ReserveOne to Go Public Through $1 Billion Merger with M3-Brigade, Establishing a Digital Asset Reserve

Foresight News reports that digital asset management firm ReserveOne has announced it has entered into a definitive business combination agreement with special purpose acquisition company M3-Brigade Acquisition V Corp. (Nasdaq ticker symbols: MBAVU, MBAV, MBAVW). ReserveOne will hold and manage a range of cryptocurrencies based on Bitcoin, including Ethereum, Solana, and other digital assets with the potential to generate yield through institutional staking and lending.

This transaction is expected to generate over $1 billion in total proceeds, including (i) up to approximately $297.7 million in capital held in the M3-Brigade trust account (assuming no redemptions), and (ii) a total of $750 million in committed capital from leading institutional investors under subscription agreements, which includes $500 million in common stock and warrants, as well as $250 million in principal amount of convertible notes (“PIPE offering”). ReserveOne will be led by CEO Jaime Leverton, an industry veteran who previously served as CEO of an exchange that was the first publicly listed company to add Bitcoin to its balance sheet. The exchange will serve as the custodian for ReserveOne’s secured Bitcoin assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin Season Index remains at 70, maintaining a 90-day high

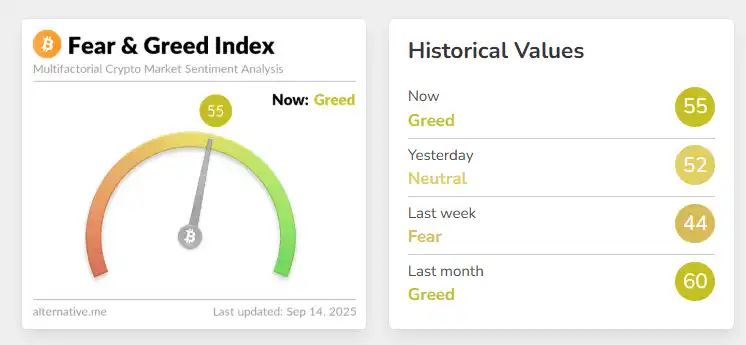

The Crypto Fear and Greed Index rises to 55, with the market returning to the "Greed" zone