Tether Aims to Lead Bitcoin Mining by 2025

- Tether seeks to lead Bitcoin mining within two years.

- Plan involves major industry realignment.

- Potential impacts on Bitcoin network security.

Paolo Ardoino, Tether’s CEO, announced on Telegram that Tether intends to become the largest Bitcoin miner by the end of 2025.

Tether’s ambitious mining expansion could alter market dynamics, impacting Bitcoin’s security and potentially affecting the valuation of held BTC reserves.

Tether has invested over $2 billion into mining infrastructure since 2023, focusing on key locations in Uruguay, Paraguay, and El Salvador. The company, with approximately 200 employees, aims to leverage these resources to potentially dominate the mining landscape.

CEO Paolo Ardoino noted their exposure to Bitcoin and the importance of contributing to network security. “Given the exposure that we have to bitcoin, it’s important to be part of the security of the network. Realistically, by the end of this year, Tether will become the biggest bitcoin miner out there.” These efforts are directly tied to safeguarding their reserves.

Tether’s expansion into mining underscores a strategic shift that could disrupt existing players and affect energy markets. Although no regulatory reactions have been publicly noted, the implications on trust and governance are under discussion.

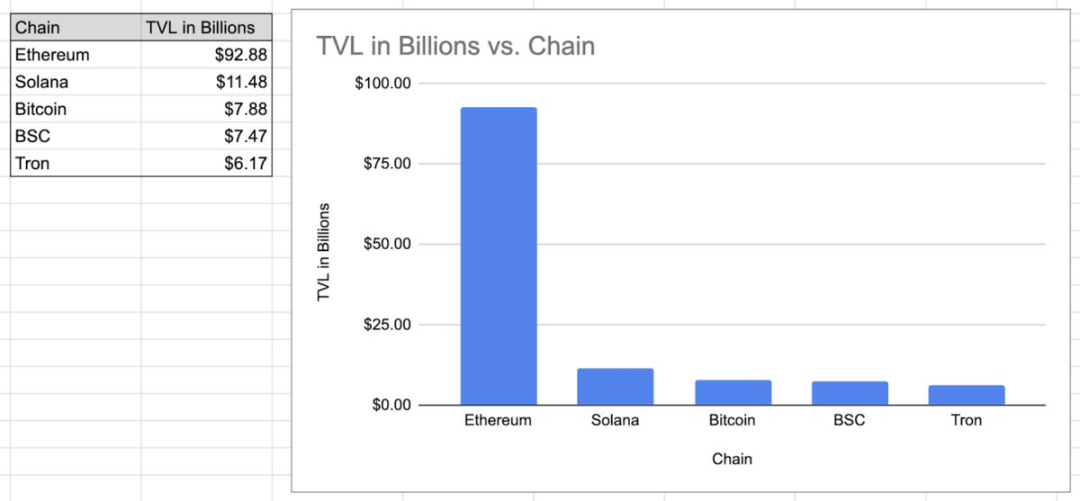

The company’s move may influence Bitcoin’s hash power distribution and spark debates over centralization in mining operations. Additionally, ripple effects may be observed in related DeFi ecosystems due to capital reallocation.

Insights into Tether’s intentions suggest financial outcomes linked to BTC value and operational scale. While similar endeavors by public miners impacted profitability, a stablecoin issuer entering mining presents unique liquidity dynamics and raises questions on market influence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (September 11)

Cboe to debut bitcoin and ether Continuous futures in November

Cboe Futures Exchange aims to introduce long-dated crypto contracts under US regulatory oversight

The Internet is building a native financial system, and the key to success or failure still lies in user experience.

Infrastructure provision is possible, but user experience wins everything.

Why are perpetual contracts inevitably part of general-purpose blockchains?

The future trend is that perpetual contracts (and all "killer applications") will make leading general-purpose blockchains even more powerful.