JPMorgan: Global Demand for Long-Term Assets Declines

According to a report by Jinse Finance, JPMorgan analyst Jay Barry stated in a mid-year outlook report that global investor demand for long-term assets appears to be declining. Based on JPMorgan's forecasts, this will lead to a decrease in the yield on US 2-year Treasury bonds, while the yield on 10-year Treasury bonds will remain near current levels. He said, "We maintain our forecast that by the end of the year, the yields on 2-year and 10-year Treasury bonds will be 3.50% and 4.35%, respectively."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

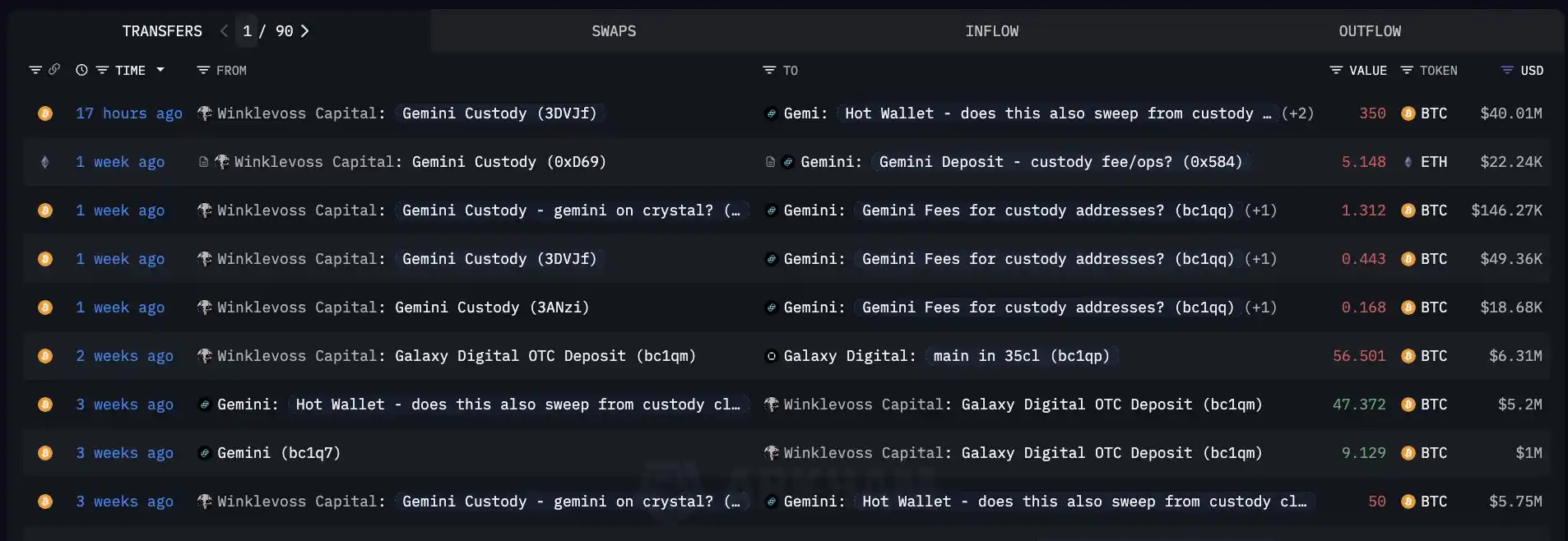

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.