Top Citi Executive Issues Warning on ‘Uncomfortable’ Stock Market Rally, Says Uncertainty Factor Hasn’t Faded

A top executive at Citigroup, the third-largest US bank, is issuing a warning about the current rally in stock markets.

In a new CNBC Television interview, Citi Wealth’s chief investment officer Kate Moore says that the macroeconomic outlook still remains highly uncertain, even as stocks hit record highs.

“I’ve been saying I’ve been pretty uncomfortable with the rally, in part because a lot of it has not been driven by fundamentals. We know against the backdrop of this rally, there’s been a decline in terms of earnings expectations. We continue to take down estimates for this year. And the key thing that I’m focused on is that the uncertainty factor hasn’t faded. This is still coming up in CEO and CFO surveys, some of the soft data that we’ve all been tracking, that we don’t really have a great sense for what the next six months look like for one’s own company operations or for the overall economy.

So we’re grinding higher on a lot of hopes and enthusiasm and expectations that the Trump administration will keep on backing off some of the most punitive measures, particularly around tariffs. But I don’t know if that’s a great investment strategy. I think we have to stay really anchored in high quality and consistent earners.”

Moore also says she is not recommending the selling of positions in tech or artificial intelligence (AI), but she would not recommend adding to these investments at the current price levels, given the uncertain economic outlook.

“This is part of the reason why I’m uncomfortable, because the high quality stuff, the companies, the sectors, the industries that have sustainable earnings that we think will be less sensitive to some of the pain and pressure from tariffs, will be able to either pass through prices or have a lot of margin buffer, are really being priced to perfection.

And at this point, Tech and AI, which I think we all understand is a durable theme, and where companies will continue to have to spend in this space regardless of what happens to overall economic growth, is very well owned by all segments of the investment community, by institutional investors, by individual investors, and as such, it’s tough to say put new money to work there. That said, we would not be selling our positions in the Tech and AI adjacent names.”

Surf The Daily Hodl Mix

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy stacks 1,955 Bitcoin for $217 million in week eight of nonstop buys

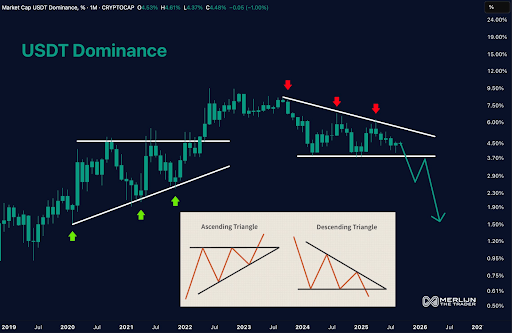

Altcoins May Outperform Bitcoin in 2025 Cycle, Analyst Says