XLM Downturn Looms: MACD Crossover and Negative Sentiment Raise Red Flags

XLM is under increasing pressure, with technical and sentiment indicators suggesting a potential drop below $0.40 unless bullish momentum reemerges.

Stellar’s XLM faces increasing downward pressure after a lackluster performance in the past week.

Technical indicators are flashing warning signs, with a key momentum indicator forming a bearish crossover. This signals weakening buy-side momentum and the potential for an extended decline.

XLM Bears Take Control: Technical and Social Metrics Align for Further Losses

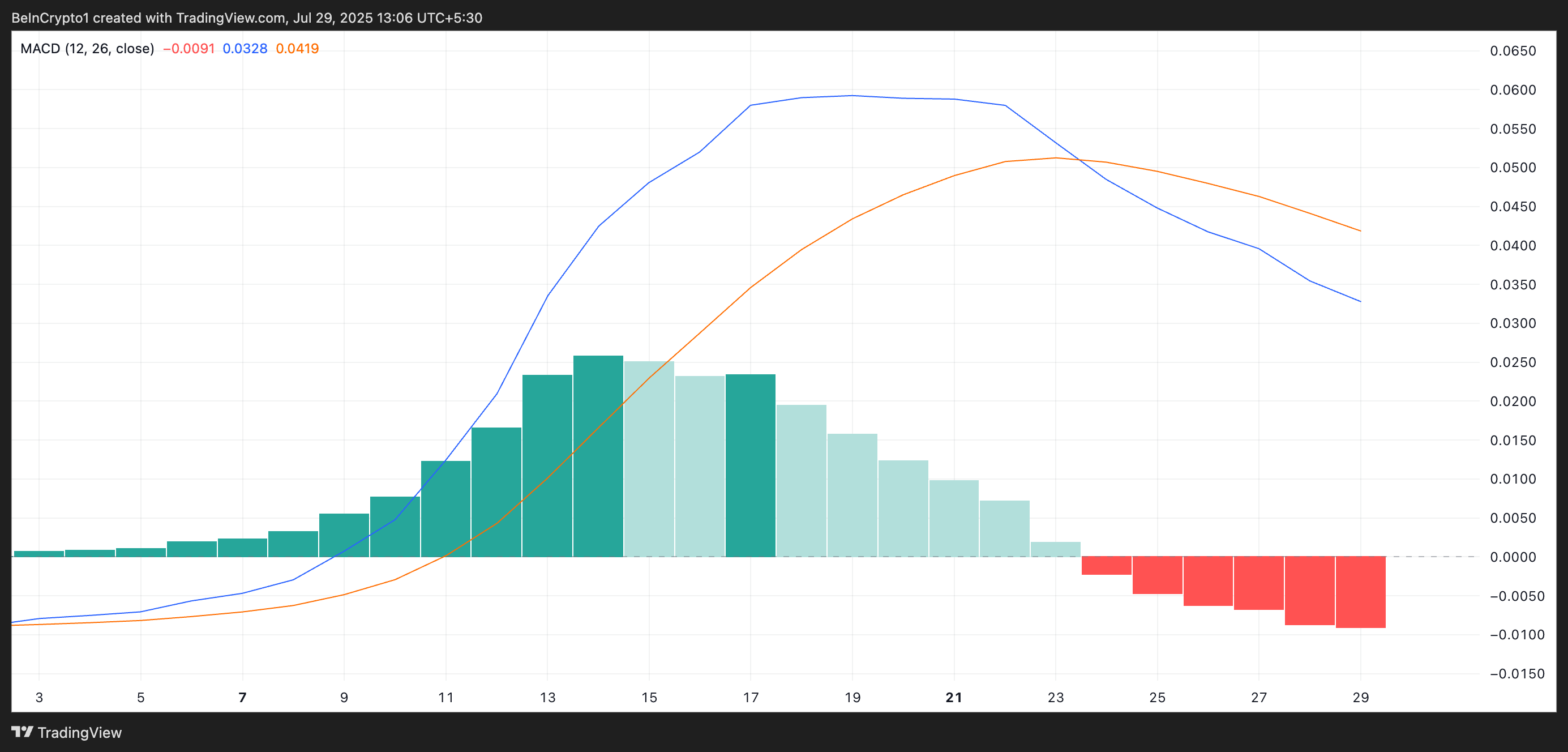

An assessment of the XLM/USD one-day chart reveals that the Moving Average Convergence Divergence (MACD) indicator formed a bearish crossover on July 24.

