Bitcoin podcaster Aubrey Strobel launches boutique PR firm with a focus on emerging tech

Quick Take In addition to public relations and marketing, Halcyon will also offer content and video production services. The firm will work with early to mid-stage companies where they can “meaningfully shape growth, building narrative and go-to-market strategy from the ground up,” Strobel told The Block.

Former Lolli executives Aubrey Strobel and Elena Nisonoff announced Tuesday the launch of Halcyon, an internet-native boutique communications firm based in New York City.

The agency will help companies building in Bitcoin, stablecoins, and artificial intelligence "create narratives that connect with both the public and the markets," according to a release shared with The Block. In addition to public relations and marketing, the firm will offer content and video production services.

"It's no secret that Bitcoin, stablecoins, and artificial intelligence have been misrepresented for some time now," Strobel stated in the release. "The Golden Age of tech is here, we cannot let it slip away because the stories failed to reflect the innovation."

The firm will work with early to mid-stage companies where they can "meaningfully shape growth, building narrative and go-to-market strategy from the ground up," Strobel told The Block.

"We're taking a VC approach, treating our clients as long-term partners aligned with our core thesis: that Bitcoin, DeFi, AI, and stablecoins are reshaping global systems," she said in an email. "Halcyon goes beyond traditional PR, taking a modern approach to how brands are telling their story for the new era of comms."

Strobel, who has nearly 150,000 followers on X, is a filmmaker and the host of "The Aubservation" podcast. She is also an advisor to Trust Machines, which builds applications on the Bitcoin protocol. She was previously head of communications at Lolli, a bitcoin rewards company that was recently acquired by Thesis.

Strobel is the producer of "Lekker Feeling: A Bitcoin Ekasi Story," a short film that explores how the combination of bitcoin and surfing is transforming a South African community.

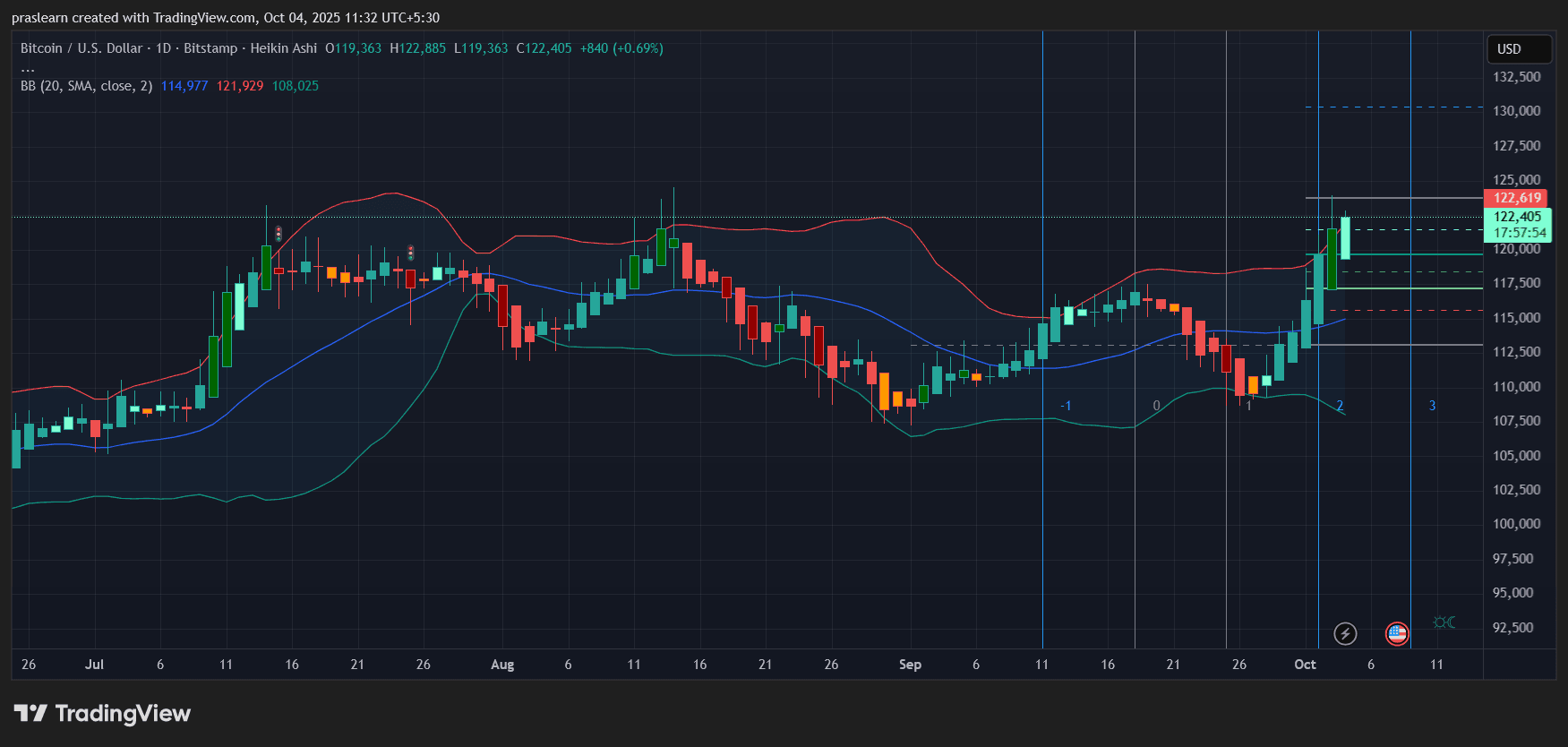

The launch of Halcyon comes after the price of bitcoin recently hit fresh all-time highs and the GENIUS stablecoin act became the first major crypto framework signed into U.S. law. Meanwhile, there could be around 15 crypto-related IPOs being prepared within the next two quarters, The Block's Yogita Khatri previously reported .

"Aubrey and I have spent years immersed in internet culture and emerging tech," Nisonoff stated in the release. "We have the unique advantage of understanding both culture and the markets, which gives us an edge in knowing where the conversation is going and how to help founders get there first."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will tariffs and Federal Reserve decisions make or break the bitcoin bull market?

As Bitcoin rises to $122,000, the Supreme Court is reviewing Trump's tariff authority and control over the Federal Reserve.

JPMorgan, Citi see Bitcoin Q4 boom: Here are their price targets

Bitcoin Surges as Crypto Market Hits $4.22 Trillion

BlackRock and Fidelity invest $212.3 million in Ethereum