VINE Risks a 50% Drop Despite Whales Buying the Dip

VINE price has plunged over 24% in the past day as retail holders exit despite whales buying the dip. Weak money flow and fragile technicals suggest a potential 50% downside risk unless bulls reclaim key levels soon.

After a blistering 300% monthly surge, the VINE price is now facing its harshest reality check yet. The token has declined by over 24% in the last 24 hours, dropping to $0.117, despite whales continuing to accumulate coins during the dip.

The divergence between whale confidence and retail behavior, paired with weakening money flow and a fragile technical setup, suggests this rally might not have enough fuel left to push higher anytime soon.

Whales Keep Accumulating as Retail Heads for the Exit

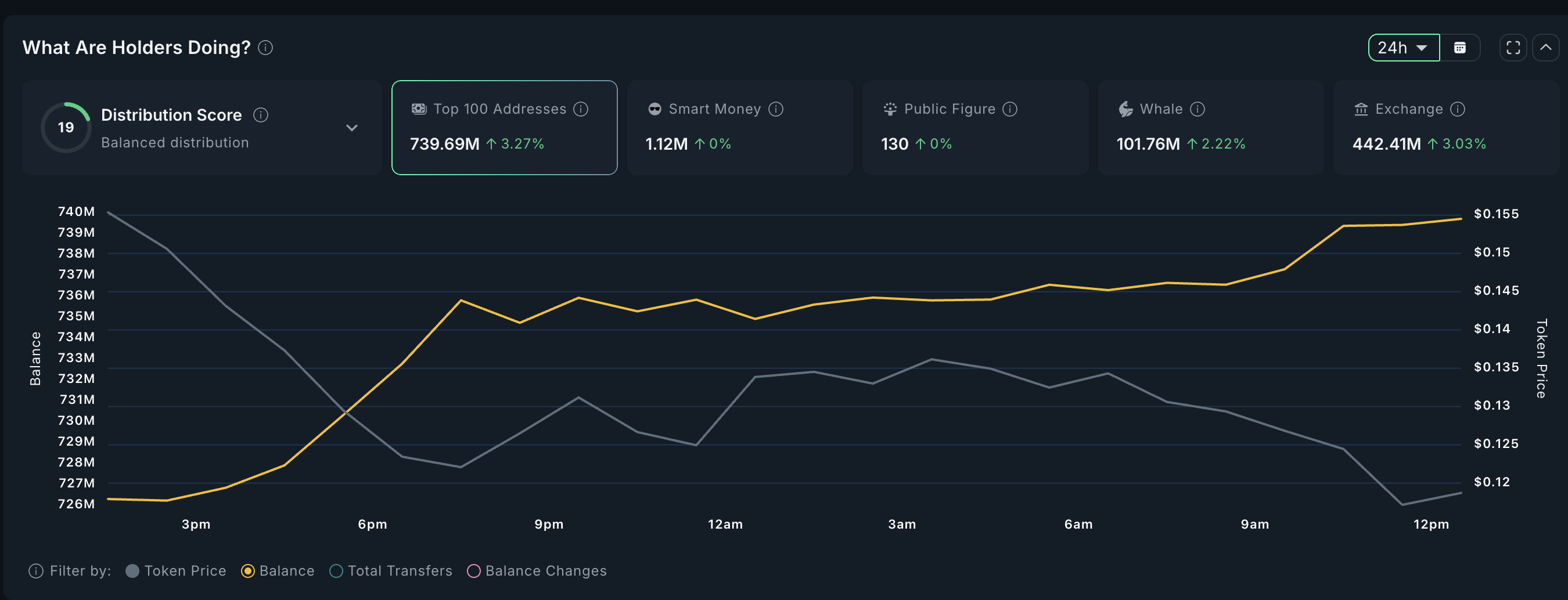

On-chain data from Nansen shows that the top 100 addresses added 3.27% more VINE in the last day, with whale wallets alone increasing holdings by 2.22%. Normally, that kind of buying would hint at growing conviction among big players. But the picture isn’t entirely bullish.

VINE price and holder momentum:

VINE price and holder momentum:

Exchange balances jumped 3.03% in the same period, meaning retail holders have been sending tokens to centralized exchanges, likely preparing to sell into strength.

This split in behavior has left VINE’s order books skewed. Whales are providing some buy-side support, but the lack of broader participation is already starting to eat into momentum. When retail flows out while big wallets try to catch falling prices, the market’s footing can quickly become unstable.

