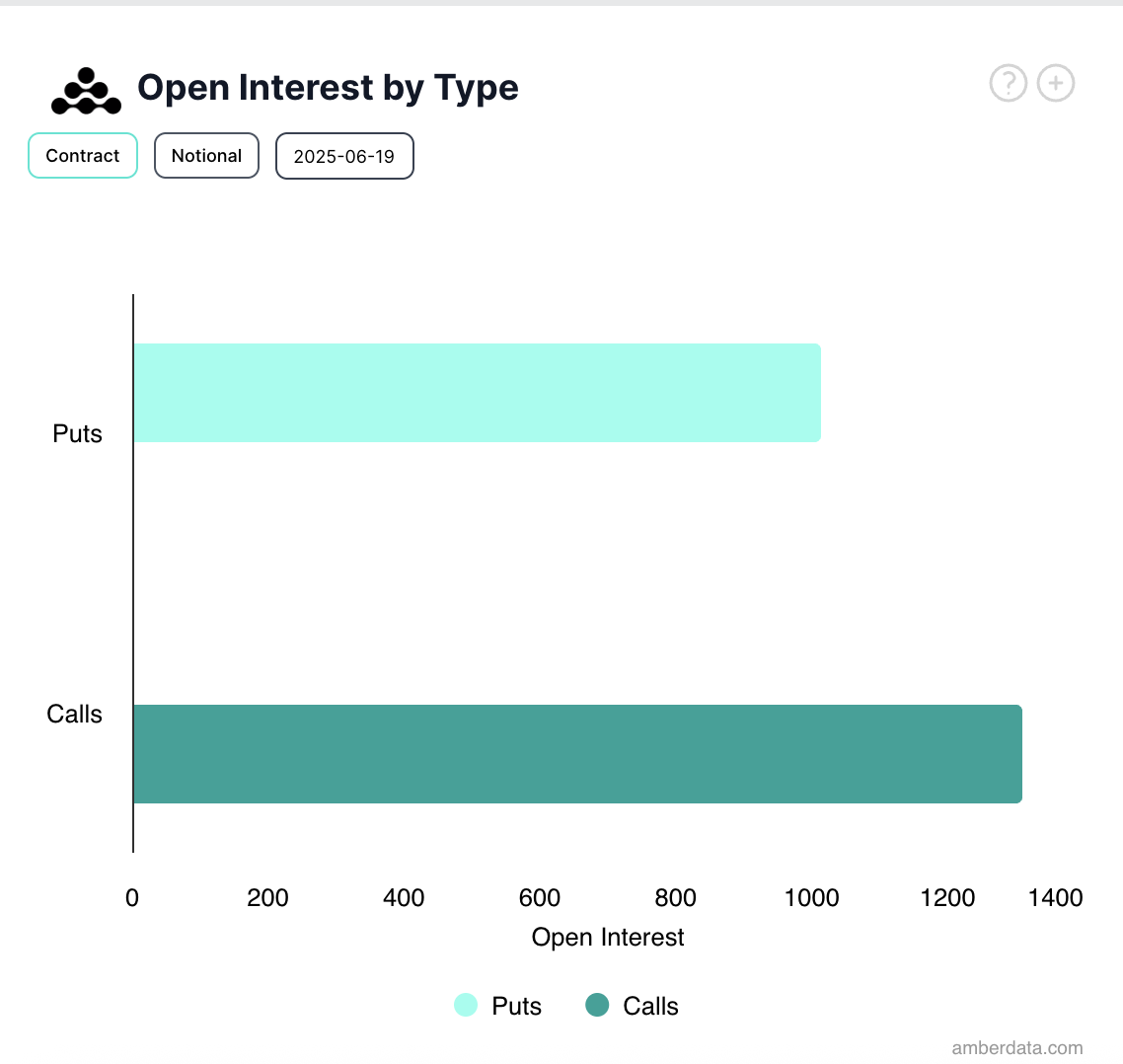

Moreover, options market activity shows a noticeable spike in call option demand today, a trend associated with bullish expectations. This hints at growing sentiment for a potential reversal in BTC’s price in the near term.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

As global uncertainty lingers, the continued momentum in Bitcoin ETF flows is a compelling indicator of the asset’s store of value in turbulent times.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Holds $0.00001288 Support as $0.00001319 Resistance Limits Upside

Dogwifhat Trades at $0.88 as Price Holds $0.8771 Support While $0.9019 Resistance Caps Upside

Bitcoin ETF Inflows Hit $741M, Highest in 2 Months

Bitcoin ETFs saw $741M in inflows yesterday, marking the biggest surge in two months amid rising market optimism.Bullish Signals Amid Market VolatilityBitcoin ETFs Gaining Investor Trust

Whales Are Hoarding Bitcoin, Small Investors Are Selling: What Does This Mean?