XRP Slides Below $3.14 as Outflows Rise and Reversal Risks Grow

- XRP dropped from $3.66 to $3.14 after sellers gained control and broke major support levels.

- Capital outflows turned negative, while $3.00 remains a critical level to watch.

- Analysts see $3.00 as support, but fading inflows could drive XRP to deeper lows soon.

XRP has dropped from its July high of $3.6626 and is now trading at $3.1390, signaling a steep price correction. The daily chart from TradingView displays a run-on liquidity, marked by an aggressive vertical rise followed by swift rejection. This type of formation typically signals exhaustion, and the sharp wick at the top adds weight to that theory.

Source:

TradingView

Source:

TradingView

As of press time, XRP trades below the 9-day SMA of $3.3713 and beneath the 0.236 Fibonacci level at $3.2486, confirming short-term bearish pressure. If bulls regain control quickly, the price is likely to revisit the visible Fair Value Gap between $3.03 and $3.24. From that retest, XRP will either start over a corrective downturn or seek higher liquidity zones above resistance levels.

The Moving Average Convergence Divergence dipped beneath the signal line. The MACD is at 0.2611 below the signal line at 0.2717. This bearish cross comes after an explosive XRP price action in July, when the price increased at a pace of nearly two times its value in under a month to trade at $3.66. The price structure in an arc shape indicates exhaustion of momentum and gives room to sellers to squeeze.

If the bearish trend continues, XRP could retest the $2.7854 level, and if that breaks, the 1.0 Fibonacci support at $1.9083 becomes the next potential destination. To shift sentiment, bulls would need to reclaim 0.236 Fib with strength, but current indicators tilt in favor of sellers.

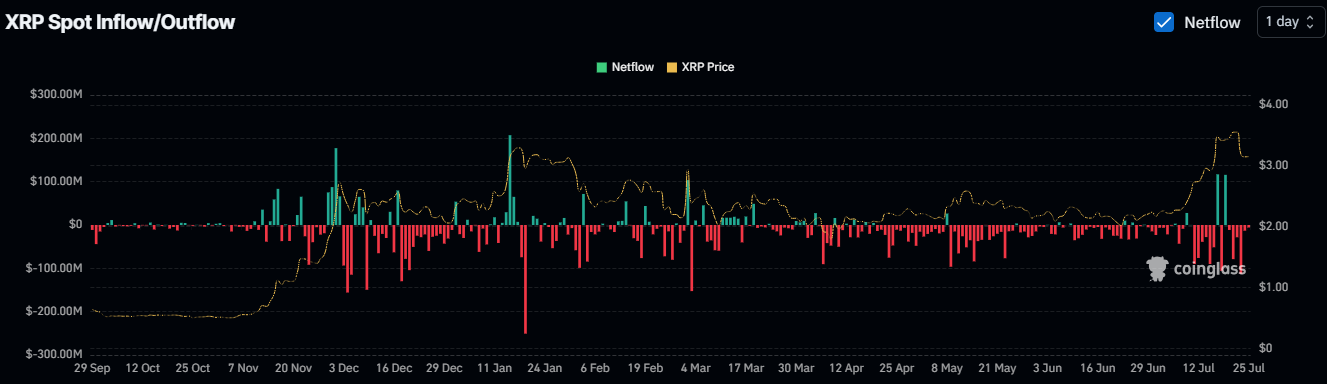

On-Chain Netflows Signal Investor Caution and Liquidity Drain

According to data from Coinglass, XRP spot netflows turned negative, marking a continuation of consistent capital outflows. This reinforces a bearish shift that began after XRP touched highs above $3.60.

Source:

Coinglass

Source:

Coinglass

Between late September 2024 and April 2025, netflows remained largely negative, with extreme outflow spikes in mid-December and late January, sometimes falling below -$250 million. Although there were very short inflow attempts in January and March, which were close to $200 million, these rallies quickly faded.

Recently, the same pattern occurred once again. After XRP’s July climb, inflows increased briefly but were again followed by outflows after July 20. Following the rise of XRP in July, inflows improved temporarily, only to be followed by huge outflows since July 20. Such an action indicates a shallow positioning in the market of traders taking great advantage of the rally to flip out. Unless it is countered by a fresh inflow of capital, such downside pressure can only increase as bulls have very little room to recover.

Related: Brazil’s VERT Launches $130M Tokenized Credit on XRP Ledger

Can XRP Hold $3.00 After Flipping Resistance Into Support?

Analyst Steph_iscrypto posted a 4-day chart on X, showing XRP breaking past its historical resistance level at $3.00. The price went upward, clearing a zone that had rejected multiple breakout attempts from December 2024 through July 2025. The same $3.00 level now appears to serve as solid support after a successful retest.

The green resistance block highlighted on the chart spans from roughly $2.60 to $3.00 and has capped price advances for months. In early July, XRP finally broke above that barrier, leading to an aggressive vertical rally.

His chart shows a possible price action of heading to 7.50, and the use of the candlesticks in vertical format shows more vigor in purchasing. This technical formation suggests that the $3.00 price must be supported; otherwise, this bullish allocation can still fail with the retesting of the long-term resistance.

The post XRP Slides Below $3.14 as Outflows Rise and Reversal Risks Grow appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise Launches Solana Staking ETF on NYSE Offering Direct SOL Exposure and Staking Rewards

Democrat Ro Khanna Proposes Crypto and Stocks Trading Ban for Elected Officials

AI Agents Can Now Access Wallets—Is It Safe?

AI agents may soon control crypto wallets via Coinbase’s x402 protocol. Is this the future, or a security risk?What Is the x402 Protocol?Safety Concerns and Questions

Markets Expect Fed Rate Cut This Wednesday

Traders price in a 97.8% chance of a 25bps Fed rate cut this Wednesday, according to CME data.Why This Matters for Crypto and StocksLooking Ahead to Wednesday’s Fed Meeting

pic.twitter.com/U4cdaIXZyt

pic.twitter.com/U4cdaIXZyt