This week in crypto, Conflux, Pudgy Penguins, and Ethena led significant price gains amid volatile markets, while Pump.fun, Tezos, and Sonic experienced notable declines, highlighting shifting investor sentiment and sector rotation.

-

Conflux surged 30% after a volatile breakout but retraced sharply, signaling uncertain momentum.

-

Pudgy Penguins showed steady bullish momentum with a controlled 28% rally, reclaiming key resistance levels.

-

Ethena maintained a bullish structure, pushing into a critical supply zone after a 24% gain.

Crypto weekly recap: Conflux, Pudgy Penguins, and Ethena lead gains while Pump.fun, Tezos, and Sonic fall. Stay informed with COINOTAG’s expert analysis.

Market Overview: Volatility Tests Crypto Investor Conviction

This week’s crypto market displayed strong volatility, challenging investor confidence across multiple sectors. Despite a massive 80,000 BTC transfer by a Satoshi-era whale, the market remained resilient, reflecting deep liquidity and steady demand. Institutional interest was reaffirmed as BlackRock’s Ethereum ETF surpassed $10 billion in assets under management, underscoring growing confidence in Ethereum’s long-term potential.

Low- and Mid-Cap Tokens Dominate Weekly Movers

Low- and mid-cap cryptocurrencies led both the top gainers and losers this week, illustrating a fragmented risk appetite and active sector rotation. This dynamic environment favors nimble traders and highlights the importance of monitoring emerging trends within altcoin markets.

Weekly Winners

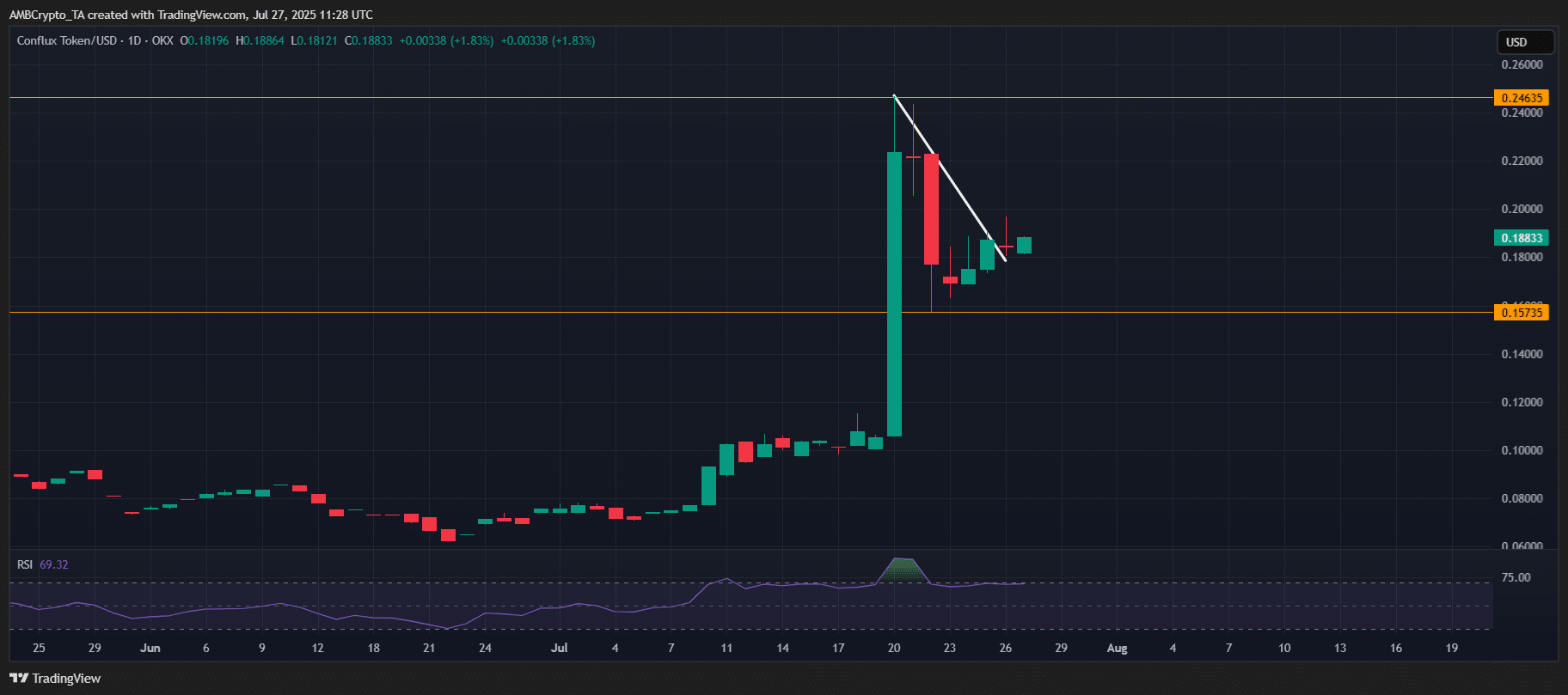

Conflux [CFX] — A Volatile Rally with Mixed Signals

Conflux [CFX] was the week’s most notable gainer, rallying 30% from a $0.105 open. The token experienced a parabolic 122% breakout early in the week, reaching a new all-time high of $0.246 amid overbought RSI conditions. However, this surge was followed by a sharp 80% retracement to $0.15, suggesting a blow-off top rather than sustained accumulation. Despite this, the technical structure remains intact, and a 20% bounce off the $0.15 level indicates potential base formation or a retest of $0.20 resistance.

