Date: Mon, July 28, 2025 | 10:30 AM GMT

The broader cryptocurrency market continues to ride a bullish wave, led by Ethereum (ETH), which has surged 60% over the past 30 days and is now trading near $3,900. This positive sentiment is spilling into promising altcoins , with Avalanche (AVAX) showing strong signs of potential upside momentum.

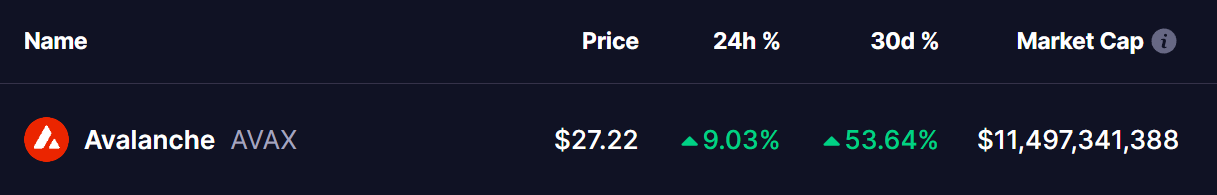

AVAX is extending its bullish streak with an impressive 9% daily gain, pushing its monthly rally to 53%. Beyond its price surge, AVAX’s price action is forming a bullish fractal pattern that closely mirrors the breakout move freshly seen in Ethena (ENA).

Source: Coinmarketcap

Source: Coinmarketcap

AVAX Mirrors ENA’s Breakout Setup

A side-by-side comparison of AVAX and ENA’s daily charts (see above) highlights a strikingly similar trajectory. ENA recently broke out of a textbook falling wedge, reclaimed its 100-day moving average, and climbed above its 200-day MA. After a quick pullback to retest that support, ENA surged 63% to the upside, reaching as high as $0.677.

ENA and AVAX Fractal Chart/Coinsprobe (Source: Tradingview)

ENA and AVAX Fractal Chart/Coinsprobe (Source: Tradingview)

AVAX now appears to be tracing the same path. It has broken free from its own falling wedge, reclaimed its 100-day MA, and is bouncing off the 200-day MA, just as ENA did before its sharp rally.

This fractal resemblance suggests that AVAX could be in the early stages of a similar move.

What’s Next for AVAX?

If this bullish fractal continues to play out, AVAX could target $35.0, representing a potential 30% upside from its current price near $27.16.However, to keep this setup intact, AVAX must hold above its 200-day moving average, currently near $23.0.