Analyst: Middle East Conflict Could Push US Summer CPI to 4%

According to a report by Jinse Finance, Bloomberg Economics analysts, including Ziad Daoud, stated that as the U.S. President's suspension of so-called reciprocal tariffs is about to expire, rising geopolitical risks are converging with the potential escalation of tariffs in the coming weeks. The most significant economic impact of the protracted Middle East conflict could be a surge in oil prices. In the extreme scenario of the Strait of Hormuz being closed, crude oil could soar to over $130 per barrel. This could push the U.S. summer CPI close to 4%, prompting the Federal Reserve and other central banks to delay future interest rate cuts. The report notes that any sharp increase in oil or natural gas prices, or trade disruptions caused by further escalation of the conflict, would become another drag on the global economy. (Jin10)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

USDC Treasury mints 250 million USDC

Alibaba launches more efficient Qwen3-Next AI model

BlackRock plans to tokenize its funds that hold real-world assets and stocks

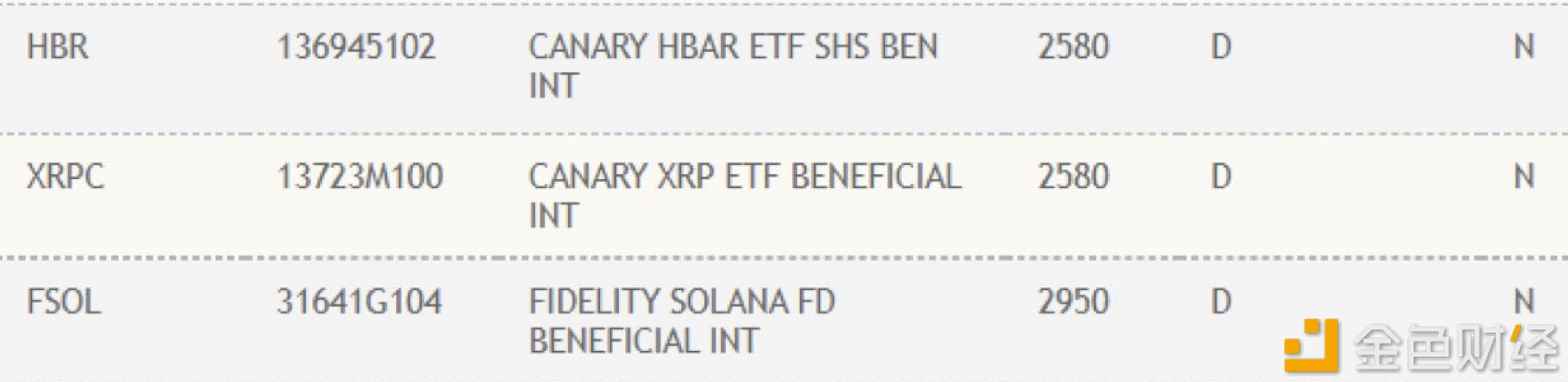

The US DTCC has now listed FSOL, HBR, and XRPC.