Ethereum ETF inflows surged to $440 million in July 2025, driven by rising institutional demand, while Bitcoin consolidates below $121,000, indicating strong market optimism and potential upcoming price movements.

-

Ethereum ETF inflows reached a record $440M in July 2025, highlighting growing institutional interest.

-

Bitcoin remains range-bound below $121,000, with traders closely watching for a breakout or retracement.

-

Strong ETF inflows reflect mainstream adoption of Ethereum, supported by Wall Street participation and strategic buying.

Ethereum ETF inflows hit $440M in July 2025, signaling rising institutional demand. Bitcoin consolidates below $121K amid strong market optimism. Read more for insights.

Why Are Ethereum ETF Inflows Surging in July 2025?

Ethereum ETF inflows have surged to $440 million in July 2025, reflecting increasing institutional confidence in the asset. The iShares Ethereum Trust ETF (ETHA) has shown steady growth since late 2024, with accelerated inflows starting January 2025. This trend indicates that institutional investors are accumulating Ethereum positions strategically, anticipating future market gains.

How Does Institutional Demand Impact Ethereum’s Market Position?

Institutional demand is a key driver behind Ethereum’s growing market legitimacy. According to market analyst Merlijn The Trader, institutions are buying aggressively rather than dollar-cost averaging, signaling strong conviction. This influx of capital from traditional investors seeking diversified crypto exposure strengthens Ethereum’s position as a mainstream digital asset.

What Is Driving Bitcoin’s Consolidation Below $121,000?

