Analyst: Bitcoin Whales Continue Accumulating at Historic Highs, Indicating Possible Early Positioning for Future Gains

Odaily Planet Daily News: CoinDesk senior analyst James Van Straten released a market analysis stating that Bitcoin (BTC) is currently only a few percentage points away from its all-time high of around $112,000. Despite prices nearing record levels, large holders (whales)—that is, investors holding more than 10,000 BTC—have recently continued to accumulate, which is seen as a sign of their confidence in further price increases. According to Glassnode’s trend accumulation score data, not only have whale wallets entered an active “accumulation mode” in recent days, but medium-sized wallets holding between 1,000 and 10,000 BTC have also started buying heavily. In contrast, smaller holders (including wallets with less than 1 BTC or between 10 and 100 BTC) have mostly chosen to reduce or distribute their holdings over the past few months. This clear contrast—while Bitcoin’s price remains stable at around $109,000—may indicate that the market is experiencing a shift in holdings from retail investors to institutions or high-net-worth individuals. The accumulation score shows that strong buying interest began to emerge after Bitcoin hit a local low of around $76,000 in mid-April. This increase in large-holder accumulation near all-time highs is further seen as a bullish signal, suggesting they may be positioning in advance for future price increases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

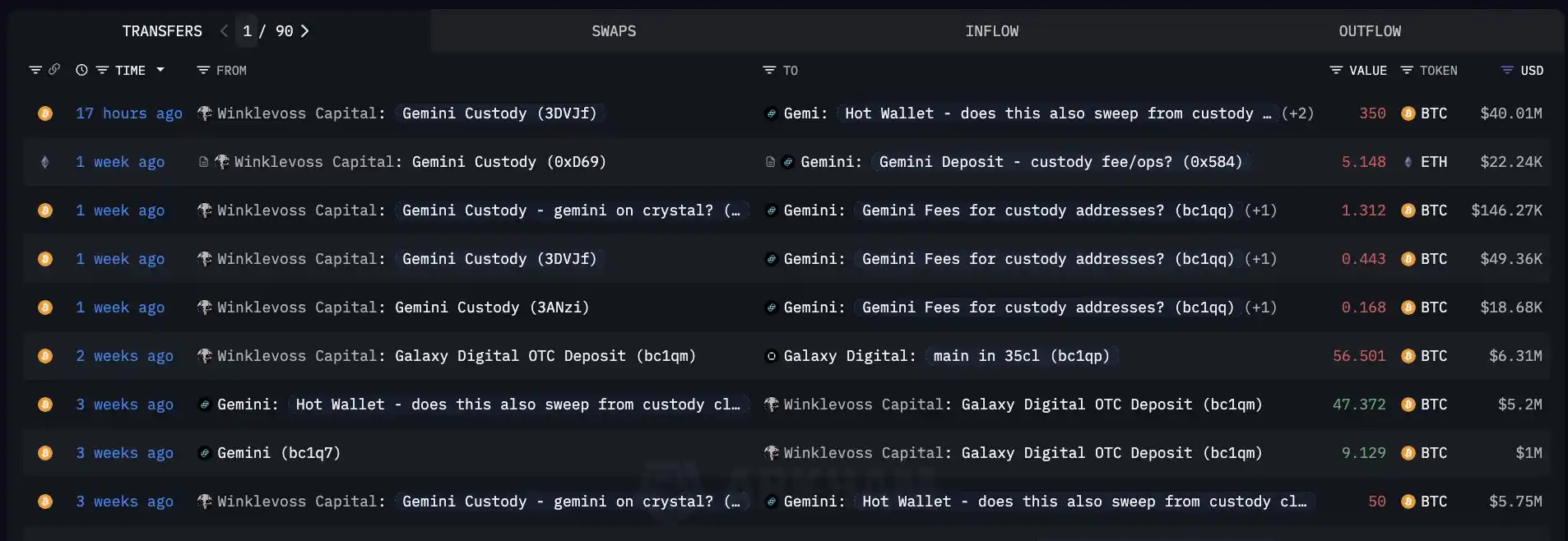

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.