Research Report|Pump.fun Project Overview & PUMP Token Valuation

I. Project Introduction

Pump.fun is the most iconic one-click token generation platform on Solana and is currently the only meme ecosystem creator engine with legitimate protocol-level revenue streams. Its core mechanism combines Bonding Curve AMM, viral social sharing, and an ultra-low barrier issuance experience, allowing users to mint tokens and list them for trading within seconds. Live rankings, streaming, and real-time community engagement create feedback loops that greatly reduce cold-start barriers for meme assets.

Since launching in early 2024, Pump.fun has enabled the creation of over 11 million tokens and generated $750 million in protocol revenue, rapidly evolving from a product prototype to an on-chain cash flow machine. Unlike traditional token launchpads, Pump.fun breaks down technical and financial liquidity barriers—making “anyone can issue, anyone can trade” a reality.

PumpSwap, the integrated DEX module, officially launched in early 2024 and provides deep liquidity for “graduated” tokens, supporting continued trading for promising projects. This upgrade transformed Pump.fun from a simple token tool to a comprehensive meme asset launchpad and exchange, mirroring Uniswap V2’s early role in DeFi.

Amid the explosive meme cycle and rapid infrastructure evolution, Pump.fun has not only built the fundamental meme trading infrastructure on Solana but also established its own platform brand and liquidity network—offering the crypto market a reference case for how “on-chain narrative can be standardized.”

II. Project Highlights

-

Ultra-Simplified Token Issuance—Anyone Can Launch a Meme

Pump.fun dramatically lowers the bar for token creation: users need only input a name and icon—no coding or deploying needed for one-click launches. Each new token defaults to 1 billion supply, with 80% automatically injected into a Bonding Curve AMM contract for instant trading depth, and 20% reserved for the creator, creating a closed-loop launch experience. -

Built-in Bonding Curve AMM for Automatic Pricing and Liquidity

The platform’s curve-based automated market-making mechanism allows price to move dynamically based on trading, eliminates order books/LP requirements, and delivers a frictionless on-chain pricing system—perfectly suited for short-cycle meme coins. -

Embedded Social Features to Amplify Meme Viral Effects

Pump.fun is a “social meme factory,” not just a launch tool. Creators can stream and promote their tokens live, while chatrooms, leaderboards, and real-time charts create a vibrant, interactive environment—naturally driving meme virality through creation, trading, and sharing. -

Mature “Graduation” System—Onramping Promising Tokens to Secondary Markets

When a token reaches ~$69,000 market cap, it is auto-migrated to DEXes like PumpSwap or Raydium, accessing deeper liquidity pools and lower fees. This “graduation" ensures fair initial launch while helping successful tokens escape illiquidity traps. -

A Meme Platform with Real Revenue & Cash Flow

Since inception, Pump.fun has earned over $750 million in protocol revenue—one of the few meme platforms with real, stable cash flow. Revenue comes from creation fees, slippage taxes, and PumpSwap trading fees, giving $PUMP a solid foundation for value accrual and making Pump.fun among the most commercially sustainable meme projects.

III. Valuation Outlook

Pump.fun is Solana’s most active meme issuance platform—over 11 million tokens created and $750 million in protocol revenue—making it one of the chain’s prime transaction hubs. The native token, $PUMP, held its ICO on July 12, 2025, and listed on multiple exchanges. It is one of the rare meme tokens with real cash flow underlying.

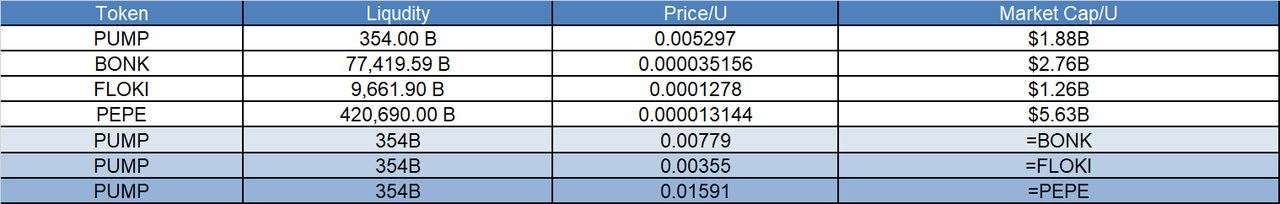

$PUMP currently trades at $0.005297, with an initial circulating supply of 354 billion tokens ($1.88 billion initial circulating market cap). Using comparables like Bonk, FLOKI, and PEPE, we benchmark market cap ranges and community reach for horizontal valuation reference.

