Detroit Sues Crypto Real Estate Platform Over Safety, Health Violations

Detroit sued crypto real estate startup RealToken LLC and affiliated corporate defendants, in what it says is the largest nuisance abatement lawsuit in its history.

Filed Tuesday in Wayne County Circuit Court, the lawsuit names the Florida-based company's co-founders, Remy and Jean-Marc Jacobson, along with 165 corporate defendants.

The suit alleges that Real Token, a blockchain-based real estate investment platform, failed to meet health and safety requirements across 400 properties under its management, leaving tenants in hazardous conditions.

"These defendants have profited from our communities while ignoring their most basic legal obligations as landlords and property owners," Conrad Mallett, corporation counsel for the City of Detroit, said in a statement published by the city's open data portal.

"Our neighborhoods are not investment portfolios, they are homes for Detroit residents," Mallet said.

While Real Token promises yields of up to 16% to investors, tenants allegedly bear the cost through unsafe, non-compliant living conditions.

The platform's tenants are "paying that price, in the form of poorly maintained rental properties" lacking compliance certificates, with some cases resulting in "unsanitary and unsafe living conditions," a copy of the complaint reviewed by Decrypt reads.

Detroit is asking the court to mandate repairs, establish rent escrow accounts, and hold Remy and Jean-Marc personally liable after "refusing to authorize payment for 'even the most basic repairs' with their former property maintenance companies."

The complaint further claims that Detroit neighborhoods have been "inundated with dangerous structures that invite squatters and criminal activity," as a result of "vacant, dilapidated properties" managed by Real Token.

Many Real Token properties lack heat, running water, or secure entryways, the complaint alleges.

One tenant described living without a working shower for over two years; another said a collapsed porch blocked access to her home. Inspectors identified 53 properties as posing an immediate risk to health and safety, citing structural damage, mold, sewage backups, and rodent infestations.

Decrypt has approached Real Token and their legal counsel for comment.

Fractional ownership

Real Token LLC (operating as RealToken Inc. and branded as RealT) had allegedly been "quietly acquiring" hundreds of properties in Detroit, "selling fractional ownership through cryptocurrency," Detroit council member Angela Calloway told local media at a press conference on Tuesday.

Fractional ownership refers to the process of tokenizing real-world assets and splitting them, allowing multiple investors to own a single asset through the purchase of shares collectively.

Real Token's whitepaper claims it "made history" by launching the "world's first real estate tokenization platform" on Ethereum in 2019, later moving its token's base blockchain to Gnosis Chain, claiming Ethereum's rising fees at the time "no longer made sense."

Asset tokenization could "apply to asset classes that are typically considered illiquid," and could thus benefit from "improved transparency, efficiencies, and lower minimum investments," an explainer from Real Token reads.

Edited by Sebastian Sinclair

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

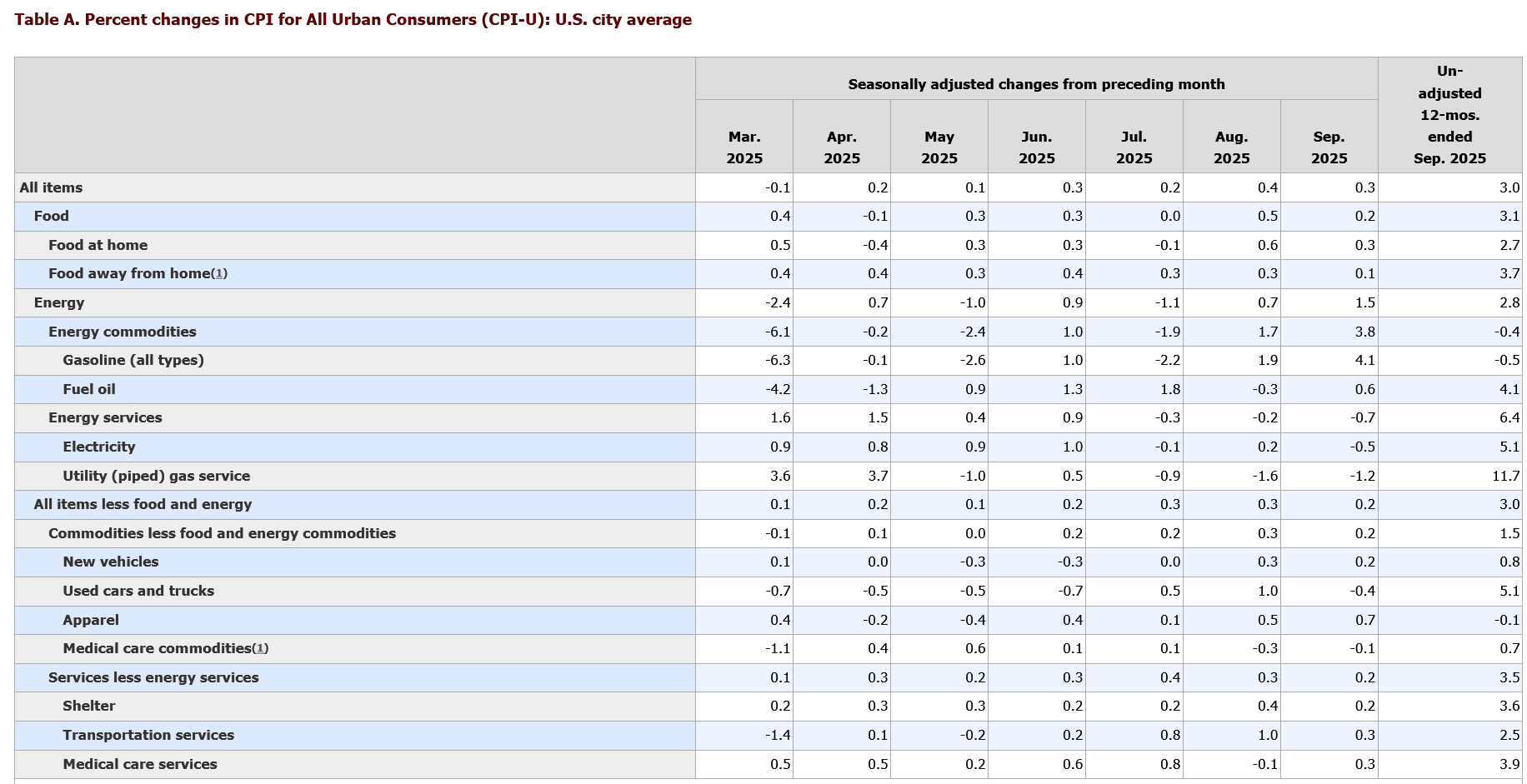

As inflation eases slightly, will XRP break its downward trend?

After several weeks of decline, XRP is finally showing signs of recovery as US inflation slightly cools.

XRP price eyes rally to $3.45 after Ripple CEO tells investors to ‘lock in’

Why is Prop AMM flourishing on Solana but still absent on EVM?

In-depth analysis of the technical barriers and EVM challenges faced by Prop AMM (Professional Automated Market Makers).

Zero Knowledge Proof Whitelist Coming Soon: Where Builders Find Purpose in the Next Blockchain Era