Money Flow Drains as Bullish Momentum Fades

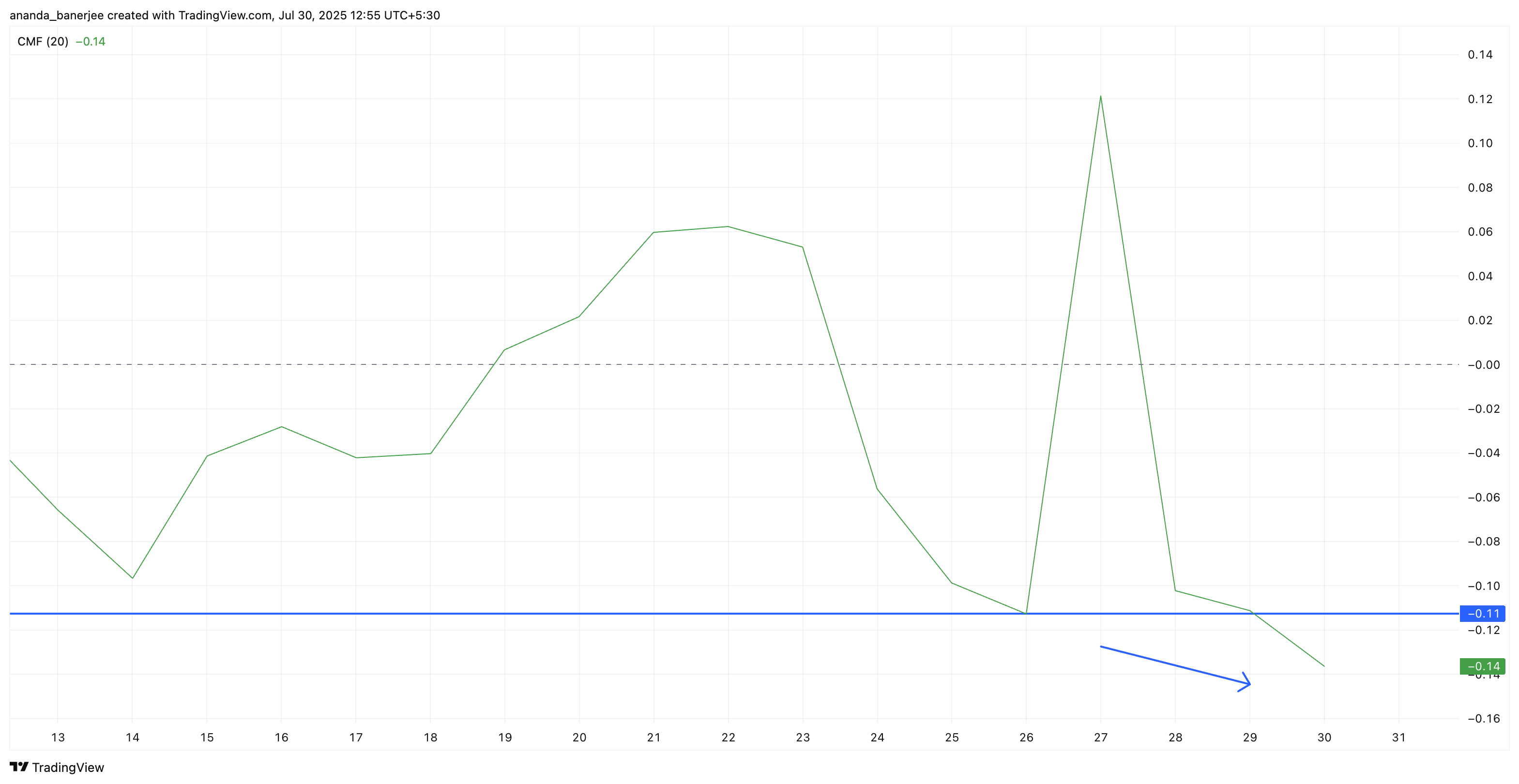

The Chaikin Money Flow (CMF), which tracks whether capital is entering or leaving the market, has fallen sharply to -0.14, even lower than levels before this month’s VINE price rally began. That signals a tide of selling pressure outweighing the pockets of whale accumulation.

