Bitcoin Satoshi-era Miners Curb BTC Sales in 2025

- Bitcoin miners hold more BTC, fewer market sales.

- BTC supply stabilizes as miner sales drop.

- Miners’ actions signal market confidence.

Bitcoin miners’ significant reduction in BTC sales impacts supply stability and market confidence, reflecting a strong hold mentality.

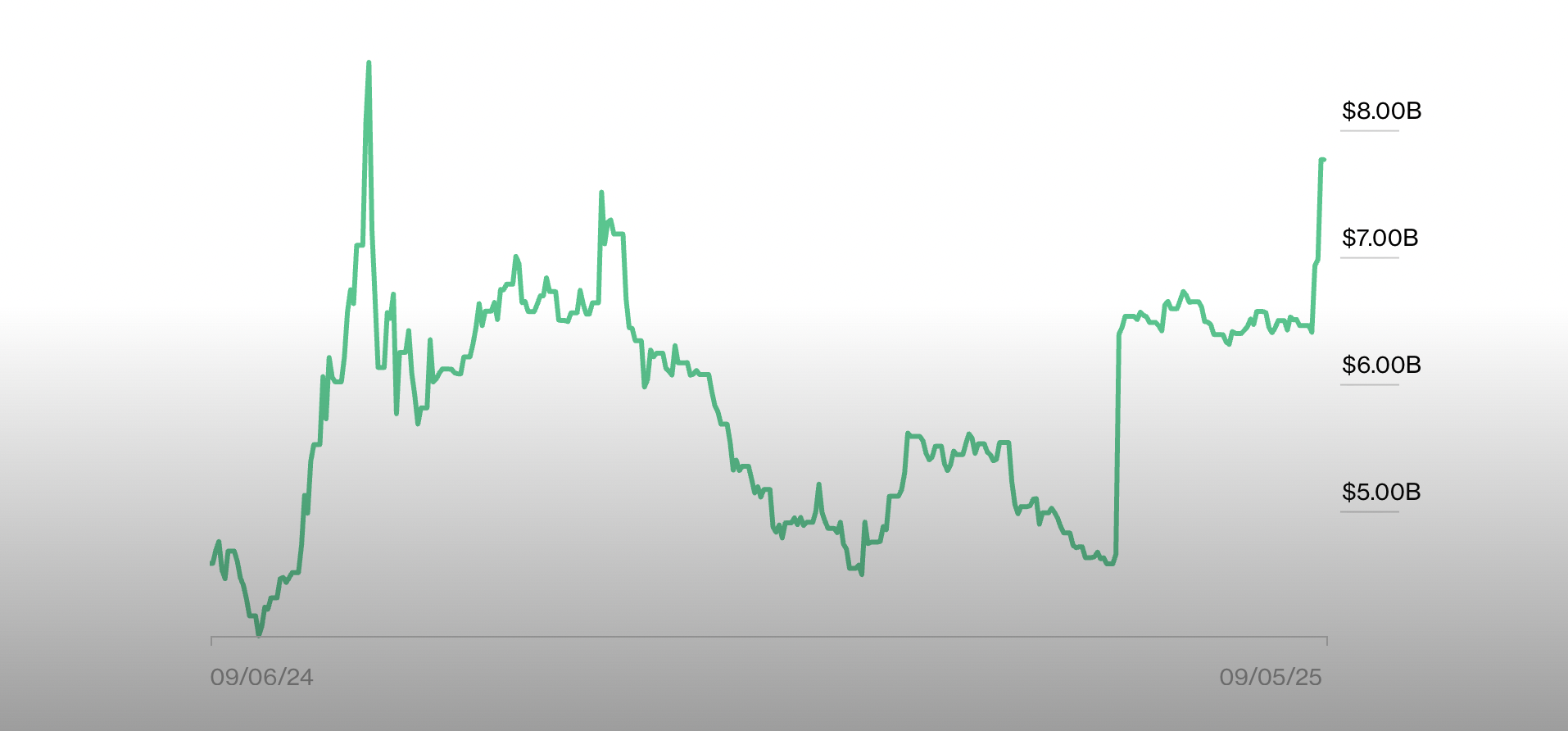

In early 2025, Satoshi-era Bitcoin miners sold a mere 150 BTC, a sharp contrast to nearly 10,000 BTC offloaded the previous year. This pivotal trend occurs as Bitcoin experiences new all-time highs, surpassing $107,000.

The decision to limit sales in 2025 is unprecedented compared to 2024, when these miners offloaded nearly 10,000 BTC. – Market Analysts, Crypto Fund Analysts

These early miners, key participants since Bitcoin’s inception, have chosen to maintain their holdings, defying past trends where they sold coins following price rallies. Their decision complements market stability, underscoring a strategic hold approach.

