UBS: Investors Should Prepare for Potential Market Volatility in the Coming Weeks

According to Jinse Finance, citing Zhitong Finance, the UBS Wealth Management Chief Investment Office stated that since concerns over U.S. tariff policies peaked in April, the S&P 500 Index has risen by nearly 30%. This reflects growing investor confidence that the United States will reach compromises with its major trading partners. Recent data also indicate that the U.S. economy has remained resilient, and market sentiment has been boosted by leading tech companies continuing to ramp up capital expenditures on artificial intelligence. UBS also cautioned that the sharp gains in recent weeks have already priced in much of the potential good news, and investors should be prepared for possible market volatility in the coming weeks. While increased certainty in U.S.-European trade will encourage the market, the level of U.S. tariffs remains about six times higher than the general level before Liberation Day. The economic impact of these tariffs is now becoming apparent, and uncertainty remains regarding their scale, distribution, and second-order effects. The economic impact of industry-level tariffs may be even greater than that at the national level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sources: Bank of Japan to pledge further rate hikes at next week's policy meeting, insiders say

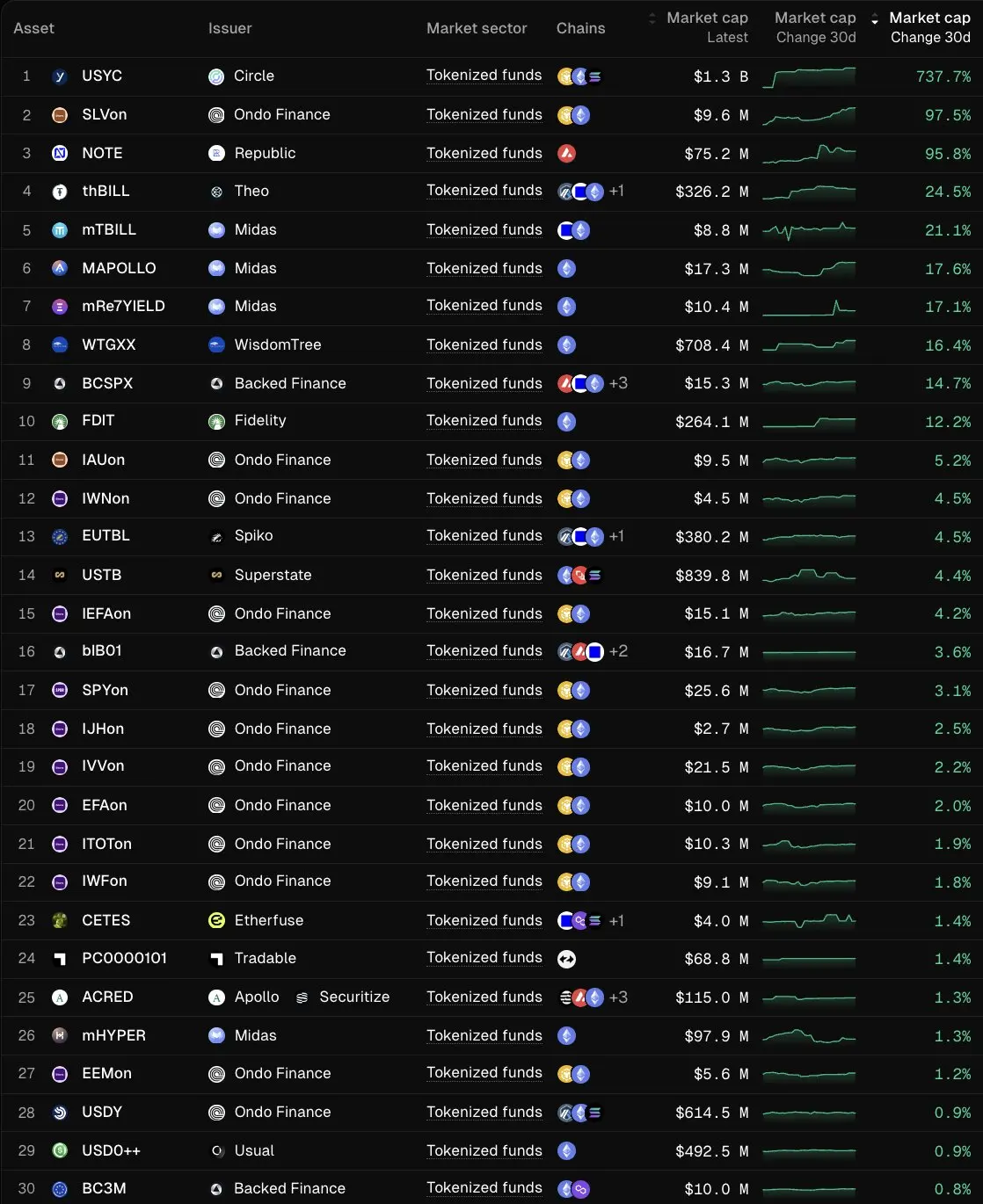

Circle CEO: Tokenized Fund USYC Sees 737.7% Market Cap Growth in the Past 30 Days

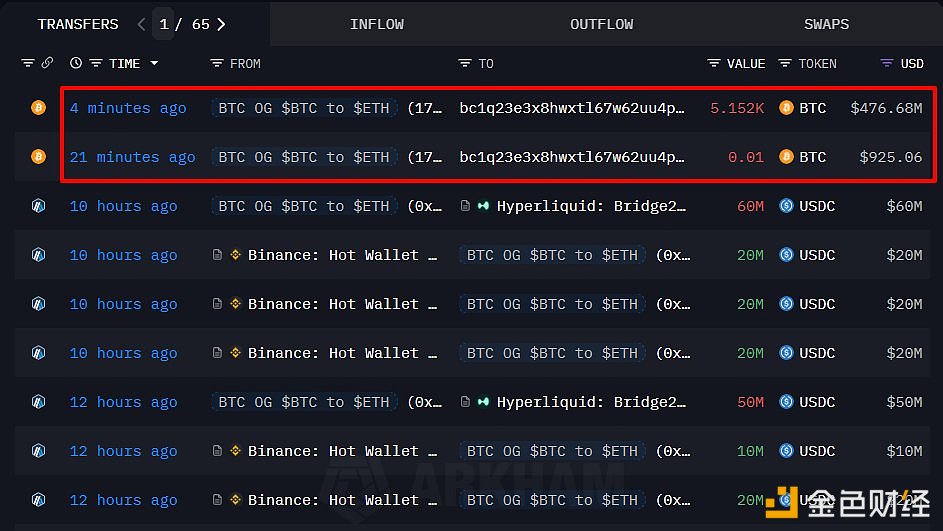

Data: Hyperliquid open interest reaches $7.73 billions, marking seven consecutive days of growth