ArkStream Capital: Market Sees Structural Turning Point Towards "Compliance Narrative + Real Yield"

With the continuous optimization of on-chain matching systems and user experience, the derivatives market is accelerating its transition from being "off-chain replicated" to "on-chain native," further driving the development of DeFi.

Original Title: "ArkStream Capital: 2025Q2 Crypto Market Sees Structural Inflection Point Towards 'Compliance Narrative + Real Yield'"

Original Source: ArkStream Capital

In the second quarter of 2025, the crypto market showed an overall warming trend, with multiple positive factors coming together to accelerate industry momentum. On one hand, the global macro environment stabilized, trade policies eased, providing a more favorable backdrop for capital flows and asset allocation. On the other hand, several countries and regions globally introduced friendly policies for the development of the cryptocurrency industry. The traditional financial markets began to actively embrace cryptocurrencies, linking token structures with traditional financial assets, achieving a "financialized" capital structure.

The stablecoin race was particularly active this quarter, from the expansion of USDT/USDC to the implementation of various countries' compliance frameworks, and Circle's IPO, all driving the cryptocurrency narrative closer to the mainstream capital markets, releasing strong bullish signals. At the same time, the on-chain derivatives narrative continued to heat up, with Hyperliquid emerging as a leading phenomenon, daily trading volumes approaching or surpassing some centralized exchanges multiple times, native tokens consistently outperforming the overall market, becoming one of the most resilient assets. With continuous optimization of on-chain matching systems and user experience, the derivatives market is accelerating the structural transition from "off-chain replication" to "on-chain native", further driving the development of DeFi.

Global Stablecoin Regulation Implementation and Potential Opportunities

Genius Act Drives Accelerated Global Stablecoin Regulation Implementation

In the second quarter of 2025, the global stablecoin market exhibited sustained growth and the accelerated implementation of regulatory frameworks. As of June 24, the total market value of global stablecoins reached $2.4 trillion, representing an approximately 20% increase from the beginning of the year. The US dollar stablecoins overwhelmingly dominate the market, with a market share exceeding 95%. The two major stablecoins, USDT and USDC, have market sizes of $153 billion and $61.5 billion, respectively, occupying a combined market share of 89.4%, further intensifying market concentration. In terms of trading volume, over the past three months, on-chain stablecoin transaction volume exceeded $10 trillion, with an adjusted effective trading volume of $2.2 trillion, totaling 26 billion transactions, adjusted to 5.19 billion transactions. Stablecoins are gradually evolving from cryptographic trading tools to mainstream payment media and are expected to expand the market size of the US dollar stablecoins to $2 trillion within the next three years, further strengthening the dominance of the US dollar in the global digital economy.

Note: The "adjusted" data in transaction volume and transaction count refers to Visa's filtering process for programmatic transactions, bot behavior, and other non-organic activities, aimed at more accurately reflecting the true usage of stablecoins.

Stablecoin Overall Data

Stablecoin Transaction Volume

Stablecoin Transaction Count

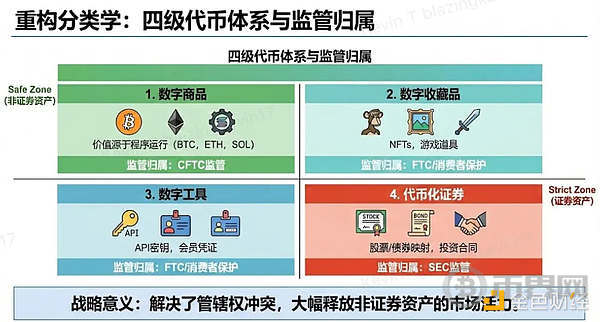

In this regulatory backdrop, oversight of stablecoins is imminent. To this end, the U.S. Congress has taken key actions, with the "U.S. Stablecoin Innovation and Regulation Act" (GENIUS Act, S.1582, hereinafter referred to as the Genius Act) overwhelmingly passing the Senate with 68 votes in favor and 30 votes against on June 17, 2025. This milestone legislation signifies the first comprehensive federal regulatory framework for a fiat-collateralized payment stablecoin being formally established in the United States. The Act, together with broader digital asset market structure legislation like the "2025 Digital Asset Market CLARITY Act," collectively shapes a new landscape for U.S. digital asset regulation.

