Citi: Tariff Deadline May Be "Irrelevant" for G10 FX, but Keep an Eye on Japan

2025/07/03 12:12

2025/07/03 12:12According to a report by Jinse Finance, Citi foreign exchange strategists believe that, to a large extent, the upcoming July 9 tariff negotiation deadline may be a "non-event" for G10 currencies. On the EU side, Citi's base case is that both parties will reach a framework agreement before July 9, at which point the 10% tariff rate will be extended and negotiations will continue. "Given the recent strength of the euro, they speculate that such news would be slightly positive for the euro, but not necessarily a significant driver, as much of the good news is already priced in." Regarding Japan, Citi believes that, given Trump's recent remarks, the likelihood of reaching an agreement is decreasing. Citi stated, "The risk of a tariff hike for Japan appears to be the highest." The bank expects USD/JPY to climb to 150 this summer, then fall below 140 later this year, as the Bank of Japan is expected to implement policy normalization and the yen regains strength.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin Season Index remains at 70, maintaining a 90-day high

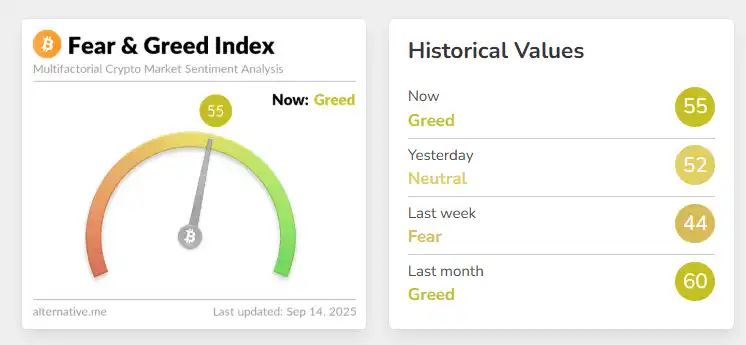

The Crypto Fear and Greed Index rises to 55, with the market returning to the "Greed" zone