Source: TradingView (CFX/USDT)

Pudgy Penguins [PENGU] — Controlled Bullish Momentum

Pudgy Penguins [PENGU] recorded a 28% gain, demonstrating a more measured and sustainable rally compared to Conflux. Starting near $0.03 resistance, PENGU pushed through to $0.40 after a brief midweek dip of 12.28%, quickly recovering as buyers re-entered. The momentum suggests a strong bullish bias, with potential to test the $0.046 local high and possibly $0.05 if buying pressure persists.

Ethena [ENA] — Stablecoin Protocol Shows Bullish Continuation

Ethena [ENA] gained 24.15%, pressing into a key $0.60 supply zone after opening near $0.50 resistance. Despite an initial 11% shakeout, bulls regained control and pushed prices up nearly 30% within three days, reaching a $0.63 high. A minor 1.37% intraday pullback indicates short-term cooling, but overall structure remains bullish, setting the stage for further gains in August.

Other Notable Winners

Memecoin [MEMECOIN] led explosive rallies with a staggering 4,445% increase, followed by Zora [ZORA] at 382% and Uranus [URANUS] with a 330% surge. These gains reflect speculative momentum dominating the altcoin space this week.

Weekly Losers

Pump.fun [PUMP] — Heavy Sell Pressure Despite Buybacks

Pump.fun [PUMP] was the top weekly loser, falling 34.62% from a $0.0042 open. The token’s decline correlates with heavy ICO-era distribution and persistent sell pressure despite $19.6 million in buybacks since launch. Current token value of $7.6 million highlights insufficient bid-side demand. A slight 8% market cap increase and 15% volume uptick suggest early dip buying, but a confirmed reversal requires holding above the $0.0023 weekly low and securing two consecutive green weekly closes.

Source: TradingView (PUMP/USDT)

Tezos [XTZ] — Bearish Reversal After Strong Rally

Tezos [XTZ] dropped 17.23% following a massive 66.57% gain last week. The pullback reflects classic distribution, with sellers taking profits after a rally. However, the daily chart suggests a reset rather than collapse, as buyers defended the $0.80 support and pushed price back to $0.90. Continued defense of this zone could lead to a breakout attempt toward $1.

Sonic [S] — Resistance Holds, Prompting Pullback

Sonic [S] declined 15% after failing to break the $0.40 resistance level. Following a 23% run-up, profit-taking led to a 16% drop early in the week. Price has since stabilized around $0.32, indicating supply exhaustion and a possible local floor. If this range holds, a rebound toward $0.40 remains plausible.

Other Notable Losers

Additional declines were seen in Nobody Sausage [NOBODY] (-38%), MindWaveDAO [NILA] (-36.7%), and FUNToken [FUN] (-36.6%), reflecting broad market cooling and increased volatility.

Frequently Asked Questions

What caused Conflux’s sharp price fluctuations this week?

Conflux’s price surged due to a parabolic breakout driven by speculative buying but retraced sharply as profit-taking increased, indicating market uncertainty and overbought conditions.

How is institutional interest impacting Ethereum’s market performance?

Institutional confidence, highlighted by BlackRock’s ETH ETF surpassing $10 billion AUM, is reinforcing Ethereum’s market stability and attracting long-term investors.

Why are low- and mid-cap tokens leading market movements?

Low- and mid-cap tokens often exhibit higher volatility and speculative interest, making them prone to sharp gains and losses during periods of sector rotation and shifting risk appetite.

Key Takeaways

- Conflux [CFX]: Experienced a volatile breakout with a 30% weekly gain but retraced sharply, indicating uncertain momentum.

- Pudgy Penguins [PENGU]: Showed steady bullish momentum with a controlled 28% rally, reclaiming resistance levels.

- Ethena [ENA]: Maintained a bullish structure, pushing into a critical supply zone after a 24% gain.

- Pump.fun [PUMP]: Declined 34.62% despite significant buybacks, reflecting ongoing sell pressure.

- Market Sentiment: Institutional interest remains strong, but low- and mid-cap tokens show fragmented risk appetite and sector rotation.

Conclusion

This week’s crypto market demonstrated resilience amid volatility, with notable winners like Conflux, Pudgy Penguins, and Ethena offset by declines in Pump.fun, Tezos, and Sonic. Institutional confidence in Ethereum remains robust, while low- and mid-cap tokens continue to drive dynamic sector shifts. Staying informed and cautious remains essential as market conditions evolve.