Kazakhstan mulls investing national reserves into crypto: report

Quick Take The move would follow a trend of countries around the world further embracing digital assets in one way or another.

Kazakhstan is considering investing national funds, such as gold and foreign currency reserves, into crypto, the head of the country's national bank said at a press conference on Monday, according to a report from local media .

The move would follow a trend of countries around the world further embracing digital assets in one way or another. President Donald Trump's decision to create a Bitcoin reserve may have been the highest-profile example of adoption at the state level, but even smaller nations like the Royal Government of Bhutan also hold crypto .

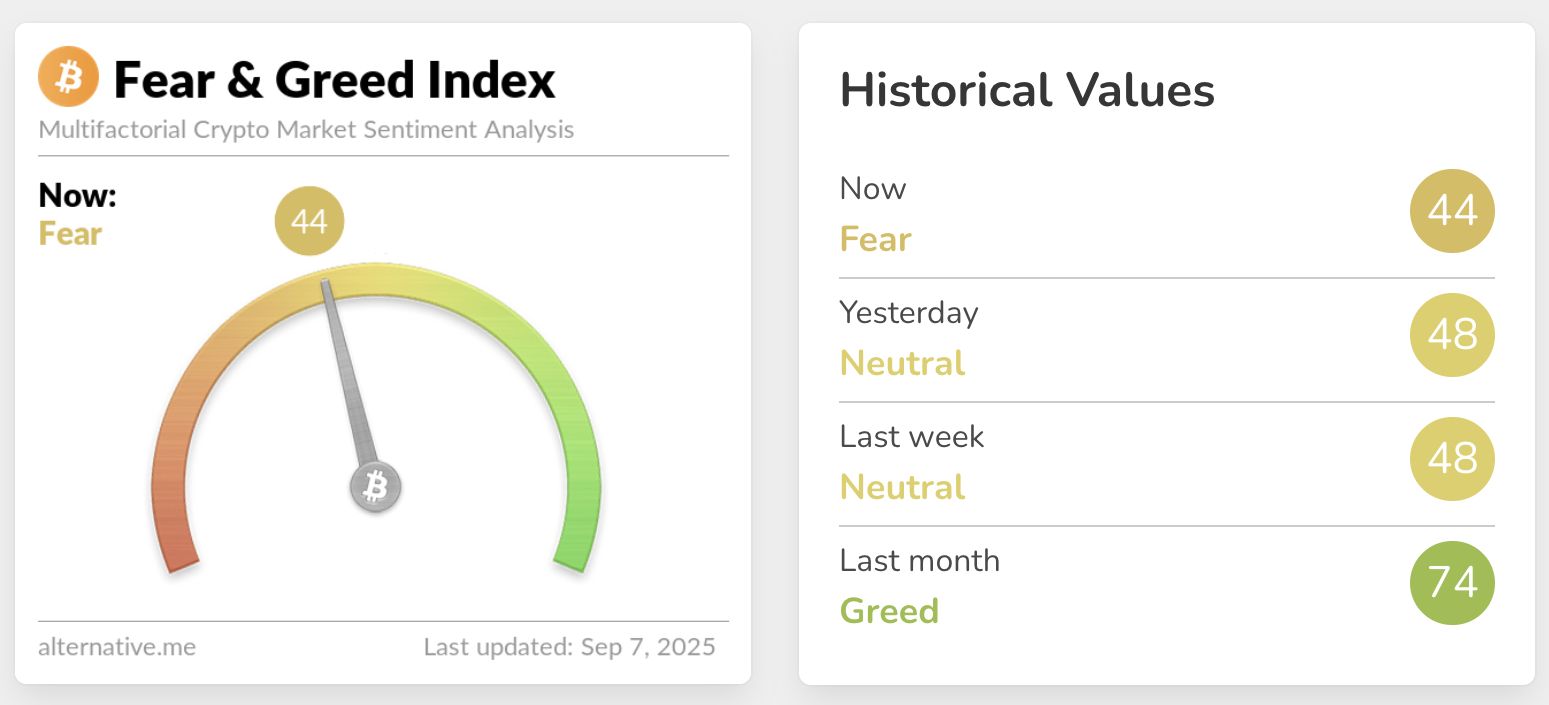

Nations and large, traditional financial institutions buying digital assets, specifically Bitcoin, bode well for the market and have buoyed prices thanks to an increase in demand. In recent days, Bitcoin hit a new all-time high .

"We have an alternative portfolio of gold and foreign exchange reserves and an alternative portfolio of the National Fund. There we use aggressive strategies to get higher investment income," said Timur Suleimenov, head of the country's national bank, according to a translation of the local report. "We looked at the experience of the Norwegian fund, the American experience, the experience of the Middle East funds. They have certain investments either in crypto assets directly or in ETFs and shares of companies that are closely related to crypto assets."

Suleimenov said Kazakhstan will not rush into a decision while noting that crypto can be "volatile." He also repeated Kazakhstan's intention of setting up a separate reserve for crypto confiscated from illegal actors.

Although a smaller economy, Kazakhstan maintains a significant position in the world of crypto. The country controls about 13% of the global Bitcoin hashrate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Eyes Cross-Border Crypto Pump-and-Dump Enforcement, Could Include Bitcoin Cases

Michael Saylor’s Net Worth May Be Linked to MicroStrategy Stock Gains and Large Bitcoin Holdings

Traders Weigh Which Major Asset May Lead Next Move as Bitcoin Remains Indecisive and Sentiment Cools

Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels