Hong Kong Treasury Bureau Drives Asset and Financial Instrument Tokenization

2025/07/05 08:51

2025/07/05 08:51According to ChainCatcher, citing Hong Kong Wen Wei Po, Hong Kong's Secretary for Financial Services and the Treasury, Christopher Hui, stated that the Hong Kong government will promote the tokenization of assets and financial instruments to advance the development of the digital asset sector. The government has released the "Hong Kong Digital Asset Development Policy Statement 2.0," aiming to establish Hong Kong as a global hub for digital asset innovation.

Hong Kong has established a regulatory framework that balances risk management, investor protection, and industry development, including the implementation of the Stablecoin Ordinance and a licensing regime for digital asset trading platforms. The government also plans to make the issuance of tokenized government bonds a regular practice and to promote the tokenization of assets such as precious metals, non-ferrous metals, and renewable energy. The Hong Kong Stock Exchange has launched the city's first digital asset indices, providing investors with transparent and reliable price benchmarks for Bitcoin and Ethereum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

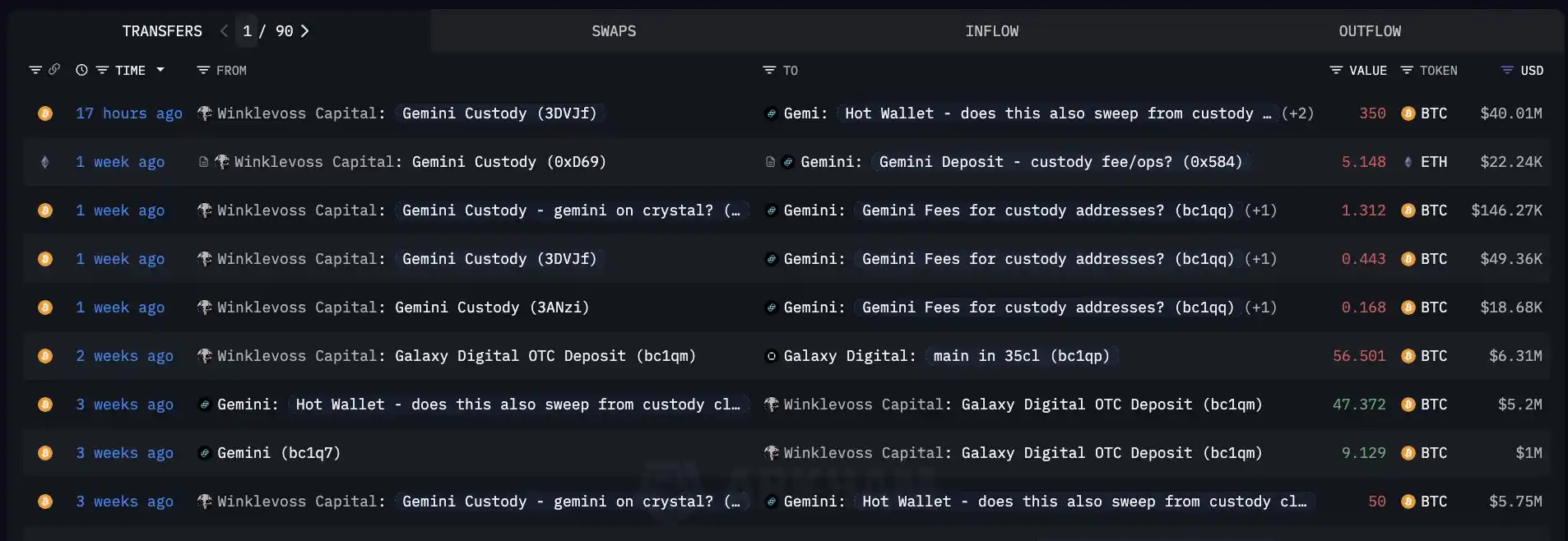

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.