VINE’s CMF is dipping:

VINE’s CMF is dipping:

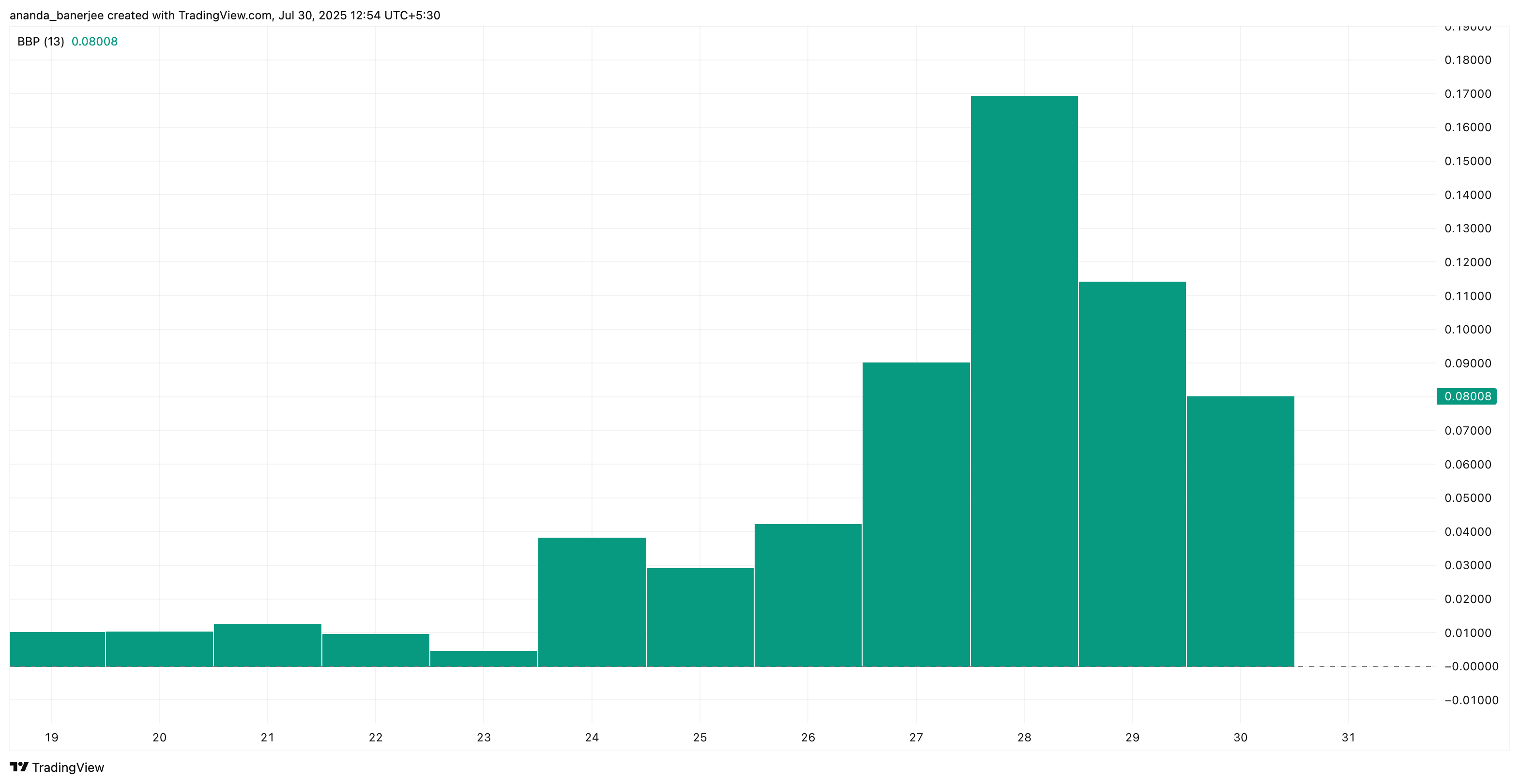

Alongside this, the Bull Bear Power (BBP) indicator, a measure of buying versus selling strength, has cooled off noticeably since July 28, showing that bullish momentum is no longer building as it once was.

