Bitcoin Market Fatigue Grows: Could BTC Price Drop Below $100,000?

2025/06/27 02:20

2025/06/27 02:20Bitcoin’s price has recently rebounded, bringing it close to the critical $108,000 level. While this recovery offers hope, the key resistance remains unclaimed as support.

Adding to concerns is a noticeable shift in investor behavior, signaling market fatigue, which could be setting the stage for a price decline below $100,000.

Bitcoin Profit Taking Slows Down

In the previous market cycle (2020–2022), Bitcoin investors realized a total of approximately $550 billion in profit during multiple rallies, including two major waves. Fast forward to the current cycle, and realized profits have already exceeded $650 billion, surpassing the previous cycle’s total. This indicates that, while large gains have been made, the market may be entering a cooling phase.

The latest data suggests that profit-taking has peaked, with the market now in a cool-down period after the third major wave of profit realization. Although gains have been secured, the momentum driving Bitcoin’s upward movement appears to be waning. As realized profitability tapers off, investor sentiment shifts, leading to reduced buying pressure.

Bitcoin Bull Market Profit Realization Trend.

Bitcoin Bull Market Profit Realization Trend.

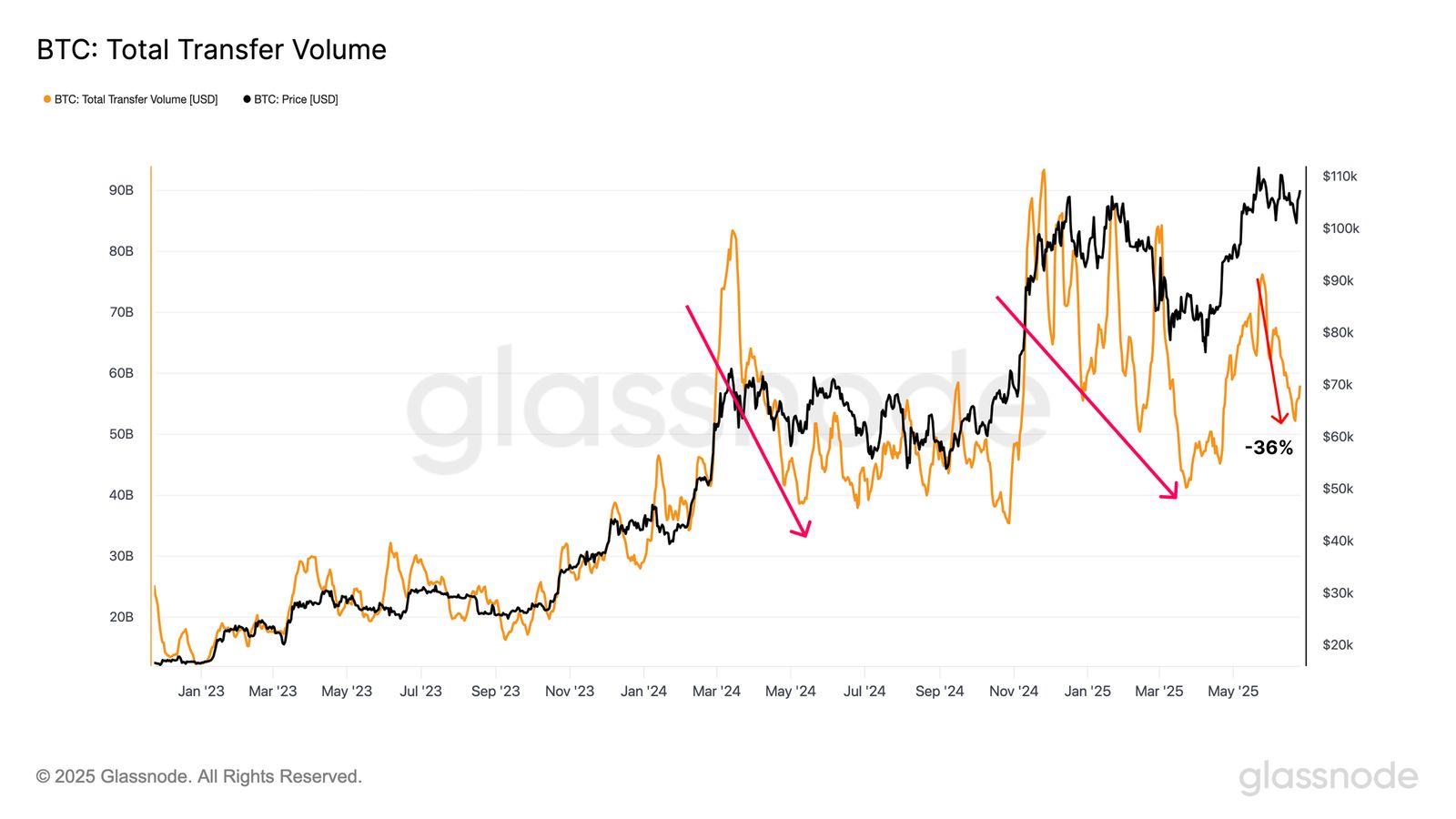

Bitcoin’s total transfer volume has also shown signs of cooling. The 7-day moving average of on-chain transfer volume has dropped by approximately 32%, falling from a peak of $76 billion in late May to $52 billion over the past weekend. This decline is consistent with the broader pattern of market cooling, signaling that Bitcoin’s bullish momentum may be losing steam.

The slowdown in transfer volume reflects a general loss of activity across key Bitcoin metrics, reinforcing the notion that market participants are taking a cautious approach. As the market eases, Bitcoin’s price could face downward pressure.

Bitcoin Total Transfer Volume.

Bitcoin Total Transfer Volume.

BTC Price Needs To Secure Support

Bitcoin’s price is currently at $106,907, just below the $108,000 resistance. For BTC to continue its upward trend, it must flip $108,000 into support. This would set the stage for further gains, pushing Bitcoin towards the $110,000 mark and potentially beyond. However, the current market sentiment remains fragile.

Given the rising signs of market fatigue and the cooling of key activity metrics, a decline is more likely in the near term. If demand does not revive, Bitcoin’s price could fall below $105,000 and test the critical $100,000 support level. Any further loss in momentum may trigger a deeper decline.

Bitcoin Price Analysis.

Bitcoin Price Analysis.

Alternatively, if Bitcoin’s price manages to hold above key support levels, the bullish trend remains intact. Successfully reclaiming $108,000 as support would clear the path for Bitcoin to rise to $110,000. A break above this level could lead to a move towards the all-time high of $111,980, maintaining the upward momentum and investor optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The largest IPO in history! SpaceX reportedly seeks to go public next year, aiming to raise over 30 billion and targeting a valuation of 1.5 trillion.

SpaceX is advancing its IPO plan, aiming to raise significantly more than $30 billion, which could make it the largest public offering in history.

DiDi has become a digital banking giant in Latin America

Attempting to directly replicate the "perfect model" used domestically will not work; we can only earn respect by demonstrating our ability to solve real problems.

Macroeconomic structural contradictions are deepening, but is it still a good time for risk assets?

In the short term, risk assets are viewed bullishly due to AI capital expenditures and affluent consumer spending supporting earnings. However, in the long term, caution is advised regarding structural risks brought by sovereign debt, demographic crises, and geopolitical restructuring.

a16z predicts four major trends will be announced first in 2026

AI is driving a new round of structural upgrades in infrastructure, enterprise software, health ecosystems, and virtual worlds.