ArkStream interprets the strategic intent and industry impact of the Genius Act from two perspectives. On the one hand, the Act embodies a grand U.S. strategic vision to modernize the payment and financial system and consolidate the global dominance of the U.S. dollar; on the other hand, it also signals a pivotal moment for the cryptocurrency industry's compliance and institutionalization.

From a strategic standpoint, the Genius Act is not merely a simple regulation of stablecoin oversight but a systemic financial arrangement by the U.S. government to maintain the U.S. dollar's core position in the global financial system. The Act stipulates that all compliant stablecoins must achieve a 1:1 full reserve in U.S. dollars, with these reserves strictly held in the form of cash, demand deposits at banks, or short-term U.S. Treasuries at regulated qualified custodians, and subject to frequent auditing and disclosure systems to ensure asset transparency and security. This move not only significantly alleviates market concerns regarding stablecoin asset transparency and reserve misuse but also establishes a "U.S. Treasury Absorption Pool" deeply integrated with on-chain payment systems. Against the backdrop of the rapid growth in stablecoin issuance scale, it is expected that in the coming years, tens of trillions of dollars in new demand for U.S. Treasuries will be driven, effectively supporting the long-term sustainable development of the U.S. fiscal position.

More importantly, the "Genius Act" clearly positions compliant stablecoins as a payment tool, excluding them from being classified as securities, fundamentally solving the long-standing issue in the U.S. of unclear regulatory classification, regulatory overlap, and legal uncertainty regarding crypto assets. By defining the boundary between stablecoins and securities, the Act has eliminated significant barriers for traditional financial institutions and large enterprises to enter the crypto market, significantly reducing compliance risks and facilitating institutional fund involvement. Moreover, the Act adopts a "dual-track" regulatory authorization model involving both federal and state levels, acknowledging the reality of the existing dual-banking system while seamlessly integrating traditional financial regulation with the emerging stablecoin ecosystem. This allows stablecoin issuance entities to obtain regulatory approval and enables financial institutions to legitimately participate in stablecoin issuance and operation.

Against the backdrop of intensifying global digital currency competition, the U.S. is actively building a global "token payment network" centered around the U.S. dollar by promoting a privately-led compliant stablecoin system. This open, standardized, and auditable stablecoin architecture not only enhances the digital circulation of U.S. dollar assets but also provides efficient and cost-effective solutions for cross-border payments and settlements. Particularly in emerging markets and the digital economy sector, stablecoins can overcome traditional banking restrictions, facilitate peer-to-peer U.S. dollar settlements, improve transaction convenience and speed, and become a new digital engine for the internationalization of the U.S. dollar. This demonstrates a realistic strategy in U.S. digital currency governance, distinguishing itself from other countries' central bank digital currency (CBDC) closed systems by emphasizing market-driven approaches and regulatory coordination to seize a leading position in the global digital financial infrastructure.

For the crypto industry, the significance of the "Genius Act" is equally profound. Over the past few years, stablecoins, as the core infrastructure of on-chain transactions and the DeFi ecosystem, have consistently faced the dual challenges of asset transparency deficiencies and regulatory gray areas, leading institutional investors to be cautious about participating in crypto assets. The Act's mandatory implementation of a 1:1 full reserve system, combined with rigorous custody, auditing, and high-frequency disclosure mechanisms, institutionally blocks "black-box operations" and reserve misappropriation risks, significantly enhancing market trust and acceptance of stablecoins. Furthermore, the Act innovatively constructs a multi-level compliance authorization system, providing a clear and actionable legal framework for stablecoin issuance and applications, significantly lowering the compliance thresholds for financial institutions, payment service providers, and cross-border trade platforms to join the stablecoin system.

