Bitcoin Primed To Hit New All-Time High Soon Enough, According to Fidelity’s Global Macro Analyst Jurrien Timmer – Here’s Why

2025/07/04 16:00

2025/07/04 16:00Fidelity Investments’ global macro director Jurrien Timmer says that the stage is set for Bitcoin ( BTC ) to have an explosive breakout.

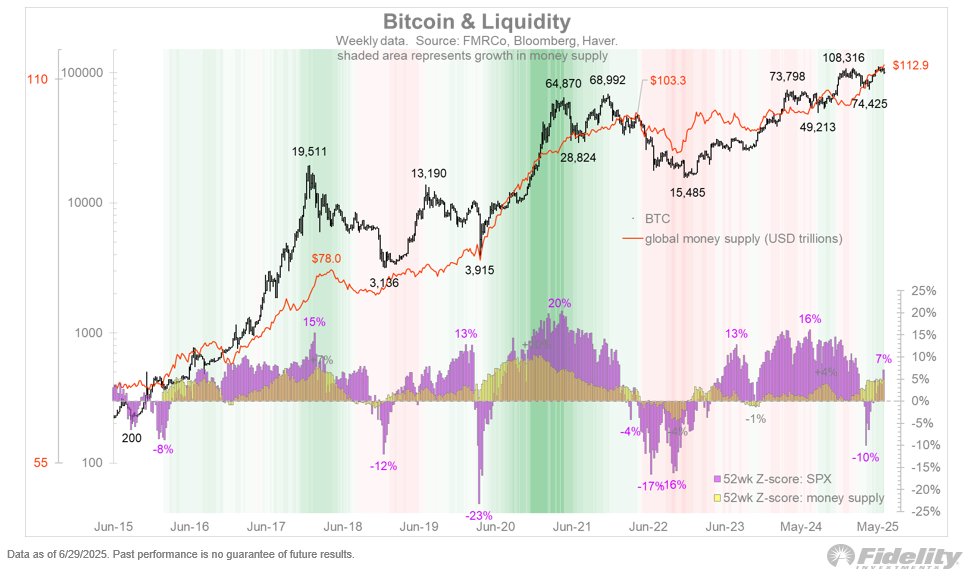

In a new thread on the social media platform X, Timmer says that based on a historical relationship between Bitcoin and the global money supply metric the top digital asset by soon print new all-time highs.

“With both liquidity improving per the global money supply and the stock market reaching new highs, it’s no surprise that Bitcoin is on the move again. Both Dr. Jekyll and Mr. Hyde are being supported for now, and Bitcoin should be at new all-time highs soon enough if this momentum continues.”

Source: Jurrien Timmer/X

Source: Jurrien Timmer/X

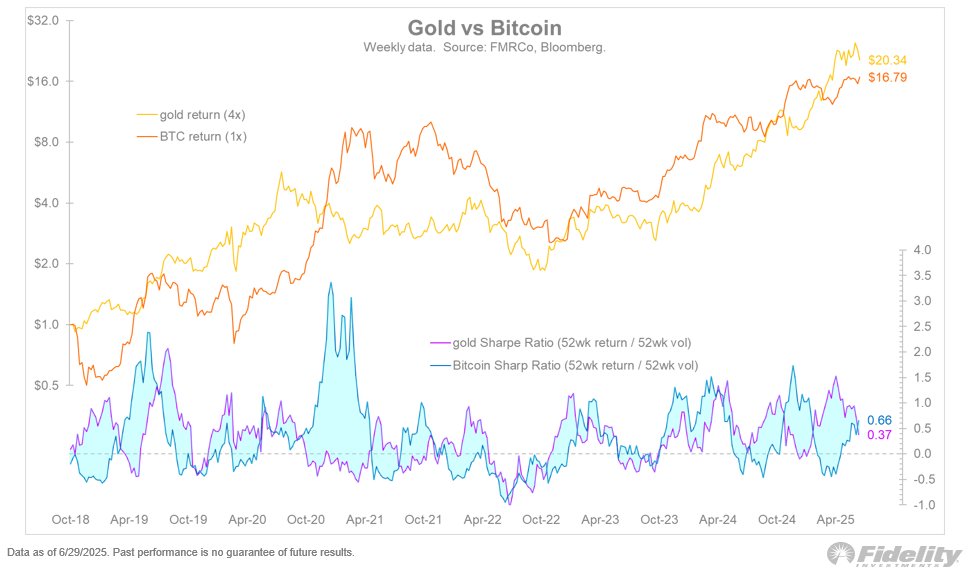

Timmer also says that a weakening US dollar may drive more investors into gold and, potentially, Bitcoin as a hedge against currency debasement.

“One of the big questions remains whether a new world order is emerging in which the US dollar loses at least some of its supremacy and is supplanted by a mixture of other fiat currencies and hard money (gold and perhaps Bitcoin). Maybe this regime change was signaled three years ago when gold stopped trading in lockstep with real rates.”

Lastly, the analyst says the Sharpe ratio is now starting to favor BTC over gold as a better return on investment. The ratio was created by Nobel laureate William Sharpe and is designed to show the amount of return an investor could potentially get for enduring the volatility of a risky asset.

“With risk appetites rising, the baton has been passed back to Bitcoin, following the pattern of recent months. You can see that in the chart below, with the two Sharpe ratios converging.”

Source: Jurrien Timmer/X

Source: Jurrien Timmer/X

Bitcoin is trading for $107,792 at time of writing, down 1.9% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SharpLink plans $200M Ethereum deployment with Linea partnership

Price predictions 10/27: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE

Bitcoin analysts say this must happen for BTC price to take out $115K

How high can SOL’s price go as the first Solana ETF goes live?