Tether Eyes $1 Trillion USDT Milestone But Faces Strict New US Rules

The GENIUS Act grants the Federal Reserve oversight of dollar-backed tokens and imposes strict audit and compliance standards on issuers like Tether.

Tether CEO Paolo Ardoino says the company could grow its USDT supply tenfold, potentially surpassing $1 trillion.

His comments follow the passage of the GENIUS Act, a sweeping stablecoin bill signed into law by President Donald Trump on July 18.

Tether Eyes $1.6 Trillion USDT Supply Following GENIUS Act Approval

The legislation is the first federal framework for stablecoin regulation in the US. It authorizes the Federal Reserve to license and supervise dollar-backed stablecoin issuers.

It also mandates full reserve backing, regular audits, and anti-money laundering (AML) compliance for all entities offering these tokens in the US.

In a statement, Ardoino said the regulatory clarity could unlock a new level of adoption for USDT, the world’s largest stablecoin.

“Now that President Trump has led the United States to embrace digital assets, we believe we can increase tenfold and cement the dollar’s global dominance,” he stated.

Tether currently reports over $160 billion USDT in circulation across more than 500 million users globally. A tenfold increase would bring its supply to $1.6 trillion, a milestone that would further entrench the token’s role in global crypto markets.

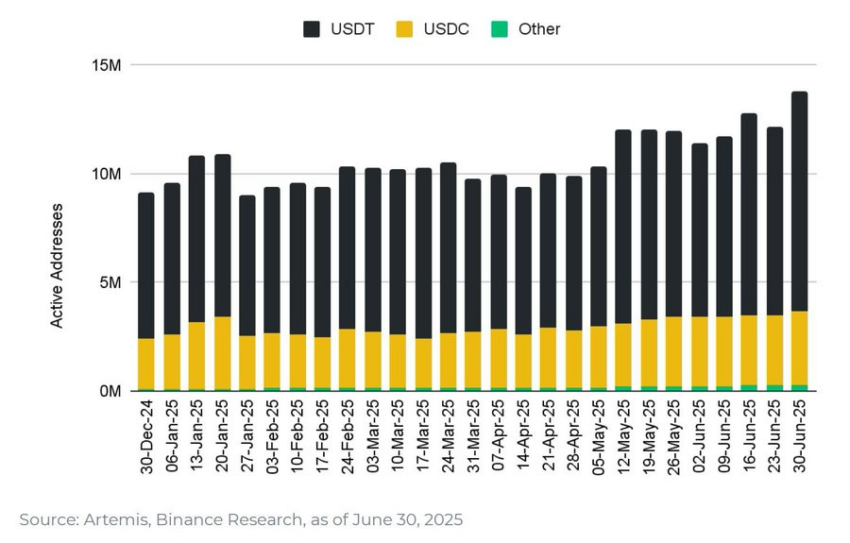

Ardoino’s goals are unsurprising considering USDT is the dominant stablecoin in the market. According to available market data, the digital asset currently accounts for 73% of global stablecoin transaction volume.

Tether Stablecoin Dominance. Source:

X/Unfolded

Tether Stablecoin Dominance. Source:

X/Unfolded

Meanwhile, despite the optimism, the GENIUS Act significantly raises the regulatory compliance bar for Tether.

Under the new law, Tether, which operates out of El Salvador, must meet US standards on licensing, AML procedures, and reserve disclosures. These requirements are essential for the company to maintain access to the American market.

To date, Tether has only been publishing quarterly attestations about its reserves. However, it has not yet delivered a comprehensive, independent audit—an omission long criticized by regulators and analysts.

Already, the company has pledged to comply with the new rules and reiterated its commitment to undergo a full audit of its reserves.

However, the company’s ability to deliver on these promises—particularly regarding reserve disclosures—will be critical.

It will likely determine whether Tether can maintain its leadership in an increasingly regulated market that is drawing interest from traditional financial giants like MasterCard.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A strange phenomenon emerges in the US: the job market cools down while the US stock market repeatedly hits new highs

The U.S. stock market is currently experiencing an extremely peculiar, even "pathological" scenario, which JPMorgan has described as a "bizarre case of jobless expansion."

Witnessing history again! Gold breaks above 3,690 intraday—will it hit 4,000 next year?

Gold prices have surged nearly 40% so far this year. Analysts say the speed of the rally has exceeded everyone's expectations, but a pullback is likely before reaching the $4,000 milestone.

Rumors of token issuance intensify: A look at 10 ecosystem layouts of Polymarket