This means that stablecoins and their derived on-chain financial activities will transition from the previous "regulatory gray area" to mainstream compliance, becoming a crucial part of the digital asset ecosystem. For innovative scenarios such as DeFi, digital asset issuance, and on-chain credit, the compliance assurance of stablecoins can not only reduce systemic risks but also attract more traditional capital and institutional participation, driving the entire industry towards maturity and scale.

Overall, the "Genius Act" is not only a key milestone in U.S. financial strategy but also a significant milestone in the institutional evolution of the crypto industry. Through dual clarification in law and regulation, stablecoins will become a core driver in advancing payment modernization, enhancing the global influence of the U.S. dollar, and paving a solid compliance path for on-chain financial innovation and mainstreaming of digital assets. ArkStream will continue to monitor the progress of this Act's implementation and its profound impact on the global digital financial ecosystem.

In addition to the United States' Genius Act, multiple countries and regions worldwide are actively advancing regulatory frameworks for stablecoins. South Korea is actively constructing a stablecoin regulatory framework. In June 2025, the ruling party proposed the Basic Digital Asset Act, allowing qualifying local companies to issue stablecoins, strengthening reserve and capital requirements to promote industry legalization. Regulatory authority will be transferred to the Financial Services Commission (FSC), while establishing a Digital Assets Commission for unified supervision. The Bank of Korea (BOK), initially opposed, has shifted towards support, contingent upon obtaining oversight of a Korean won stablecoin. This "central bank co-governance" model reflects a practical regulatory evolution in the face of stablecoins impacting the traditional banking system and monetary policy backdrop. Meanwhile, South Korea is also advancing broader market liberalization reforms, such as postponing crypto taxes until 2027, opening up corporate crypto accounts, planning spot crypto ETFs, complemented by crackdowns on market manipulation and illicit trading platforms, forming a regulatory combination of "guiding compliance + combating violations" aimed at consolidating its position as a crypto hub in Asia.

By 2025, Hong Kong will formally implement the Stablecoin Act, becoming one of the world's first jurisdictions to establish a stablecoin licensing regime. The act is expected to take effect in August, requiring stablecoin issuers to register in Hong Kong, hold 1:1 reserve assets, undergo audits, and participate in a regulatory sandbox testing mechanism. Hong Kong's institutional design not only aligns with international standards (such as MiCA) but also provides a compliance gateway for mainland Chinese enterprises, solidifying its position as a "controlled innovation" financial gateway.

Against this backdrop, Chinese companies such as JD.com, Ant Group, as well as several Chinese securities firms and financial institutions, are all exploring entry into the stablecoin industry. JD.com, through its subsidiary JD Coin Chain Technology, is piloting a Hong Kong dollar stablecoin in the regulatory sandbox, emphasizing compliance, transparency, and efficiency, with the goal of reducing cross-border payment costs by 90% and shortening settlement times to 10 seconds. Its strategy follows a "B2B first, C2C follow-up" approach, planning to obtain licenses from major global countries to serve global e-commerce and supply chain settlements. This layout complements the domestic positioning of China's digital RMB, forming a dual-track system in the national digital currency strategy—controlled by the central bank for domestic circulation and explored by leading enterprises for international circulation, taking the initiative in the global digital asset landscape.

The Huge Opportunity Stablecoin Compliance Brings to the Crypto Market

For the two leading stablecoins on the current market, USDC (issued by Circle) and USDT (issued by Tether), the passage of the Genius Act has a profound impact. This Act explicitly defines payment-type stablecoins that meet its strict criteria as non-securities, providing a clear legal status and regulatory "gateway" for issuers like USDC that have actively sought compliance. This means that these stablecoins will no longer be subject to the burdensome regulations of securities laws but will follow a framework specifically designed for payment instruments. The Act requires a 1:1 full USD reserve, independent audits, monthly disclosures, and formal licenses, which will further enhance the legitimacy and market trust of transparent stablecoins like USDC. For USDT, this Act expands the regulatory scope, bringing foreign stablecoin issuers serving U.S. users into the fold. This means that Tether, regardless of its headquarters' location, will be subject to U.S. legal jurisdiction and must comply with anti-money laundering (AML) compliance requirements. While this may increase its compliance burden, in the long run, this regulatory clarity is also seen as advantageous for Tether because it helps enhance its legitimacy in the U.S. market. Additionally, the Act explicitly prohibits interest-bearing stablecoins, which may limit the revenue model of issuers but aims to strengthen stablecoins' nature as payment tools rather than investment products.