IV. Tokenomics

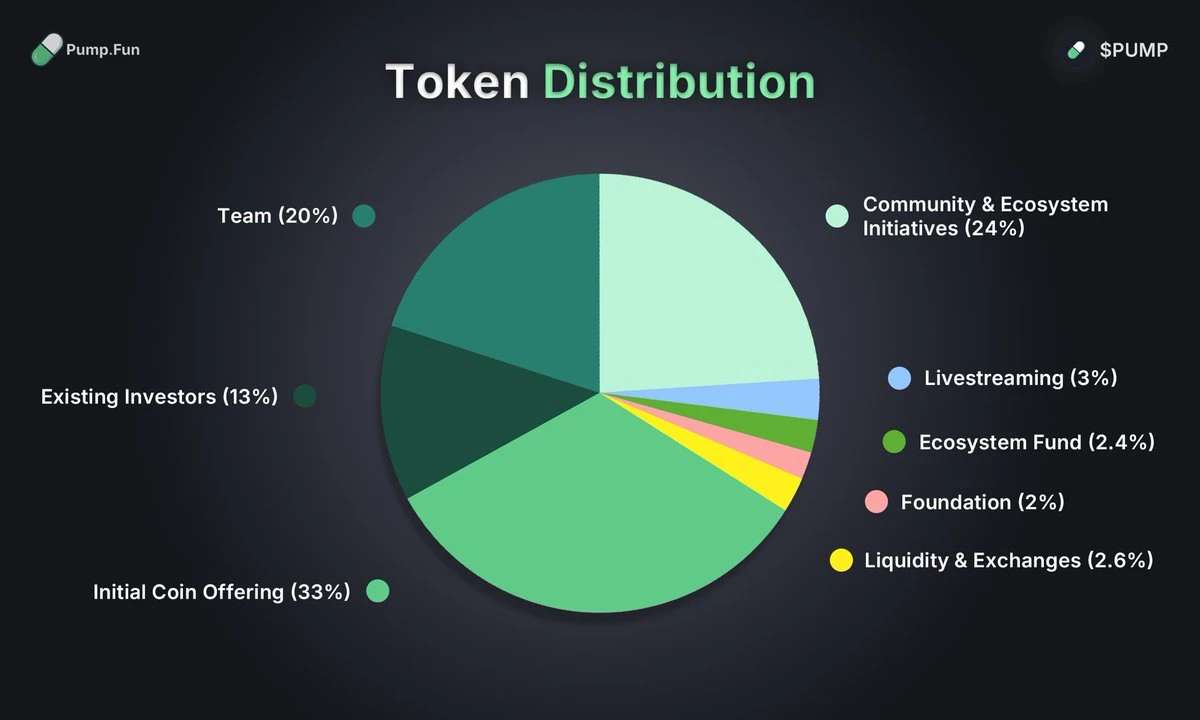

Total Supply: 1,000,000,000,000 (1 trillion)

Allocation:

- 33% sold in initial coin offering (ICO)

- 24% reserved for community and ecosystem programs

- 20% to the project team

- 2.4% for the ecosystem fund

- 2% to the foundation

- 13% to existing investors

- 3% for streaming incentives

- 2.6% for liquidity and trading platforms

Of the 33% sold in ICO: 18% to institutional investors, 15% to public sale. Both investors and public buyers received identical terms (price, immediate unlock at TGE). Tokens sold at $0.004 each; private allocations are fully distributed.

Utility:

- Creator Incentives and Revenue Sharing:

$PUMP holders benefit from fee buyback programs. The platform plans to use ~25% of protocol revenue to buy and burn $PUMP, enhancing deflationary expectations. - Governance and Proposal Rights:

$PUMP will act as the platform’s governance token, giving holders voting and proposal rights for incentive programs, feature updates, trading mechanism changes, etc.

V. Team & Funding

Team:

Founded by Noah Tweedale, Alon Cohen, and Dylan Kerler, Pump.fun launched on Solana mainnet in January 2024:

- Noah Tweedale: product/community strategy, seasoned crypto project designer

- Alon Cohen: lead interaction/deployment developer, architected one-click issuance and social modules

- Dylan Kerler: technical lead, built the Bonding Curve AMM and trading infra

The team’s core vision is “on-chain content as assets,” and the platform stands out for “ultra-low barrier, viral reach, and automation” design.

Funding:

- ICO (July 2025): $500 million raised

- FDV: $4 billion

- ICO date: July 13, 2025 (UTC)

- All allocations (institutional/public) on identical terms, fully unlocked at TGE

- Specific institutional investors not disclosed; no evidence of concentrated holdings

Pump.fun did not conduct traditional seed/strategic rounds. Financing is primarily “product-driven + community-based”—a crypto-native approach. The ICO marks the protocol’s official tokenization and value capture milestone.

VI. Risk Disclosures

- Despite $750M+ in protocol revenue, there was historically no clear revenue-sharing. At times, large portions of revenue were converted to SOL and withdrawn to CEXs (Kraken), drawing “drainage” criticism. While withdrawals are currently paused, long-term commitment to ecosystem support via income remains to be seen.

- While over 10 million tokens have launched, most are short-lived “fast food” projects with no sustained operation. The platform lacks robust project incubation or community vetting, potentially jeopardizing long-term user trust, engagement, and fee consistency.

VII. Official Links

- Website: https://pump.fun/board

- Twitter: https://x.com/pumpdotfun

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethiopia is Turning Hydropower Into Bitcoin Mining

Whale Sits on $9M Profit After Leveraged Bets on BTC & Memecoins

DeFi Tops $300B TVL; Chainlink May Help Drive Institutional Adoption

Bitcoin May Remain Range-Bound Near $115,500–$116,500 as No Reversal Signals Emerge