Key Market Information Discrepancy on July 21st - A Must-See! | Alpha Morning Report

1.Top新闻:Jack Dorsey旗下Block将于7月23日被纳入标准普尔500指数 2.代币解锁:无

Featured News

1.Ethereum Launches The Torch NFT to Celebrate Its 10th Anniversary, Will Open NFT Minting to the Public on July 30

2.Jack Dorsey's Block to Be Added to the S&P 500 Index on July 23

3.USDC Circulation Surpasses 6 Billion, Reaching an All-Time High

4.Trump Releases Video with Caption "The Greatest Bitcoin Explanation in History"

5.Ethereum Surpasses Vanguard Group in Market Cap, Ranks 28th in Global Asset Market Cap

Articles & Threads

1. "Amid the Surge of Crypto Treasury Companies, What Are Some Potential 'Pitfalls'?"

More and more public companies are starting to 'treasury reserve' cryptocurrency. They are no longer just purchasing BTC or ETH but are emulating MicroStrategy, building a replicable financial model: through PIPE, SPAC, ATM, Convertible Bond, and other traditional financial instruments, they are engaging in large-scale financing, positioning, and adoption, combined with the new narrative of 'on-chain treasury,' incorporating cryptocurrencies like Bitcoin, Ethereum, SOL into the core assets on the balance sheet. This is not just a change in asset allocation strategy but rather a new form of 'financial engineering': a market experiment driven by capital, narrative, and regulatory loopholes.

UTXO Management, Sora Ventures, ConsenSys, Galaxy, Pantera, and other institutions have successively entered the scene, facilitating several niche publicly listed companies to complete a 'metamorphosis,' becoming 'cryptocurrency-reserve-type monster stocks' in the US or Hong Kong stock markets. However, this seemingly innovative capital feast is also arousing caution among old-school finance professionals. On July 18, renowned Wall Street short seller Jim Chanos warned that the current 'Bitcoin treasury fever' is echoing the 2021 SPAC bubble—companies are buying coins through issuing convertible bonds and preferred stocks but lack actual business support. "Every day there are announcements of billions, just like the madness back then," he said. This article delves into the four key tools and representative cases behind this wave of trends, attempting to answer a question: when traditional financial instruments meet crypto assets, how can a company evolve from 'buying coins' to 'making moves'? And how should retail investors identify the risk signals in this capital game?

2.《A Week Surge of 400%, Who Is the Real SOL Version of MicroStrategy》

Under the catalysis of projects such as Robinhood, xStocks, and Republic, a large number of companies' on-chain "stocks" have appeared in the Solana ecosystem, and an unprecedented "coin-stock linkage" experiment is underway. Upexi, after continuously increasing its SOL holdings over the past few months, has surpassed 730,000 tokens in holdings, becoming the Nasdaq-listed company with the most SOL holdings. It recently announced that it will tokenize its SEC-registered stocks on Solana through the Opening Bell platform under Superstate.

Another "SOL micro-strategy company," SOL Strategies, also plans to launch "tokenized stocks" on the same platform. They are both trying to build a three-tier circular structure, using traditional equity (or debt) financing to purchase SOL assets, unlocking liquidity through on-chain tokenization, and ultimately leveraging DeFi protocols to achieve capital circulation amplification. The success or failure of this model will directly impact the integration process between traditional finance and on-chain finance.

Market Data

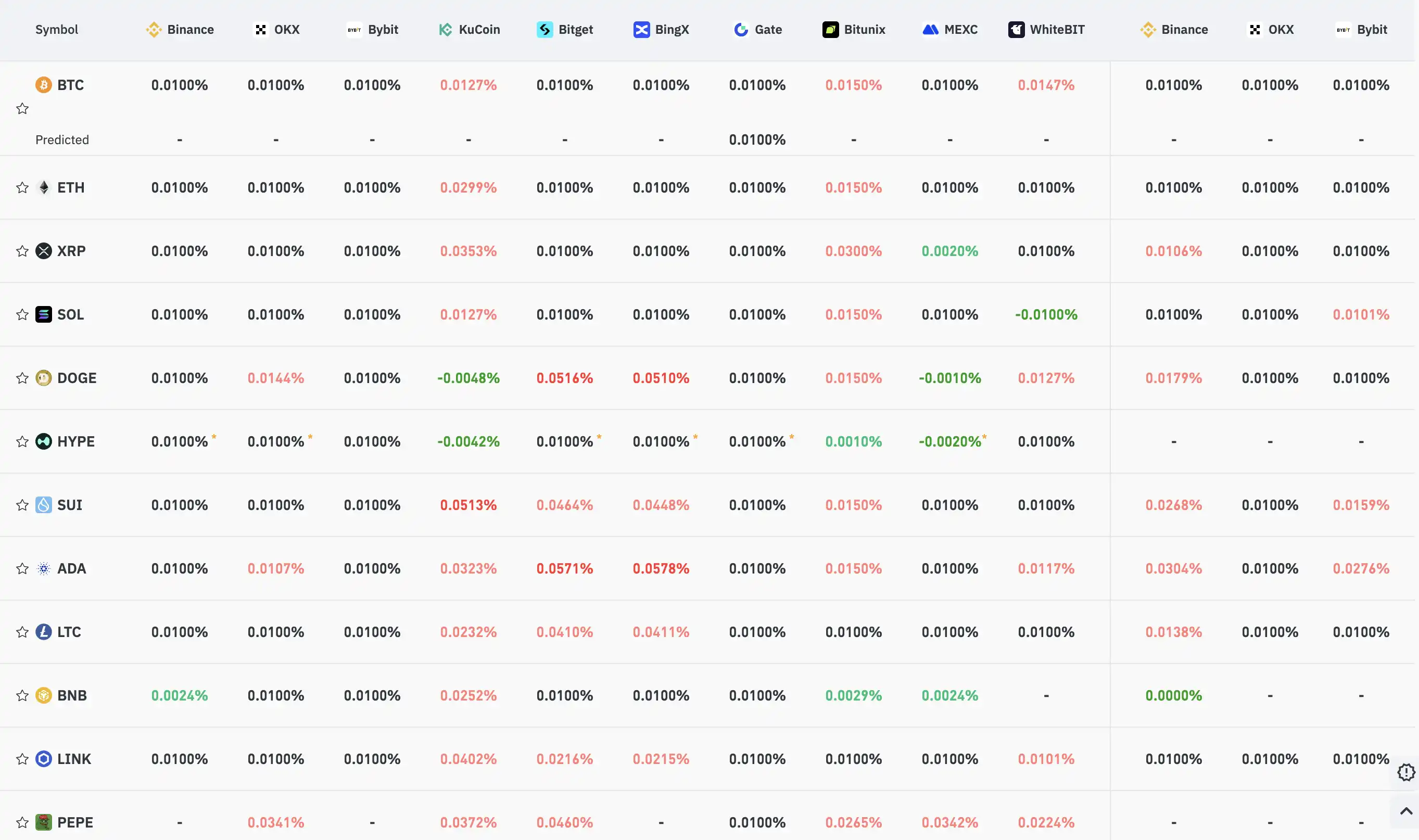

Daily Market Overall Capital Heat (Reflected by Funding Rate) and Token Unlocking

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocking

No token unlocking today

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid’s USDH Ticker Assigned via Onchain Vote

Bitcoin’s Bull Run Continues Despite Short-Term Corrections

HYPE Token Soars as Paxos Aims to Lead USDH Stablecoin

Michael Saylor’s Strategy Acquires 1,955 Bitcoin