Overall, these regulations have not only paved a clear compliance path for leading stablecoins but also laid a solid foundation for the healthy development of the entire industry. The passing of the "Genius Act" has opened unprecedented development opportunities for the cryptocurrency industry, primarily reflected in the following three key areas.

First, the deep integration of compliant stablecoins with the DeFi ecosystem has unlocked immense capital potential. The law has clarified the legal status of stablecoins and regulatory framework, providing an institutional funding green light to enter the DeFi ecosystem. Taking WLFI and top-tier DeFi projects as examples, more and more teams are committed to building compliant, transparent, secure liquidity pools, and credit protocols. Compliance enhancement not only lowers the investment threshold but also propels DeFi from "experimental" to mainstream, unleashing a potential incremental value of billions of dollars.

Second, stablecoins have brought revolutionary opportunities to the payment sector. With the rapid growth of digital payment demand, acquisitions such as Stripe acquiring Bridge and exchanges like Binance and Coinbase accelerating stablecoin payment card services have propelled the payment infrastructure towards stablecoin adoption. With the low-cost, high-efficiency settlement advantage of stablecoins, they are particularly suitable for cross-border payments, instant settlements, and emerging market microtransactions, helping them become a pivotal bridge connecting traditional finance and the digital economy.

Third, Real World Assets (RWA) combined with stablecoin anchoring and blockchain technology have driven asset digitization and liquidity innovation. Leveraging compliant contracts and on-chain issuance, tangible assets such as real estate and bonds are transformed into tradable digital assets, expanding traditional asset liquidity and providing investors with diversified allocation options. The blockchain's characteristics reduce intermediary costs and enhance transparency. With the stablecoin compliance foundation solidifying, RWA on-chain issuance and circulation are expected to rapidly develop, promoting a deep integration of the crypto ecosystem with the real economy.

Of course, beyond opportunities, the "Genius Act" also brings challenges. It expands the definition of digital asset service providers, requiring developers, validators, etc., to comply with anti-money laundering regulations. Although it does not regulate the blockchain protocols themselves, decentralized projects face greater compliance pressures. The law is more suitable for centralized institutions, and decentralized projects may be forced to move out of US regulation, leading to market fragmentation.

Circle Listing Leads New Paradigm: Corporate Balance Sheets Moving Towards On-chain

In the early second quarter of 2025, amidst the global macroeconomic uncertainty caused by the tariff storm and a high-interest-rate environment, the crypto market entered a phase of consolidation. Investor risk appetite decreased, internal industry divergences became more apparent, funds significantly concentrated in Bitcoin, and Bitcoin Dominance reached its highest level in four years, while the altcoin market remained under pressure. However, institutional participation remained strong, especially through compliant channels such as spot ETFs and stablecoins, continuously flowing in. The status of crypto assets in the global asset allocation system further improved.

Bitcoin Dominance

Circle is the biggest beneficiary in this frenzy of institutional participation, with its IPO undoubtedly being the highlight of the quarter. As the issuer of USDC, Circle successfully went public on the NYSE at a price of $31 per share, higher than the expected range, raising a total of $1.1 billion. The IPO valuation reached $6.9 billion, and within less than a month, the market cap surged to $680 billion. Circle's strong performance signifies the formal entry of regulated compliant crypto companies into the mainstream capital markets. Its path of compliance with MiCA and long-term SEC filing has become a key model for the stablecoin industry, opening the door for other crypto companies to go public.