This occurs when an asset’s MACD line (blue) breaks below the signal line (orange). It happens when short-term momentum weakens and dips below the longer-term trend. It often marks the beginning of a downtrend or a period of sideways consolidation.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

XLM MACD. Source:

TradingView

XLM MACD. Source:

TradingView

Since the crossover emerged, XLM has mostly traded within a narrow range, facing persistent resistance around $0.44 while finding support at $0.41. This price action reflects a clear loss of bullish momentum and confirms the current period of low trading activity and indecision among market participants.

The lack of strong directional movement reinforces the bearish outlook for the altcoin, especially if support at $0.40 begins to weaken.

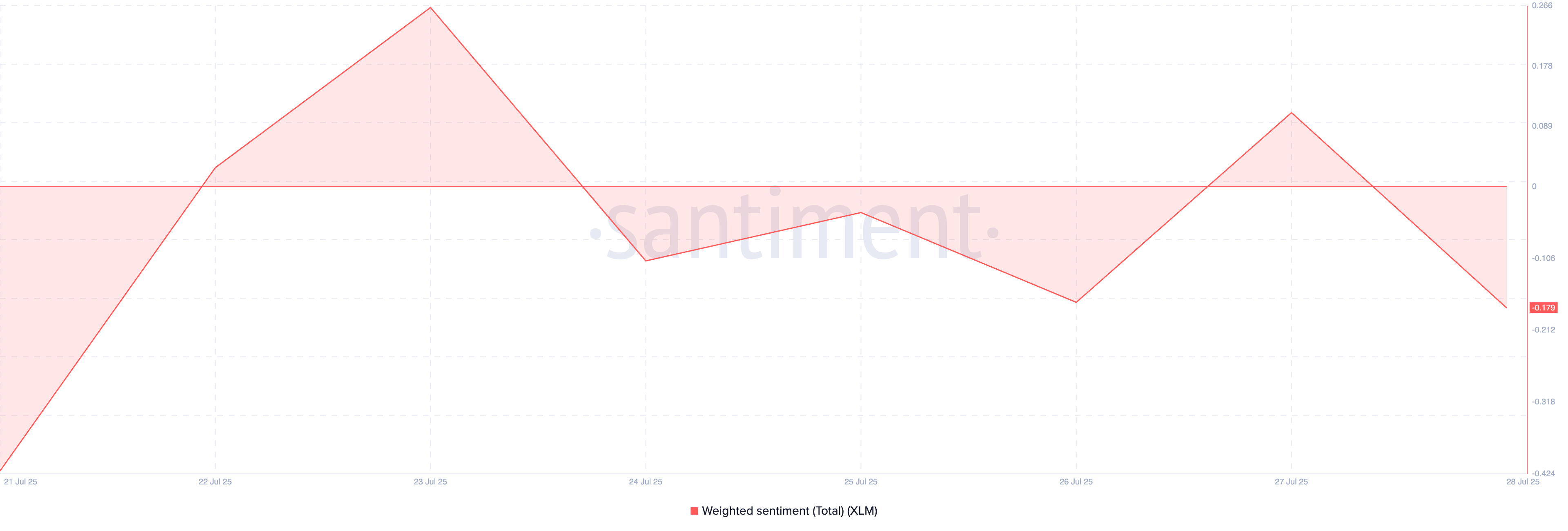

Furthermore, on-chain sentiment around XLM has also turned notably negative, amplifying the likelihood of a continued price slide. According to Santiment, the token’s weighted sentiment stands at -0.179, adding to the bearish pressures on its price.

XLM Weighted Sentiment. Source:

Santiment

XLM Weighted Sentiment. Source:

Santiment

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions.

When it is negative, it is a bearish signal, as investors are increasingly skeptical about the token’s near-term outlook. This prompts them to trade less, exacerbating the price decline.

