The Smarter Web Company adds $36 million in bitcoin, enters top 25 public treasuries with 1,600 BTC

Quick Take The Smarter Web Company has purchased another 325 BTC for approximately $36.45 million at an average price of $112,157 per bitcoin. The firm now holds a total of 1,600 BTC, entering the top 25 public bitcoin treasury companies for the first time.

The Smarter Web Company, a UK web design firm that has transitioned into a bitcoin treasury-focused company, announced on Wednesday that it has acquired an additional 325 BTC for £27.15 million ($36.45 million) at an average purchase price of £83,525 ($112,157) per bitcoin.

The Aquis-listed firm now holds a total of 1,600 BTC — bought at an average price of £79,534 ($106,798) per bitcoin for a total cost of £127.25 million ($170.88 million). As a result, The Smarter Web Company has entered the top 25 public bitcoin treasury companies for the first time, overtaking Fold's 1,488 BTC, according to Bitcoin Treasuries data .

With bitcoin currently trading for $118,850, according to The Block's BTC price page , having reached a fresh all-time high above $123,000 on Monday, the firm is up around 11.3% or $19.26 million on its investment on paper. The firm also holds £4 million ($5.36 million) in available cash in its treasury.

The rapid pace of the Smarter Web Company's bitcoin acquisitions compared to many of its peers, announcing the purchase of more than 1,056 BTC in July alone, sees it rapidly climbing the ranks among the now 141 public company holders — up from 36th at the beginning of July, with CEO Andrew Webley eyeing the top 20 within a month.

Bitcoin miner HIVE Digital currently occupies that spot with 2,201 BTC. Strategy , MARA , Tether-backed Twenty One , Riot Platforms and Metaplanet lead the list, with 601,550 BTC, 50,000 BTC, 37,230 BTC, 19,225 BTC, and 16,352 BTC, respectively.

The Smarter Web Company offers web design, development, and online marketing services, generating revenue from setup fees, annual hosting fees, and optional monthly charges. It has accepted bitcoin payments since 2023 and began integrating a bitcoin treasury policy in April as part of its belief in Bitcoin's role in the future financial system.

The David Bailey and UTXO Management-advised firm's 10-Year Plan focuses on expanding its client base organically and through selective acquisitions of bitcoin to deliver long-term value to shareholders and fund future growth.

The Smarter Web Company also introduced the "P/BYD ratio" on Wednesday, a new metric for analyzing the performance and valuation of bitcoin treasury companies, similar to how the P/E ratio is used for traditional stocks.

BTC/GBP reaches all-time high with UK bitcoin treasury firms also on the rise

While it took longer than the U.S. dollar pairing, bitcoin finally made a new all time high against the pound sterling on Monday, reaching around £91,115 before correcting — a reflection of dollar weakness compared to other fiat currencies this year. The previous record of approximately £89,633 was set on Jan. 20.

U.S. firms, led by Michael Saylor's Strategy , continue to dominate corporate bitcoin acquisitions. However, the number of BTC treasury companies in the UK is also on the rise.

Tao Alpha (to be renamed Satsuma Technology under the ticker SATS) is arguably one of the biggest potential entrants, with the London Stock Exchange-listed firm planning to allocate up to two-thirds of its reserves to bitcoin.

Nevertheless, The Smarter Web Company currently remains the largest of more than a dozen UK firms with similar bitcoin treasury plans. The second-largest is Phoenix Digital Assets with 247 BTC ($29.37 million), followed by Coinsilium with 102 BTC ($12.13 million). Crypto asset manager CoinShares, based in the British Crown Dependency of Jersey, also holds 236 BTC.

The Smarter Web Company was listed on the Aquis Stock Exchange under the ticker SWC through a reverse takeover and began trading on April 25. Aquis is a UK exchange for small and mid-sized growth firms — a low-cost alternative to the LSE but far smaller and less liquid.

The firm's stock subsequently rose nearly 20,000% to £605 following the announcement of its bitcoin treasury strategy, before plunging 70% to a low of £192.66, according to TradingView. SWC has since rebounded over 50% from that low but is currently trading down 2.9% on Wednesday at £290.

SWC/GBP price chart. Image: TradingView .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Faces Heavy Selling | Long-Term Trend Still Bullish

Exclusive Interview with Brevis CEO Michael: zkVM Scaling Is Far More Effective Than L2

The infinite computing layer leads the way for real-world applications.