In addition to Circle, several publicly traded companies have taken substantial steps in digital asset allocation. One of the most notable examples is SharpLink Gaming (SBET), which as of June 20, 2025, held a total of 188,478 ETH and staked all of its holdings in staking protocols, yielding an annualized return rewarding 120 ETH in staking rewards. The company raised funds through PIPE financing and the "in the market" issuance mechanism, with support from institutions like Consensys and Pantera. Furthermore, SharpLink actively utilizes the ATM (At-The-Market) financing mechanism to flexibly issue shares based on market conditions, swiftly raising operational funds, further enhancing its asset allocation and business expansion capabilities. With diversified financing channels, the ETH strategy has become a core asset management approach for SharpLink.

DeFi Development Corp (formerly Janover Inc.) has reshaped its business structure with Solana as its core asset. In April 2025, it accumulated a total of 251,842 SOL through two rounds of transactions, equivalent to $36.5 million. Additionally, on June 12, it announced securing a $500 million equity line of credit to further increase its position. DFDV plans to tokenize its company stock on the Solana chain in collaboration with Kraken, creating a "natively listed company on the blockchain." This transformation not only represents a shift in asset allocation strategy but also an innovation in financing and liquidity mechanisms.

Apart from Ethereum and Solana, Bitcoin remains the preferred reserve asset for institutions. Strategy (formerly MicroStrategy) held 592,345 BTC as of June 2025, with a market value exceeding $63 billion, firmly holding the position of the world's largest public BTC holder. Metaplanet is swiftly advancing its Bitcoin reserve strategy in the Japanese market, increasing its BTC holdings by 1,111 BTC in the second quarter of 2025, reaching a total of 11,111 BTC, with a target of holding 210,000 BTC by 2027.

From a geographical perspective, the corporate crypto asset strategy is no longer limited to the US market, with active exploration in the Asian, Canadian, and Middle Eastern markets, showing characteristics of globalization and multi-chain. Correspondingly, there have been attempts to utilize assets in more complex ways, such as staking, DeFi protocol integration, on-chain governance participation, and more. Enterprises are no longer just holding assets passively but are building asset-liability sheets and revenue models centered around crypto assets, driving the financial model from "reserve" to "interest-bearing" and from "hedging" to "production."

On the regulatory front, the Circle IPO representing regulatory compliance, the SEC's repeal of SAB 121, and the establishment of the "Crypto Task Force" signify that the US policy stance is moving towards a clearer direction. Meanwhile, although Kraken is still facing SEC litigation, its proactive approach to early-stage IPO financing also demonstrates that leading platforms still hold expectations for the capital markets. Animoca Brands plans to list in Hong Kong or the Middle East, Telegram is exploring a revenue-sharing mechanism using TON, reflecting that regulatory jurisdiction is becoming a key part of crypto company strategies.

This quarter's market trends and corporate behaviors indicate that the crypto industry is entering a new stage of "institutional structural reallocation" and "on-chainization of corporate balance sheets." The "MicroStrategy-like" strategies have provided new incremental funding for several top-market-cap altcoins. ArkStream believes that native crypto VCs should take advantage of this moment and will focus on the following directions in the future: projects with stablecoin, staking, and DeFi income-generating capabilities, service providers that can assist enterprises in complex asset allocation (such as institutional-grade staking platforms, crypto financial accounting systems), and top enterprises that embrace compliance and are willing to enter the public capital markets. The depth and pattern of future enterprises' allocation to specific altcoin ecosystems will become a core variable in the industry's new round of valuation restructuring.

The Rise of Hyperliquid, On-Chain Derivatives, and Real Yield DeFi

In the second quarter of 2025, the decentralized derivatives protocol Hyperliquid achieved a key breakthrough, further solidifying its dominant position in the on-chain derivatives market. As the derivatives platform with the smoothest on-chain trading experience and product design closest to centralized exchange platform standards, Hyperliquid has not only continued to attract top traders and liquidity but has also effectively driven the growth of the entire derivatives track and user migration trends. Simultaneously, its native token, HYPE, also performed impressively during the quarter, with a price surge of over 400% from its April low and reaching a new all-time high of around $45 in mid-June, further validating the market's consensus on its long-term potential.

