Bitcoin nears $120K as analysis predicts 'larger price swings' next

Key points:

- Bitcoin stages a late comeback into the weekly close as price approaches important liquidation zones.

- Traders and analysts emphasize various key price points to reclaim next.

- Volatility is expected based on large-volume trading behavior, analysis reports.

Bitcoin surged above $119,000 Sunday as bulls extended a rebound from two-week lows.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Bitcoin price volatility returns into weekly close

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD approaching a key reclaim area.

Now attempting a daily close above its 10-day simple moving average, the pair held onto a rebound from near $114,500 as the market forgot one of the largest-ever BTC sales.

The uptick came amid news that the US and China had agreed to further delay the introduction of reciprocal trade tariffs.

Market participants thus focused on the key levels to look for going into the new week.

“$BTC needs to break above $119.5K for a big move. If that doesn't happen, this consolidation will continue,” crypto investor and entrepreneur Ted Pillows summarized in a post on X.

“I think BTC could break above this level next month which will start the next leg up.”

BTC/USDT 4-hour chart with RSI data. Source: Ted Pillows/X

BTC/USDT 4-hour chart with RSI data. Source: Ted Pillows/X

Popular trader and analyst Rekt Capital eyed a slightly higher range ceiling just below the $120,000 mark.

“Bitcoin has Daily Closed above the blue Range Low, kickstarting a break back into the very briefly lost Range,” he told X followers alongside a print of the daily BTC/USD chart.

“Any dips into the Range Low (confluent with the new Higher Low) would be a retest attempt to confirm the reclaim.”

BTC/USD 1-day chart. Source: Rekt Capital/X

BTC/USD 1-day chart. Source: Rekt Capital/X

Others warned that price could still fill the daily downside wick left by the trip to $114,500.

In an X thread on the topic, fellow trader CrypNuevo identified a downside target confluent with an area of exchange order-book liquidity.

“If we zoom out, we can see that the main liquidation level is at $113.8k,” he commented.

“Consequently, I consider the downside liquidation cluster to be the natural target in the mid-term ($114.5k-$113.6k).”

Analyst sees “larger price swings” next

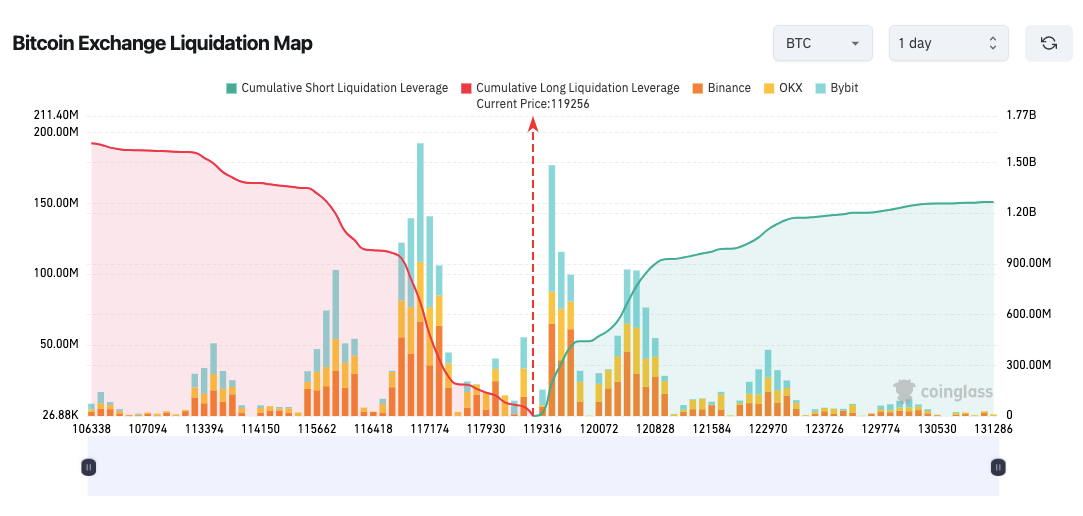

The latest data from monitoring resource CoinGlass meanwhile puts the “max pain” for BTC shorts at around $119,650.

Should Bitcoin return to challenge all-time highs near $123,000, short liquidations would total over $1.1 billion.

Bitcoin exchange liquidation map (screenshot). Source: CoinGlass

Bitcoin exchange liquidation map (screenshot). Source: CoinGlass

“Strong resistance forming around 119,000–120,000, indicated by dense liquidation clusters,” crypto analysis platform Coinank agreed while examining its own liquidity data.

Analyst TheKingfisher additionally warned of heightened volatility on short timeframes.

“Seeing predominantly red on the BTC GEX+ chart. This indicates dealers are heavily short gamma, suggesting they may amplify volatility to hedge their positions,” he reported on X Sunday.

“Expect potentially larger price swings in the near term. Monitor these shifts closely.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big Volatility During the Rate-Cut Cycle: Will Bitcoin Rise First and Then Fall?

The Federal Reserve has begun a rate-cutting cycle, which could trigger a parabolic surge; however, this bull market may end with a historic crash.

Fed Cuts Rates, Bitcoin Dominance Forms Death Cross, Alts Get Ready

Former BlackRock Executive Joseph Chalom: Ethereum is Redrawing the Global Financial Landscape

Ethereum OBV, Bullish Cross Indicate Possible Test Above $5,000 This Month