Yield on US 2-Year Treasury Note at Auction Falls Below Pre-Auction Trading Level

According to Jinse Finance, the U.S. Treasury auctioned $69 billion in two-year bonds, with a winning yield of 3.920%. The pre-auction trading level at the 11:30 a.m. New York bidding deadline was 3.925%, showing little change during the day. The market reaction to the auction results was minimal. Primary dealers were allocated 10.3%, lower than the previous auction, while direct bidders’ allocation rose to 34.4%, and indirect bidders’ allocation fell to 55.3%. The bid-to-cover ratio was 2.62, in line with the average of the previous six auctions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EU may propose 19th round of sanctions against Russia as early as Friday

BBH View: Risk sentiment remains positive but limited after the Fed's neutral rate cut

Trump Signs the "Technology Prosperity Agreement," Designates "ANTIFA" as a Terrorist Organization

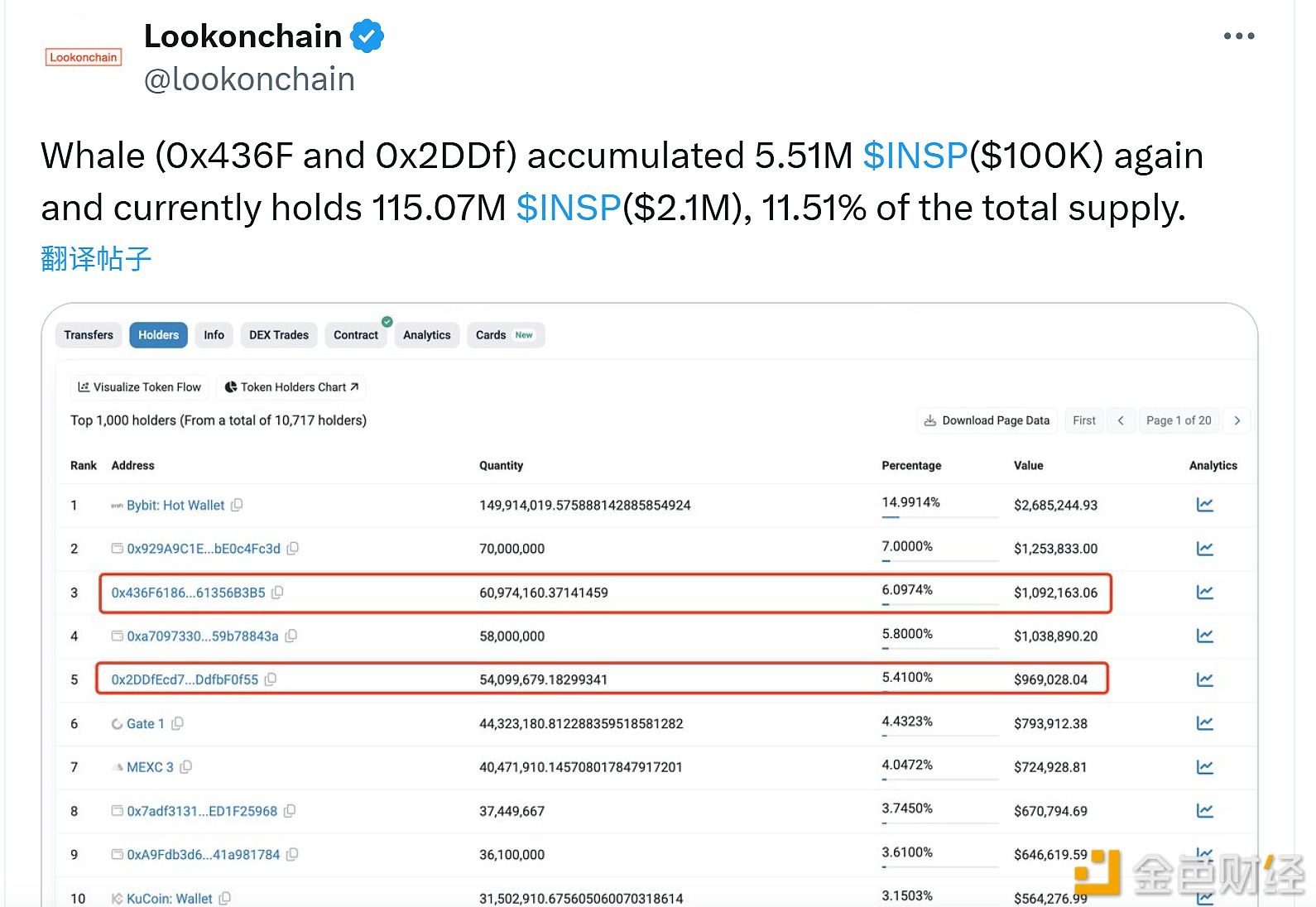

A certain whale address has accumulated an additional 5.51 million INSP tokens.