The rise of the HYPE token is mainly driven by the explosive growth in platform trading volume. In April 2025, Hyperliquid's monthly trading volume was around $1.875 trillion. In May, this number surged by 51.5% to a record-breaking $2.48 trillion. During this period, the trading frenzy sparked by renowned trader James Wynn significantly boosted the platform's visibility, serving as a key catalyst for this growth. As of June 25, Hyperliquid's monthly trading volume remained at $1.86 trillion, with a total second-quarter volume of $6.215 trillion. At the same time, Hyperliquid's market share in the decentralized perpetual contract market reached 80%, far exceeding the 30% in November 2024; its May monthly perpetual contract trading volume accounted for 10.54% of Binance's centralized exchange derivative total of $23 trillion, setting a new record. These data fully demonstrate Hyperliquid's appeal in the on-chain derivatives market, user stickiness, rapid rise, and leading position in the industry.

Hyperliquid Trading Volume

The core revenue source of Hyperliquid relies entirely on the trading volume generated on its platform. The protocol accumulates income by charging a fee on each transaction, establishing a highly sustainable profit model. With the increase in user activity and trading depth, the platform's fee income continues to grow, becoming a fundamental driver of token value and ecosystem expansion. 97% of this income is directed towards repurchasing HYPE tokens through the Aid Fund, creating a robust value recirculation mechanism. Over the past seven months, Hyperliquid's total fees amounted to $4.5 billion, and the Aid Fund holds over 25.5 million HYPE tokens, with a market value exceeding $1 billion based on the current price of approximately $39.5. This repurchase not only steadily reduces the market's circulating supply but also directly links platform growth to token performance, significantly enhancing HYPE's price elasticity and long-term growth potential.

Hyperliquid Aid Fund Address

To strengthen this economic model, Hyperliquid has designed a fee structure centered around user incentives and community orientation. The platform sets tiered fee rates based on the user's weighted trading volume over the past 14 days, with spot trading volume counted twice, high-frequency users receiving lower fees, and market makers even enjoying negative fee rebates in higher tiers, encouraging them to continue providing liquidity to the order book. By staking HYPE, users can also receive up to a 40% additional fee discount and referral rewards, further enhancing the token's utility and holding incentive. It is worth noting that all protocol revenue belongs to the community, not distributed to the team or privileged accounts, and the Aid Fund is fully on-chain custodied, with all operations requiring verification by the designated number of validators to ensure governance transparency. In terms of the liquidation mechanism, the platform does not charge direct fees, and the profit and loss from retrospective liquidation belong to the community, further avoiding the common "profit from user losses" model seen in centralized exchanges, enhancing user trust and platform credibility.

The reason Hyperliquid has been able to consistently hit new highs and achieve such a significant market position is not only due to its innovative tokenomics but also attributed to its unique technical architecture. Hyperliquid runs on a proprietary Layer-1 chain powered by the HyperBFT consensus mechanism. This infrastructure enables ultra-fast transaction finality and processes up to 100,000 orders per second. This architecture provides performance akin to centralized exchanges while maintaining non-custodial and crypto-native features, greatly enhancing user experience. This illustrates that ongoing innovation in blockchain underlying technology is not just talk but significantly improves productivity and user experience, providing the technical foundation for a manyfold increase in on-chain users in the future.

Hyperliquid's success is not only evident in transaction growth but has also sparked the industry's renewed focus on the concept of Real Yield. In the DeFi space, Real Yield refers to income generated from actual economic activities, such as transaction fees, lending interest, or protocol revenue, rather than through inflationary token issuance. This marks a stark contrast to the early DeFi patterns of 2020-2022 when protocols rapidly grew by distributing native tokens as rewards. However, these rewards often exceeded the platform's actual revenue, leading to long-term dilution and capital flight after a short-lived boom. The shift to Real Yield is crucial for the long-term viability and survival of DeFi protocols, as any revenue model needs a foundation supported by income to endure. Key features include income derived from actual protocol activities rather than promises, a focus on long-term capital efficiency and user trust, providing genuine financial utility that users are willing to use even without incentives, and emphasizing reliability, availability, and real value over mere hype.

