Tezos collapses 15-day withdrawal bottleneck with lightning-fast Etherlink exits

What once took half a month now takes a moment. Tezos has activated fast withdrawals for Etherlink, using a native liquidity bridge and smart contracts to unshackle users from the long delays of optimistic rollups.

According to a press release shared with crypto.news on June 27, Tezos has rolled out Fast Withdrawals on its Etherlink Layer 2, enabling users to transfer Tez ( XTZ ) to Tezos Layer 1 in roughly one minute.

The upgrade replaces the standard 15-day waiting period associated with optimistic rollups by introducing a built-in liquidity mechanism. Unlike third-party bridging solutions, the feature is embedded directly into the protocol, allowing users to withdraw XTZ almost instantly by paying a nominal fee, while liquidity providers front the funds and are later reimbursed.

How Tezos sidestepped layer 2’s most annoying trade-off

Optimistic rollups have long been a double-edged sword for Ethereum scaling—offering cheaper transactions at the cost of painfully slow exits.

While networks like Arbitrum and Optimism impose a 7-day dispute window to secure optimistic rollups, Tezos’ Etherlink extends this period to 15 days. Until now, users had to either wait it out or rely on a centralized bridge and navigate counterparty risk.

Tezos’ fast withdrawals eliminate that dilemma by keeping the process entirely on-chain. The system works through a decentralized liquidity pool model. When a user requests a fast withdrawal, liquidity providers on Tezos Layer 1 immediately send them the Tez, minus a small fee.

In return, those providers are guaranteed reimbursement once the standard 15-day challenge period lapses. Smart contracts enforce the entire flow, meaning no middlemen or external custodians are involved, just code.

For traders, the implications are obvious: no more locked capital during volatile markets. But the upgrade’s real significance lies in how it rethinks Layer 2 architecture. Most rollups treat slow withdrawals as an unavoidable byproduct of fraud proofs. Tezos, however, treats it as a solvable liquidity problem—one that doesn’t require sacrificing decentralization for speed.

At the same time, Etherlink’s EVM compatibility means Ethereum developers can port their dApps without inheriting its scaling pain points. Combine that with near-instant withdrawals, and Tezos suddenly becomes a compelling alternative for projects tired of Ethereum’s Layer 2 bottlenecks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US-China Trade Deal’s Impact on Crypto Markets

Borrowing the Fake to Achieve the Real: A Web3 Builder's Self-Reflection

Honeypot Finance’s AMM Perp DEX addresses the pain points of traditional AMMs through structural upgrades, including issues such as zero-sum games, arbitrage loopholes, and capital mixing problems. These upgrades achieve a sustainable structure, layered risk control, and a fair liquidation process.

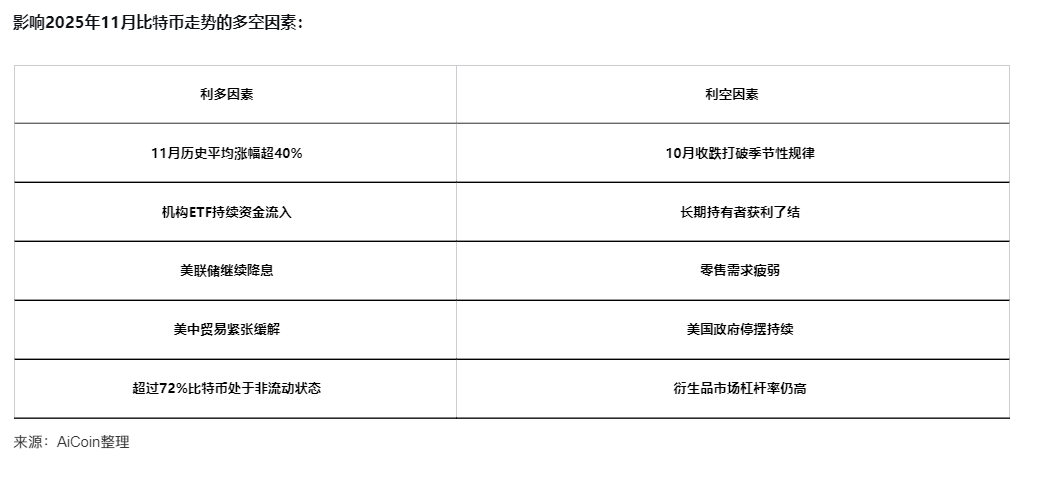

Bitcoin closed lower in October—can November bring a turnaround?

Trump’s Crypto Magic: From “Don’t Know” to a $2 Billion Pardon Spectacle