Bull power is weakening:

Bull power is weakening:

These readings hint that VINE’s explosive run may have been more hype-driven than sustainably supported. With fresh money failing to enter the market and sellers taking control, the token is showing signs of exhaustion, leaving the VINE price action vulnerable to sharper moves down.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

VINE Price Setup Flags Fragile Support and Steep Downside Risk

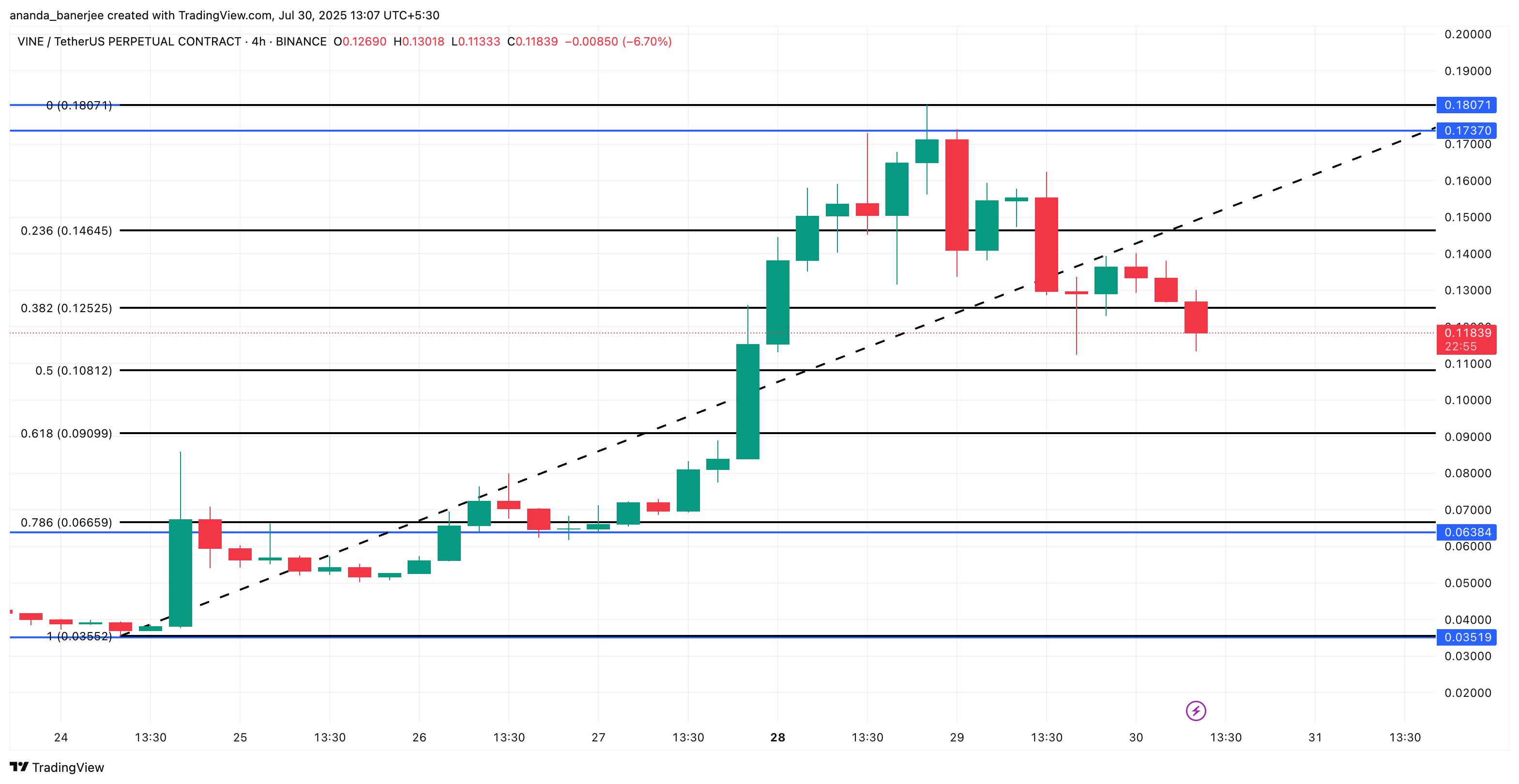

VINE’s 4-hour chart gives a clearer view of short-term volatility, and the picture isn’t encouraging. The token price is forming an ascending wedge, a pattern that often signals a bearish reversal.

VINE price pattern:

VINE price pattern:

VINE price is now clinging to support at $0.1129. A breakdown here opens the path toward the next major support around $0.063, nearly a 50% drop from current levels.

VINE price analysis:

VINE price analysis:

Fibonacci levels on the same timeframe highlight where bulls need to step in to change the story. A move back above $0.1465 could invalidate this bearish outlook and revive upward momentum.

Until then, the path of least resistance looks lower, with whale buying alone unlikely to stop further corrections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price gets $92K target as new buyers enter 'capitulation' mode

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.