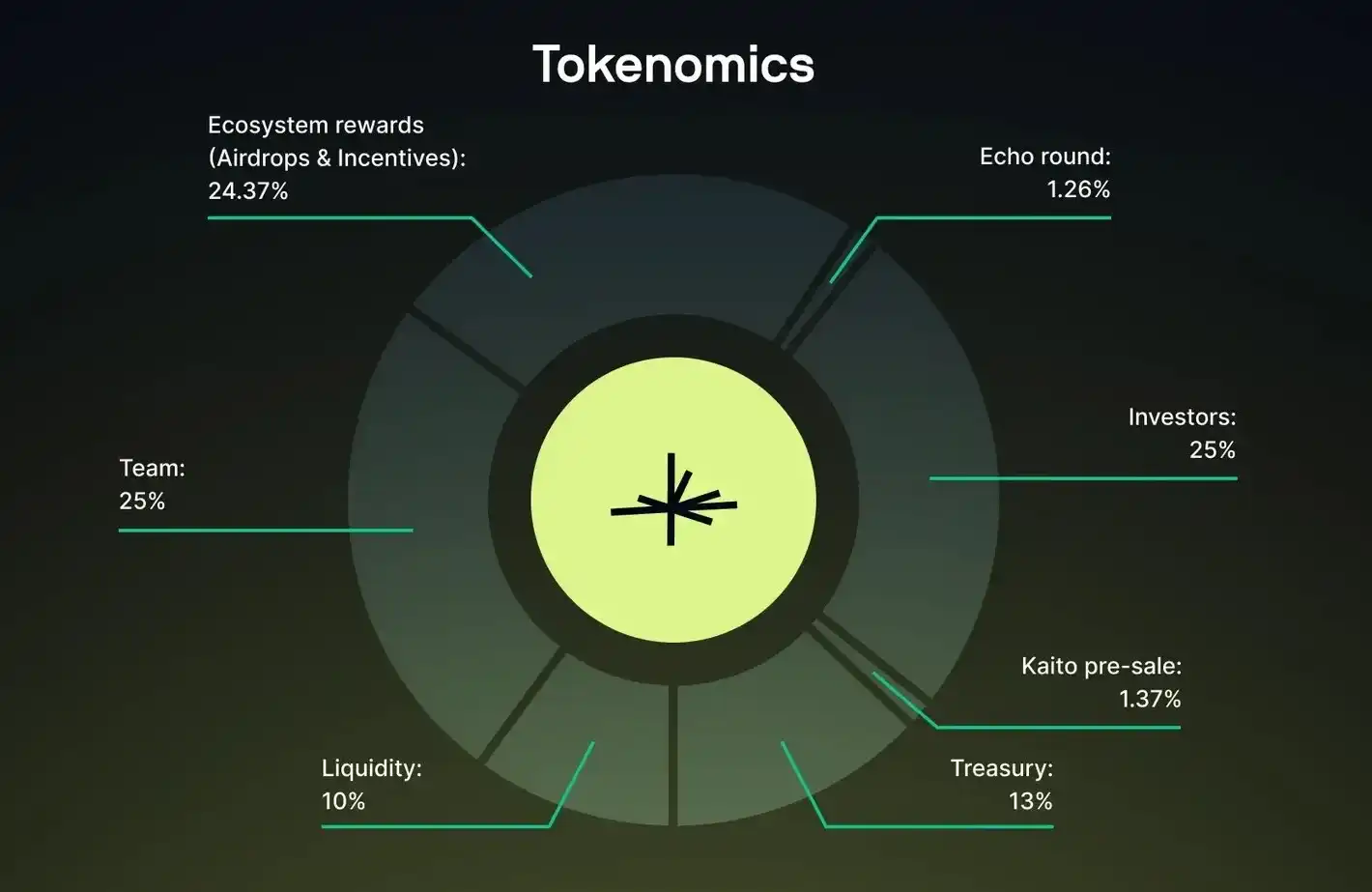

Limitless surprise TGE: Secret launch to avoid sniping, but unavoidable market doubts

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

Virtuals Robotics: Why Did We Enter the Field of Embodied Intelligence?

Digital intelligence gains embodiment, with thought and action merging in the field of robotics.