One Push Could Send It to $0.39 or Trigger a Rebound

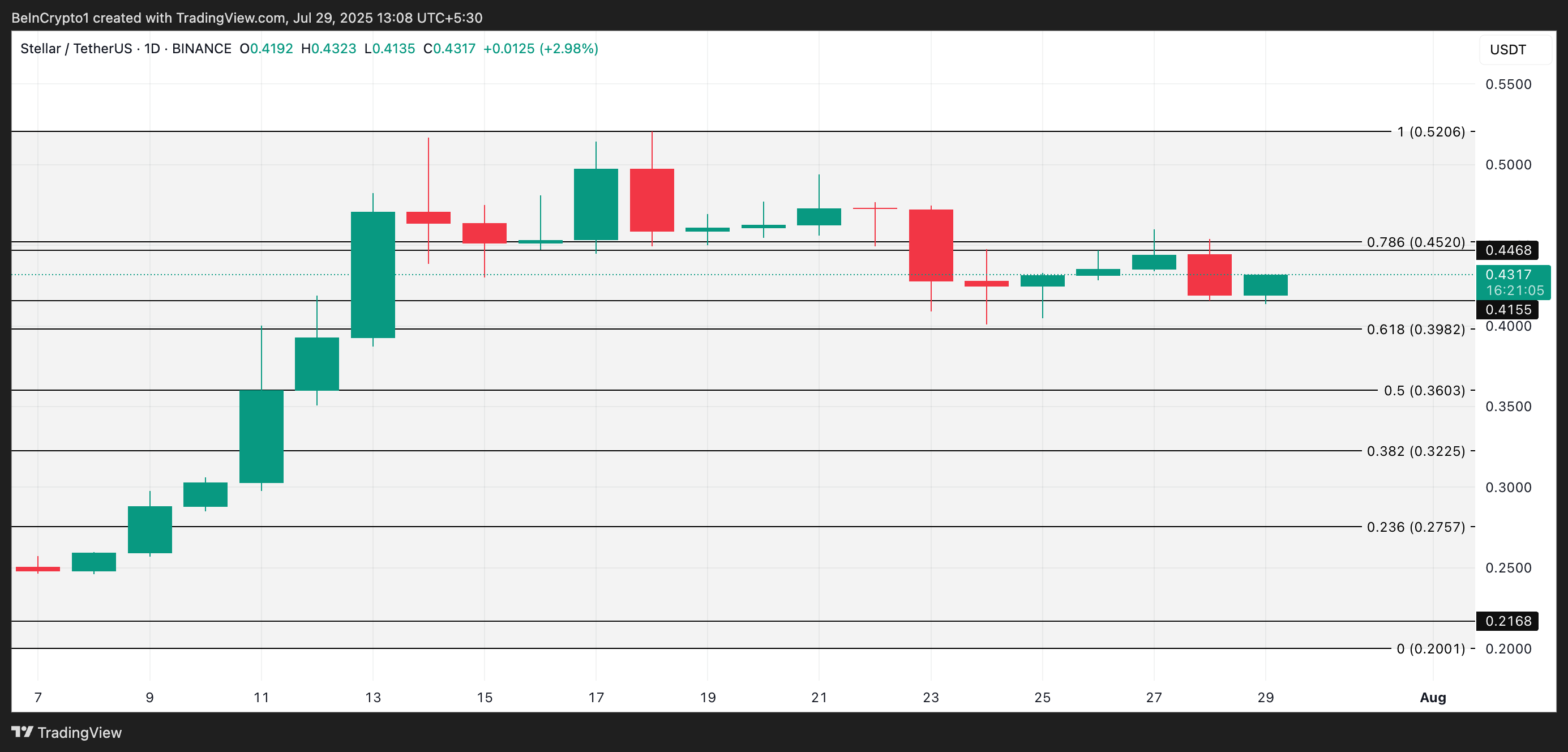

XLM trades at $0.43 at press time, down 2% amid the broader market pullback. If negative sentiment strengthens and new demand remains absent, the altcoin could break out of its narrow range and fall to $0.39.

XLM Price Analysis. Source:

TradingView

XLM Price Analysis. Source:

TradingView

Conversely, a resurgence in bullish sentiment could prevent this from happening. If buying activity resumes, XLM could reverse its current course, break resistance at $0.44, and rally toward $0.45.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The second round of the Web3 livestreaming track begins: If PumpFun is Taobao Live, then Sidekick is Douyin Live!

For PumpFun, livestreaming is merely a catalyst for token issuance; for Sidekick, livestreaming serves as a carrier for various types of content.

In-depth Analysis of the Capital Game Behind the "Difficult Birth" of the Korean Won Stablecoin

The launch of the Korean won stablecoin has already been delayed.

Deutsche Börse Launches Institutional Solution for OTC Crypto Trading