The market witnesses added stability as a result, significantly reducing volatility during price oscillations and inviting greater confidence from institutional and retail investors. This shift does not appear to affect altcoins or Layer-1 assets directly.

While past bull cycles saw significant Bitcoin releases by these miners, 2025 sets a precedent with restrained sales. This tactic emphasizes a potential long-term bullish stance and mitigates abrupt market fluctuations traditionally linked with high sales volume periods.

Regulatory bodies and major market leaders have not released statements concerning Satoshi-era miners. However, on-chain data indicates that miner reserves have climbed, reflecting a strategic decision to accumulate rather than distribute BTC, aligning with market maturity trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump family's wealth grew by $1.3B following ABTC and WLFI debuts: Report

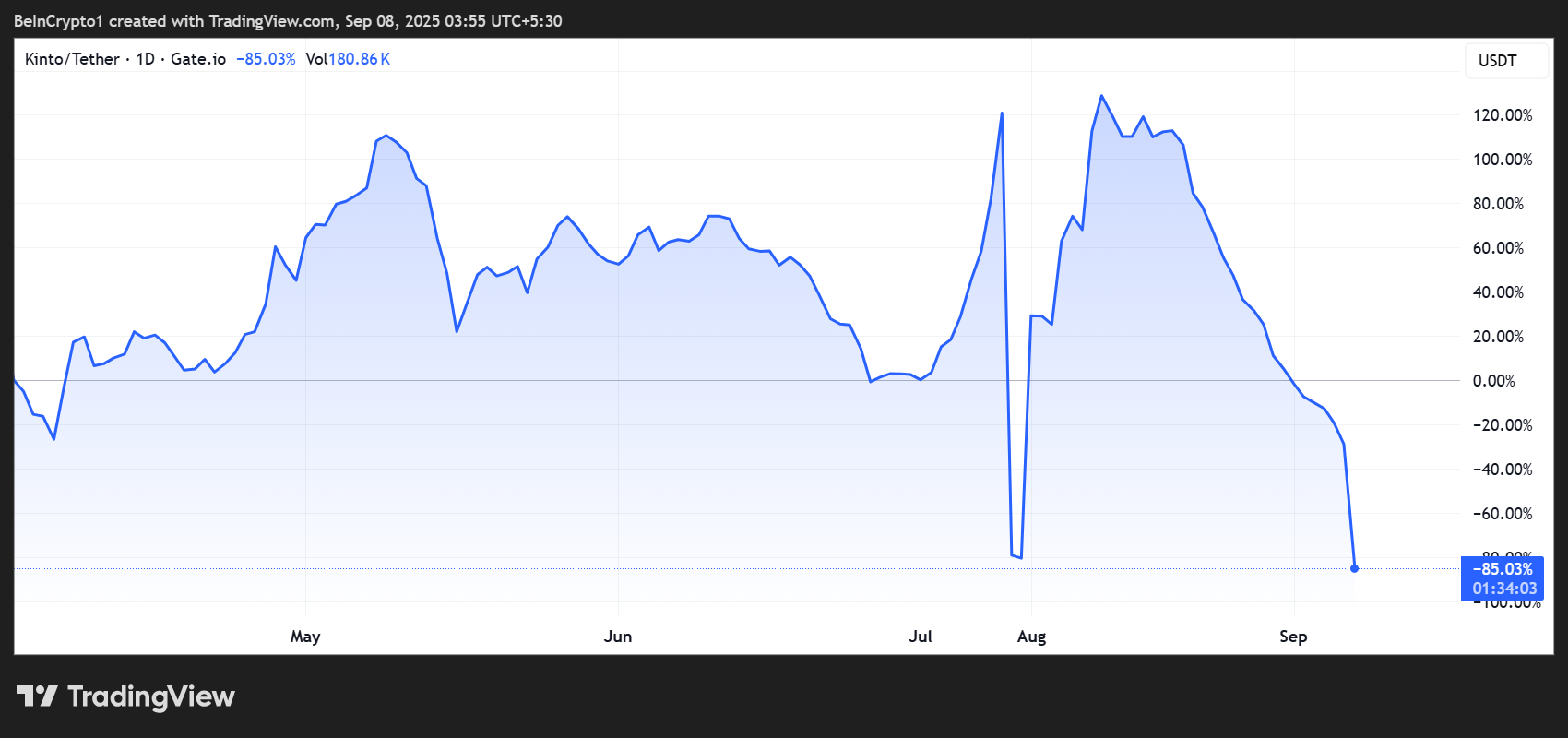

Why Kinto’s K Token Collapsed Before Unlocking

Sell Everything: A Crypto Market Crash Is Coming