U.S. Senator Cynthia Lummis Proposes Comprehensive Crypto Tax Reform Bill

According to a report by Jinse Finance, U.S. Senator Cynthia Lummis introduced a comprehensive digital asset tax bill today, aiming to secure several key outcomes for the crypto industry and create a level playing field for digital asset users across the country. Cynthia Lummis stated, "To maintain America's competitive edge, we must reform our tax laws to adapt to the digital economy, rather than burden digital asset users. I welcome public feedback on this legislation and hope to see it reach the President's desk soon." According to estimates from the Joint Committee on Taxation, the bill is expected to generate a net revenue of approximately $60 million during the 2025 to 2034 fiscal years. The bill proposes reforms on several digital asset tax issues, including: tax exemption for small transactions by setting a $300 de minimis threshold, eliminating double taxation for miners and stakers, ensuring tax parity between digital assets and traditional financial assets (such as lending, wash sales, and mark-to-market taxation), and waiving valuation reports for charitable donations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

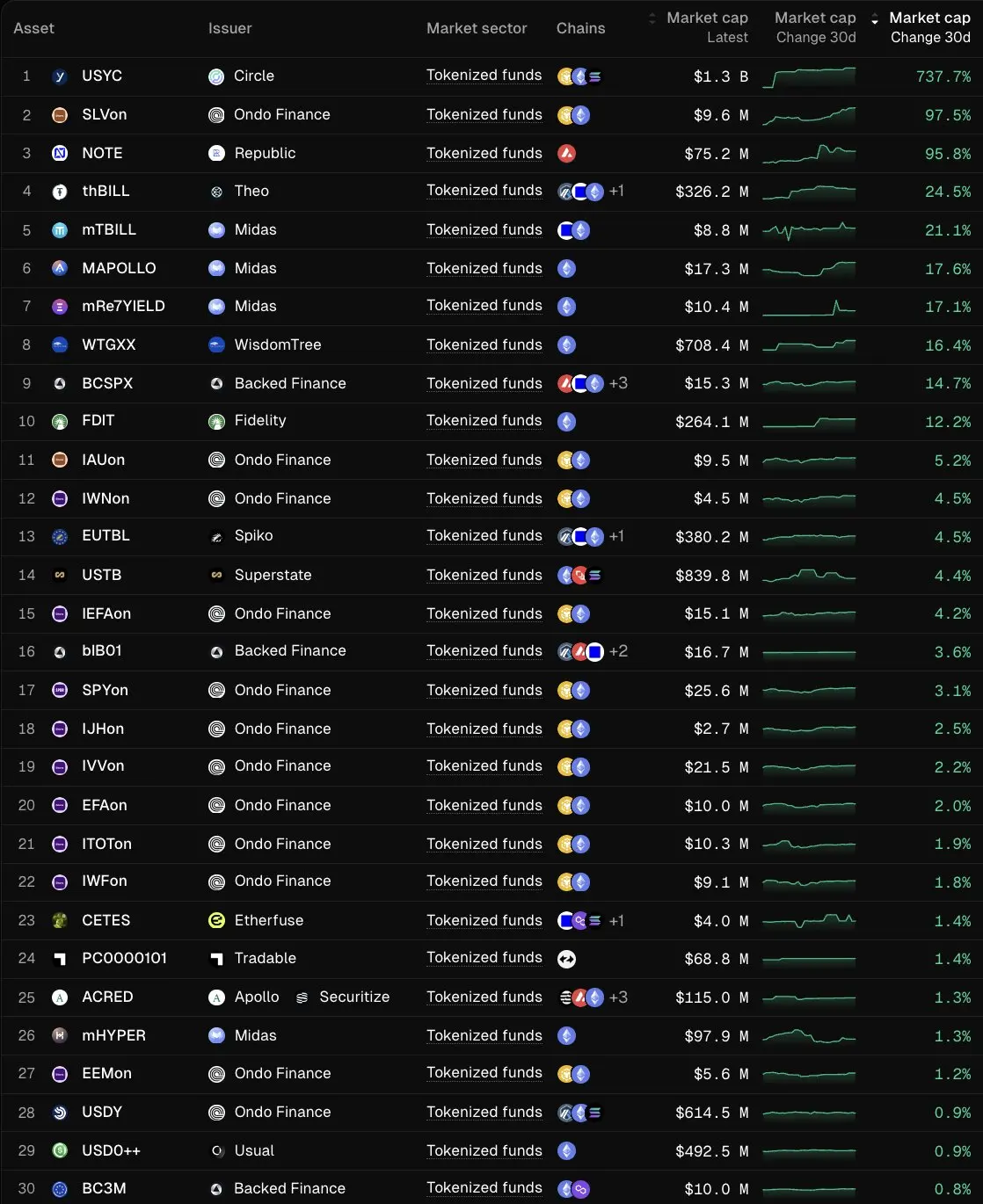

Circle CEO: Tokenized Fund USYC Sees 737.7% Market Cap Growth in the Past 30 Days

Data: Hyperliquid open interest reaches $7.73 billions, marking seven consecutive days of growth

AllScale: A total of $5 million in invoice settlements has been completed.