Bitcoin Surges to New ATH as Rising BTC Dominance Drains Altcoins

- Bitcoin surged to a new all-time high at $123,091 after a rally from around $105,000.

- BTC dominance rose above 64.6%, pressuring altcoins amid shifting market funds.

- Technical signals and ETF inflows indicate Bitcoin may push toward $130,000 soon.

In the current rally, Bitcoin reached a record-breaking price of above $123k. The milestone came at a time when major altcoins were selling off compared to a substantial rise in Bitcoin’s dominance. There is an evident shift toward Bitcoin in the cryptocurrency sector, and this trend is significantly affecting altcoin performance.

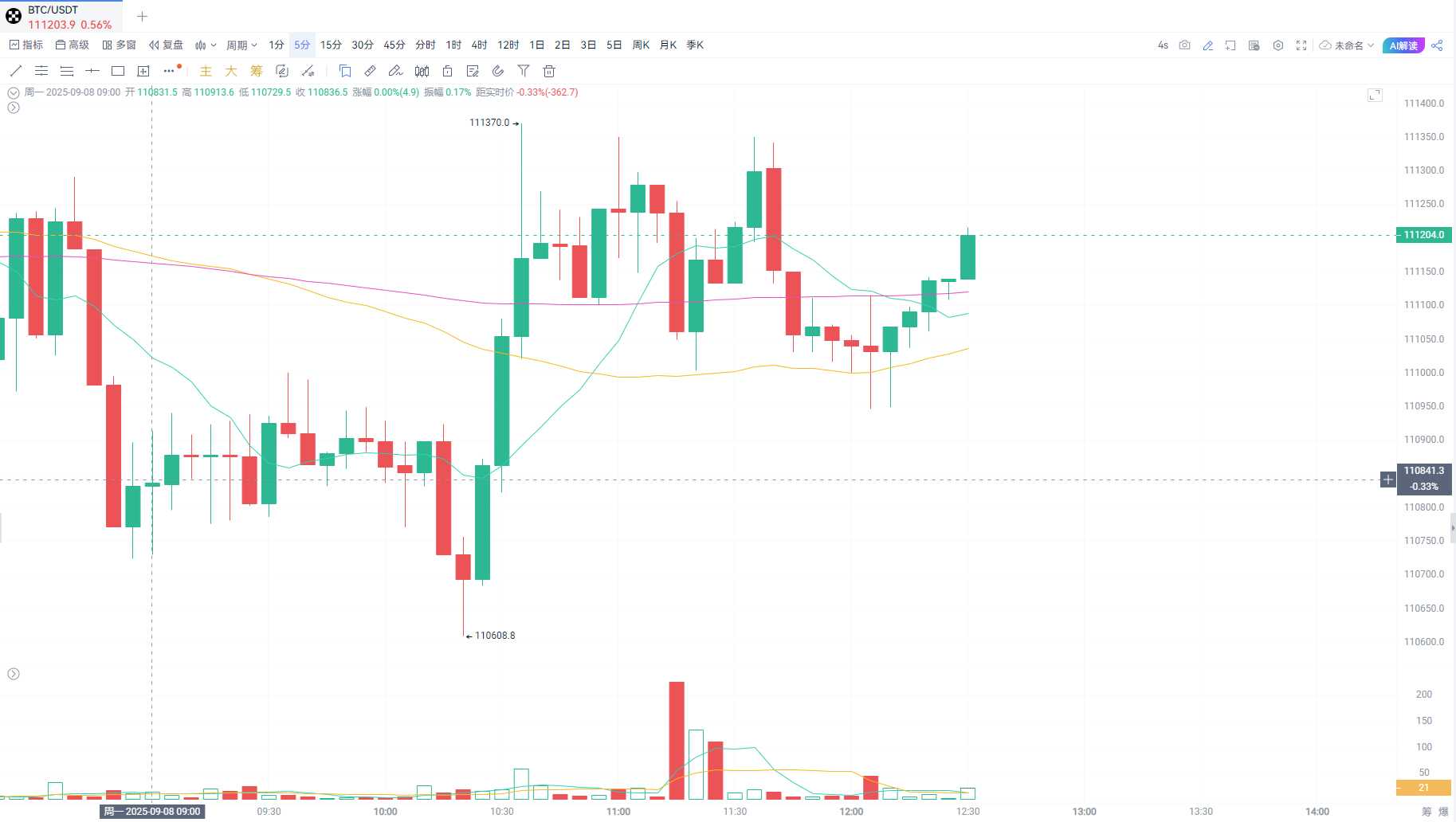

Bitcoin Breaks $123,000 Resistance with Strong Momentum

The price of Bitcoin hit a new all-time high of $123,091 on July 14 amid a sharp rally that pushed the asset from around $105,000 in early July. The breakout followed Bitcoin holding a key support at $120,000, which had previously acted as resistance. Additionally, the surge was accompanied by increased trading volume, which confirms strong buyer interest.

Source:

Tradingview

Source:

Tradingview

Furthermore, the sharp rise above $117,000 on July 12 significantly triggered the breakout. Bitcoin’s price movement showed long-bodied candles and minor pullbacks, demonstrating a continuous bullish trend. The technical indicators also indicate a potential short-term correction around the levels of $118,000 to $119,000 before the subsequent rise. Nevertheless, the outlook for Bitcoin is favorable as long as prices do not fall below resistance at $120,000.

Altcoins Face Selling Pressure as Bitcoin Dominance Surges

As Bitcoin set a new record, altcoins were under pressure. Bitcoin dominance climbed to 64.6% at press time, down slightly from its late June peak of around 66%. This trend implies that capital is moving toward Bitcoin and away from alternative cryptocurrencies.

Source:

Tradingview

Source:

Tradingview

Historically, increased BTC dominance has usually correlated with underperformance in the altcoins. Until dominance reaches or drops below several essential points, traders are likely to defer Altcoin investments.

Most of the top altcoins followed Ethereum in showing gains over the last few weeks, but failed to keep up with Bitcoin’s explosive pace. This divergence indicates Bitcoin’s current strength in an environment of stable macroeconomics and renewed interest from institutional investment.

Related: Bitcoin Flips Amazon’s $2.3T, Satoshi Ranks 11th Richest Person

Market Outlook Points to Potential $130,000 Target for Bitcoin

The current price action forms part of a bullish “flag” pattern. Following a strong uptrend, Bitcoin consolidated briefly before breaking above the resistance. This trend implies a steady ride to the next target, which is $130,000.

ETF-related funds poured another $2.7 billion into Bitcoin last week, contributing to the rally. The declining increase in inflows and tightening supply, since over 94% of the maximum supply is already in circulation, strengthens the case for continued price appreciation.

Bitcoin might test psychological resistance levels of between $130,000 and $140,000 in the next few weeks. Meanwhile, altcoins might continue to be dormant until BTC dominance stabilizes or decreases.

The post Bitcoin Surges to New ATH as Rising BTC Dominance Drains Altcoins appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin whales dump 115,000 BTC in biggest sell-off since mid-2022

Trump's second son clarifies: Cooperation in the Asian market is only with Metaplanet

Taiwan University signs Memorandum of Understanding with Kaia to accelerate the expansion of Taiwan's Web3 ecosystem

The four main points of the MOU are: joining forces to strengthen the Web3 community, expanding blockchain infrastructure, jointly exploring solutions for fiat and virtual asset on/off ramps, and developing a decentralized (DeFi) financial ecosystem.

An Overview of RoboFi: Understanding the Web3 Robot Ecosystem

How will a decentralized, on-chain collaborative intelligent ecosystem reshape our future?