Therefore, as an investment institution, priority should be given to protocols with real economic activity and defensible business models, strong tokenomics, and revenue-sharing models, such as Hyperliquid, AAVE, with a focus on their long-term sustainability rather than just TVL or speculative price trends.

Project Investment

Bio Protocol

Bio Protocol is a decentralized protocol designed for scientific research, aiming to rebuild the funding flow, incentive structure, liquidity management, and research automation in the traditional research system through blockchain technology, creating an open, transparent, and market-oriented scientific financial infrastructure. Its core goal is to support the creation and accelerated development of a new generation of BioDAO, achieving a full-chain cycle of scientific research projects from screening, funding, governance to results conversion. The protocol is built around five major research basic operation modules: decentralized research curation, research launch funding, automated liquidity management, milestone incentives, and AI-driven research automation assistants (BioAgents). Bio Protocol ensures project quality and alignment of interests through on-chain governance and staking mechanisms, uses the Treasury to provide diversified liquidity support, combines AI agents to enhance research efficiency, and creates an integrated, sustainable research ecosystem. Furthermore, Bio Protocol introduces IP-Tokens (Intellectual Property Tokens) to enable on-chain governance rights and participation rights for research outcomes, promoting community-driven and co-governed research processes, creating a transparent and efficient research asset pool.

IoTeX

IoTeX is a decentralized, modular Web3 infrastructure platform designed to connect smart devices and real-world data with blockchain, building a decentralized real-world open ecosystem. The core goal is to bridge the connection between Web2 and Web3, allowing smart devices, real-world data, and various decentralized applications (DApps) to interact securely, trustlessly, and efficiently, enabling value exchange.

Vaulta

Vaulta is a high-performance Web3 banking operating system built for the next generation of digital finance, positioned as the core infrastructure for RWAs and compliant financial markets. Its underlying technology utilizes its proprietary Savanna consensus mechanism and Vaulta EVM, supporting sub-second transaction finality and concurrent processing capabilities, ensuring stable low-fee transaction performance even under high-load conditions to meet the throughput and reliability requirements of institutional-grade applications. Unlike typical public blockchains, Vaulta's native design supports programmable finance and modular banking architecture, allowing developers to build composable account systems, customizable permissioned asset management logic, and nested governance structures.

In the RWA field, Vaulta provides a full suite of end-to-end asset tokenization infrastructure, including natively supported asset custody, compliant whitelists, layered account permissions, and on-chain auditable revenue distribution mechanisms. On the compliance front, Vaulta does not circumvent regulation but deeply integrates with existing regulatory logic. Its built-in permissioned runtime environment supports account audits and fund path monitoring in various regulatory jurisdictions. Additionally, Vaulta has constructed an audit-friendly ledger structure and programmable compliance rule set, allowing financial institutions to meet financial regulatory requirements in different regions without sacrificing control.

Event Attendance

Attended as a guest the event hosted by BlockBeats on 【The Real Impact of Singapore's DTSP Bill on DeFi】

Participated in the Space hosted by Cryptic on 【Can True Decentralization Coexist with VC Ownership and Governance Influence?】

Participated as a mentor in the fourth cohort of the Web3 Accelerator program hosted by TDefi

Participated as a judge in the ETH Huangshan event hosted by KeyMapDAO

Participated as a guest in The Left Curve interview program hosted by Radarblock

Reference Links

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump to interview pro-crypto Christopher Waller for next Fed Chair: WSJ

Ethereum Spot ETFs Face Alarming $223.7M Exodus: 4th Day of Major Outflows

Bitcoin ETF Shock: $277.4 Million Flees US Funds as BlackRock Leads Outflow