- Around $1 billion has been wiped out of the crypto market, with $658 million involving Bitcoin shorts.

- An analyst has predicted that Bitcoin (BTC) could extend its ongoing rally to between $130k and $168k.

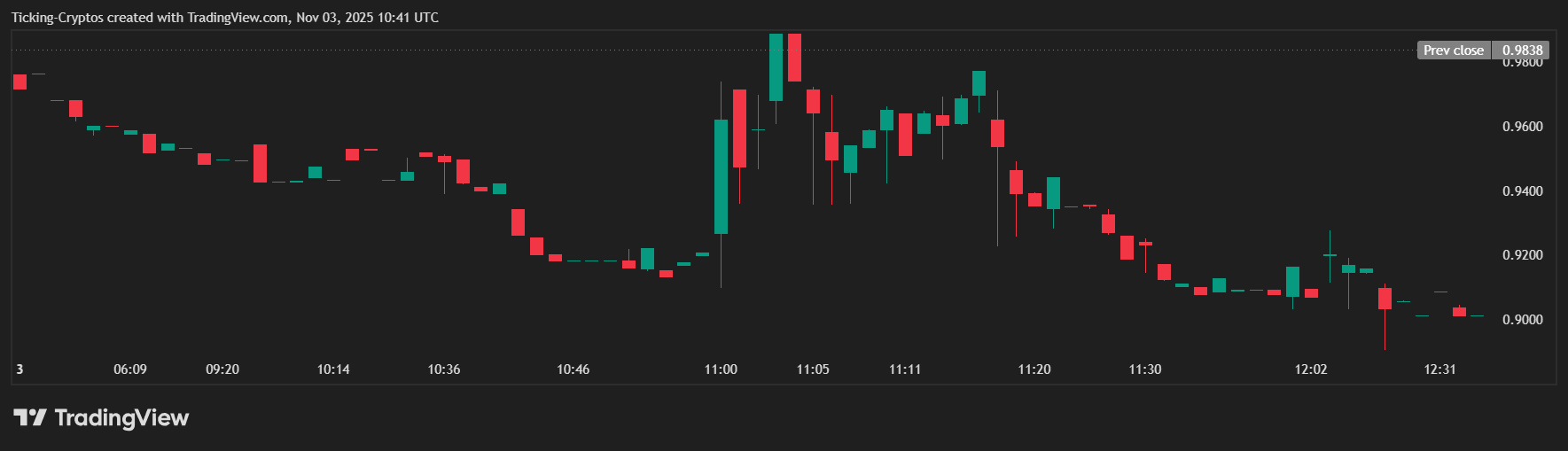

Bitcoin’s (BTC) historic run to $118k and the ongoing broad market rally are reported to have led to more than $1 billion in liquidation in short positions in just 24 hours. According to Coinglass data , around 232,149 traders were affected.

The Breakdown of the Market Liquidation

Out of the $1 billion liquidation, $658 million was in Bitcoin shorts while Ethereum (ETH) shorts saw $250 million wiped out of the market.

Source: Coinglass

Source: Coinglass

The total amount liquidated within the period is almost a double of the $552 million recorded in February, as detailed in our previous news brief. According to a trader known as Daan Crypto Trades, this is a “massive short squeeze on BTC and ETH.”

Prior to this, analysts disclosed that many traders showed “lack of follow-through strength” as Bitcoin struggled to break above its previous resistance level.

In a post, Bitfinex analysts pointed out that the impact of bulls had been significantly nullified by the lack of fresh catalysts or macro signals.

However, analyst Michaël van de Poppe signalled an upcoming rally. On June 30, he advised that investors keep an eye on the $109,000 level. According to him, that point would mark the beginning of an upward momentum that could happen in the upcoming week.

The inevitable breakout to an ATH on Bitcoin might even happen during the upcoming week.

Similarly, another analyst called Mags shared a chart that suggests the formation of an “inverted head-and-shoulders pattern in higher time frames”. Fascinatingly, Mags pointed out that the neckline of the pattern was at $112k, and breaking above it could lead to a huge rally.

Analyst Jelle also had this right as he highlighted the $108,000 and $110,000 range as a crucial psychological barrier that could cause a massive shift in sentiment.

Currently, Bitcoin (BTC) has recorded a pullback to $117.7k, reducing its daily gains to 5%. However, its trading volume makes a significant move to $115 billion, representing an 88% surge from the previous trading session.

Similarly, Ethereum (ETH) has recorded a 6% surge in the last 24 hours to trade at $2,970. Supporting this move, its trading volume has recorded a 32% surge with $38 billion changing hands.

How Far Can Bitcoin (BTC) and Ethereum (ETH) Rise

According to analyst TradingShot, Bitcoin could trade within the $130k and $168k range in the near term. As noted in our recent post, this analyst believes that Bitcoin has been trading within an upward channel since bottoming in November 2022, imitating the last two cycles.

Technically, the break-out from this bull flag targets the 2.0 Fibonacci extension, which currently sits at $168,500.

In a previous update, CNF reported that Bitcoin could also reach $250k in the long term based on the analysis of network economist Timothy Peterson. For Ethereum, Tron founder Justin Sun earlier predicted the price could reach $10k. However, analysts at Standard Chartered have revised their prediction for the asset from $10k to $4k as outlined in our earlier blog post.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?