Bitcoin’s Supply Shifts to Weaker Hands—Is a Sell-Off Next?

2025/07/02 01:30

2025/07/02 01:30Amid Bitcoin’s recent struggle to stabilize above the critical $105,000 price level, on-chain data has revealed a trend.

The total circulating supply held by short-term holders (STHs) has surged significantly over the past few days, a signal that historically leans bearish for the coin’s near-term price action.

BTC Under Pressure as Weak Hands Accumulate

According to Glassnode, the total supply of coins held by BTC STHs plunged to a year-to-date low of 2.24 million coins on June 22 and has since rebounded strongly. At 2.31 million, these newer or more reactive investors, typically called “weak hands” or “paper hands,” have bought 70,000 coins.

BTC Total Supply Held by Short-Term Holders. Source:

Glassnode

BTC Total Supply Held by Short-Term Holders. Source:

Glassnode

STHs are investors who have held their coins for less than 155 days. The group is historically known for being more sensitive to price fluctuations. Therefore, when their accumulation spikes, an asset is at risk because they will likely exit the market quickly at the first sign of uncertainty, amplifying volatility.

Additionally, data from Glassnode confirms that this trend occurs alongside a slight reduction in holdings by Long-Term Holders (LTHs). According to the data provider, their total supply holdings have dipped by 0.13%.

BTC Total Supply Held by Long-Term Holders. Source:

Glassnode

BTC Total Supply Held by Long-Term Holders. Source:

Glassnode

As these investors offload some of their coins, the market’s underlying support may weaken. This makes BTC more susceptible to sharp price swings in the near term.

BTC Struggles Under Bearish Weight

The lengthening red bars of BTC’s BBTrend reflect the steady buildup in bearish pressure. This consistent growth signals that sellers are gradually regaining market control, with downward momentum intensifying.

The BBTrend measures the strength and direction of a trend based on the expansion and contraction of Bollinger Bands. When it returns red bars, the asset’s price consistently closes near the lower Bollinger Band, reflecting sustained selling pressure and hinting at the potential for further downside.

If this continues, the coin could extend its decline and plummet to $104,709.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

On the other hand, if demand spikes, it could push BTC’s price above $107,745 and toward $109,310.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

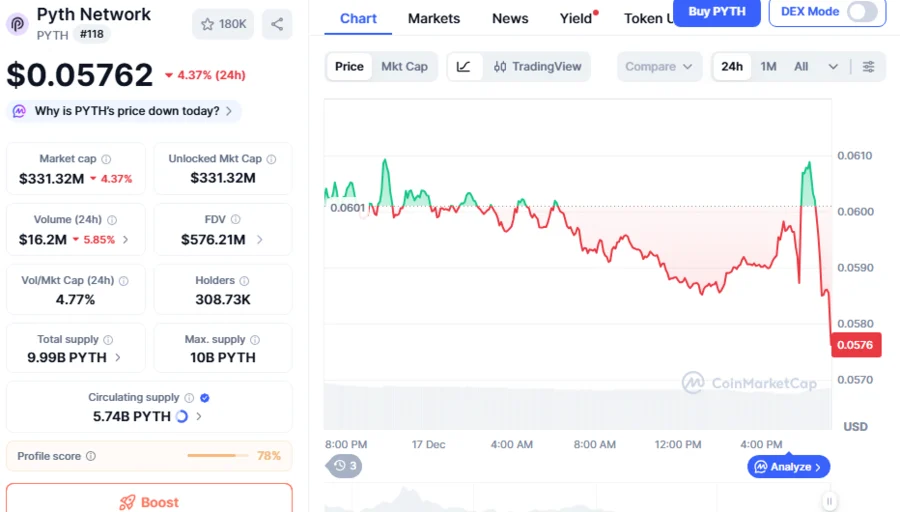

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day