Dogecoin whales accumulated 130 million DOGE within 24 hours amid price fluctuations, signaling strong confidence and limited sell pressure during recent market corrections.

-

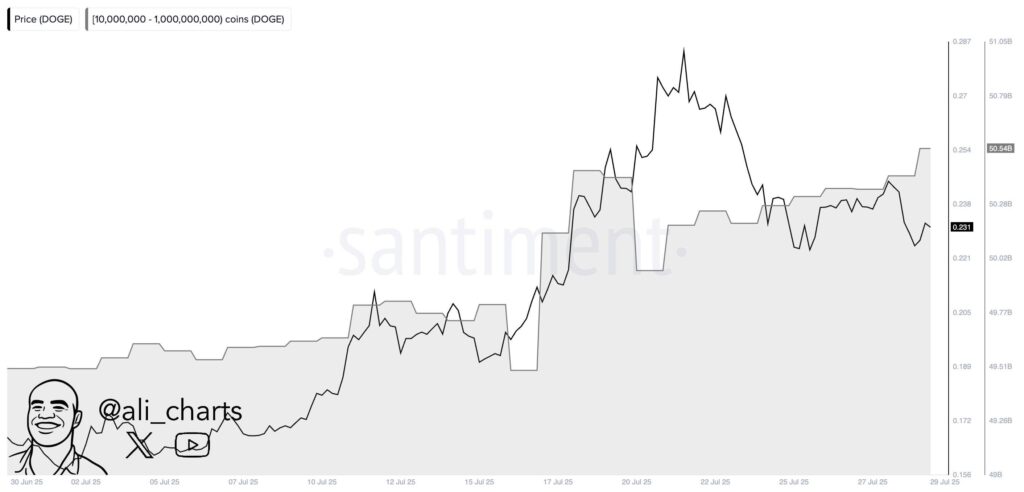

Whales increased holdings to 50.79 billion DOGE during the July rally, reflecting bullish sentiment.

-

Despite price dropping to $0.21, whale holdings remained stable, indicating long-term positioning.

-

Continued exchange outflows post-peak suggest reduced selling pressure from major holders.

Dogecoin whales amassed 130M DOGE amid price swings, showing strong confidence and reduced sell pressure. Stay informed with COINOTAG’s latest crypto insights.

-

Dogecoin whales are actively accumulating large amounts of DOGE, signaling bullish market behavior.

-

Price retracements have not triggered significant sell-offs from major holders, highlighting confidence in DOGE’s long-term value.

-

On-chain data and exchange outflows confirm sustained holding patterns by whales during volatile periods.

Dogecoin whale accumulation highlights strong market confidence amid price swings. Discover detailed analysis and data-driven insights at COINOTAG.

How Did Dogecoin Whale Accumulation Surge During the Mid-July Price Peak?

Dogecoin whale accumulation surged significantly as the price peaked in mid-July, with holdings rising from 49.26 billion to 50.79 billion DOGE. Between June 30 and July 10, DOGE price remained stable, but from July 10 onward, both price and whale holdings sharply increased. This trend reflects strong confidence from large holders during the rally, supported by on-chain data showing increased wallet activity in the 10 million to 1 billion DOGE range.

What Does the Exchange Outflow Data Reveal About Whale Behavior?

Exchange outflows dominated between July 18 and 22, with multiple outflows exceeding $20 million, indicating that whales were moving DOGE off exchanges. This pattern reduces available supply and suggests a decreased likelihood of immediate selling. Netflow data from July 23 to 29 confirms continued outflows, some surpassing $30 million, reinforcing the view that whales are holding rather than selling during price retracements.

What Trends Are Visible in Dogecoin Inflow and Outflow Patterns?

Before the mid-July rally, net inflows to exchanges were modest, rarely exceeding $10 million. However, inflows spiked between July 11 and 17, reaching $50-$60 million, coinciding with the buildup to DOGE’s price rally. After the peak, outflows dominated, indicating that whales moved funds off exchanges to reduce short-term selling risk. This divergence between price and wallet activity suggests large holders maintain positions despite temporary price corrections.

DOGE holders chart, Source: Ali on X

DOGE holders chart, Source: Ali on X

How Did Whale Holdings React to Price Retracement After July 20 Peak?

After peaking near $0.287 on July 20, DOGE’s price declined to around $0.21 by July 28. Despite this, whale holdings remained near 50.54 billion DOGE by July 29, showing no significant sell-off. This stability indicates strong conviction among large holders. Netflow data supports ongoing accumulation or holding, with outflows continuing to reduce exchange supply and limit sell pressure during the dip.

DOGE Spot Inflow/Outflow chart, Source: Coinglass

DOGE Spot Inflow/Outflow chart, Source: Coinglass

| Whale Holdings (July 20) | 50.79B DOGE | ↑ from 49.26B on July 10 |

| Price Peak | $0.287 | ↑ from $0.18 on July 10 |

| Exchange Outflows (Peak Period) | Multiple > $20M | Higher than prior weeks |

Frequently Asked Questions

What causes Dogecoin whales to hold during market dips?

Whales hold DOGE during dips to maintain long-term positions, reflecting confidence in future price appreciation and reducing market volatility.

How does Dogecoin accumulation impact price trends?

Accumulation by large holders decreases circulating supply on exchanges, which can lead to upward price pressure and reduced volatility.

Key Takeaways

- Whale accumulation surged during Dogecoin’s mid-July price peak, indicating strong bullish sentiment.

- Stable whale holdings during price retracements suggest long-term confidence and reduced sell pressure.

- Exchange outflows post-peak highlight decreased availability of DOGE for short-term selling.

Conclusion

Dogecoin whales’ significant accumulation amid price swings demonstrates robust confidence in DOGE’s long-term potential. The sustained holding patterns and exchange outflows reduce sell pressure, supporting price stability during corrections. Monitoring whale activity remains crucial for understanding Dogecoin’s market dynamics and future trends.