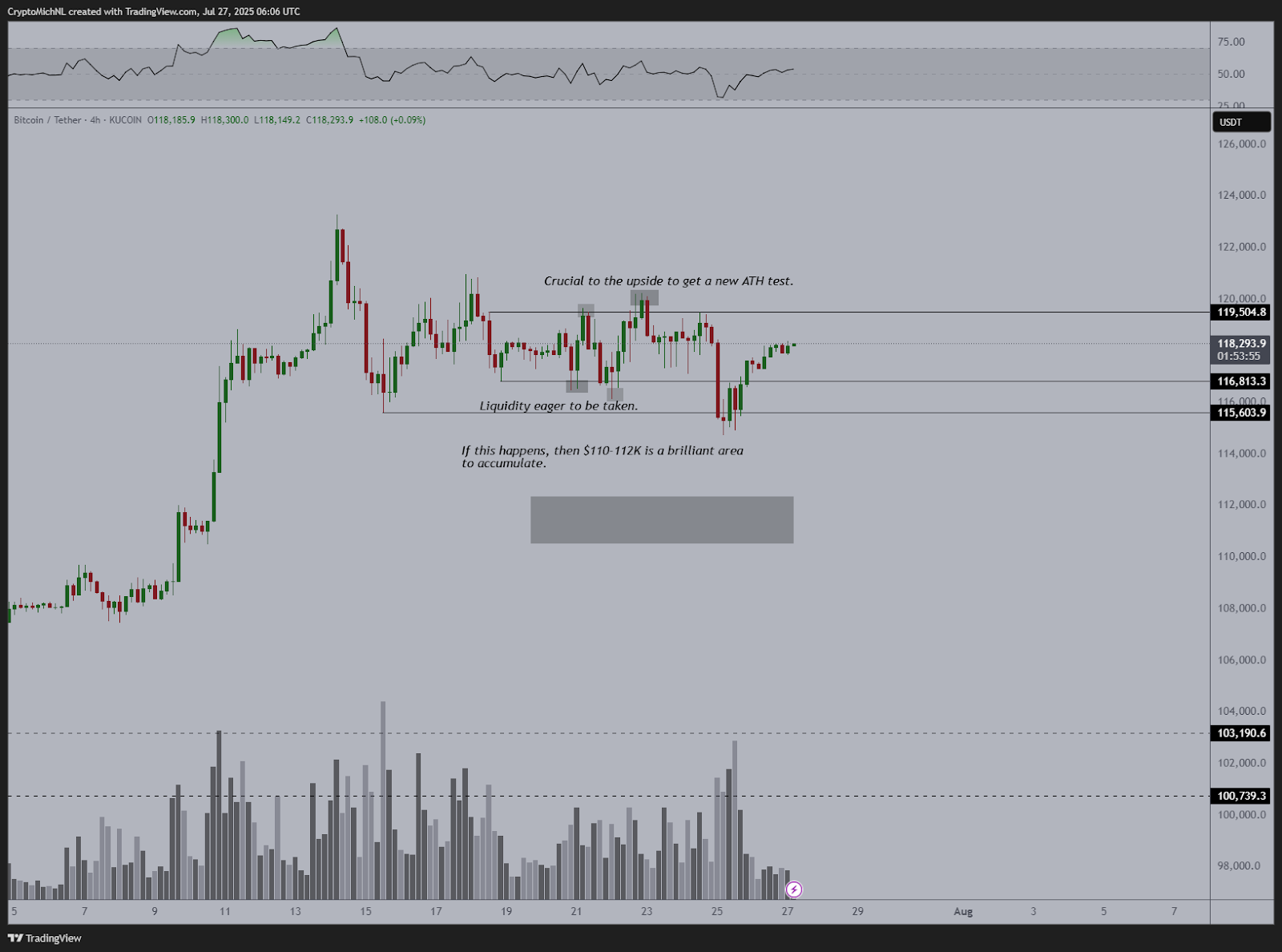

Bitcoin has been consolidating in a narrow range between $115,000 and $121,000 for over two weeks. This price action shows indecision among traders as they await a breakout or breakdown. Technical indicators reveal accumulation in the $110,000–$112,000 support zone, suggesting that market participants are positioning for a potential significant move.

What Are the Possible Outcomes of Bitcoin’s Current Price Range?

Analysts, including Michaël van de Poppe, expect that a confirmed breakout above $121,000 could trigger a rally toward new all-time highs around $126,000. Conversely, a breakdown below support levels may lead to deeper retracements. Volume surges at lower price points support the buildup of positions, indicating strong interest at current levels.

Source: Michael Van de Poppe

| Ethereum (ETH) | $440 Million | Not Applicable |

| Bitcoin (BTC) | Minimal ETF inflows | $115,000 – $121,000 |

How Does Institutional Participation Influence Cryptocurrency Markets?

Institutional participation enhances market stability and legitimacy. The growing inflows into Ethereum ETFs demonstrate that traditional investors are increasingly viewing cryptocurrencies as viable assets. This trend supports broader adoption and may reduce volatility over time by introducing long-term capital.

What Are Experts Saying About This Trend?

Market experts emphasize that aggressive institutional buying ahead of anticipated market moves signals confidence in Ethereum’s fundamentals. This behavior contrasts with retail investors’ often reactive trading patterns, suggesting a maturing market environment.

Frequently Asked Questions

What factors are driving Ethereum’s ETF inflows in 2025?

Institutional investors are increasing their Ethereum exposure through ETFs due to strong fundamentals and expectations of future price appreciation, leading to record inflows in July 2025.

How might Bitcoin’s price behave after the current consolidation?

Bitcoin may either break above $121,000 to reach new highs or fall below support levels, triggering a correction. Traders are closely monitoring volume and price action for clues.

Key Takeaways

- Ethereum ETF inflows reached $440M in July 2025: Signaling strong institutional demand and market confidence.

- Bitcoin consolidates below $121,000: Traders are positioning for a possible breakout or retracement.

- Institutional participation boosts crypto legitimacy: Increasing mainstream adoption and market stability.

Conclusion

The surge in Ethereum ETF inflows alongside Bitcoin’s consolidation highlights a dynamic crypto market with growing institutional involvement. This trend underscores Ethereum’s rising mainstream adoption and suggests potential volatility ahead for Bitcoin. Investors should monitor these developments closely as they signal evolving market sentiment and opportunities.