BNB’s All-Time High Euphoria Fizzles as Mid-Term Holders Dump Bags

BNB price has fallen 7% since its $858 ATH, with mid-term holders selling and buying momentum fading. Weak OBV and early bearish signals put a new all-time high on hold.

BNB’s explosive surge to a new all-time high of $858 just days ago has faded fast, with the coin now hovering around $800, down nearly 7% in the last 24 hours. The quick reversal has traders questioning whether a new BNB all-time high is anywhere close, or if sellers are already tightening their grip.

On-chain data shows mid-term holders cashing out, buying power losing momentum, and early bearish signs flashing on lower timeframes. For now, the rally looks vulnerable, and another push to new highs may have to wait.

Mid-Term Holders Step Back, Slowing the Rally

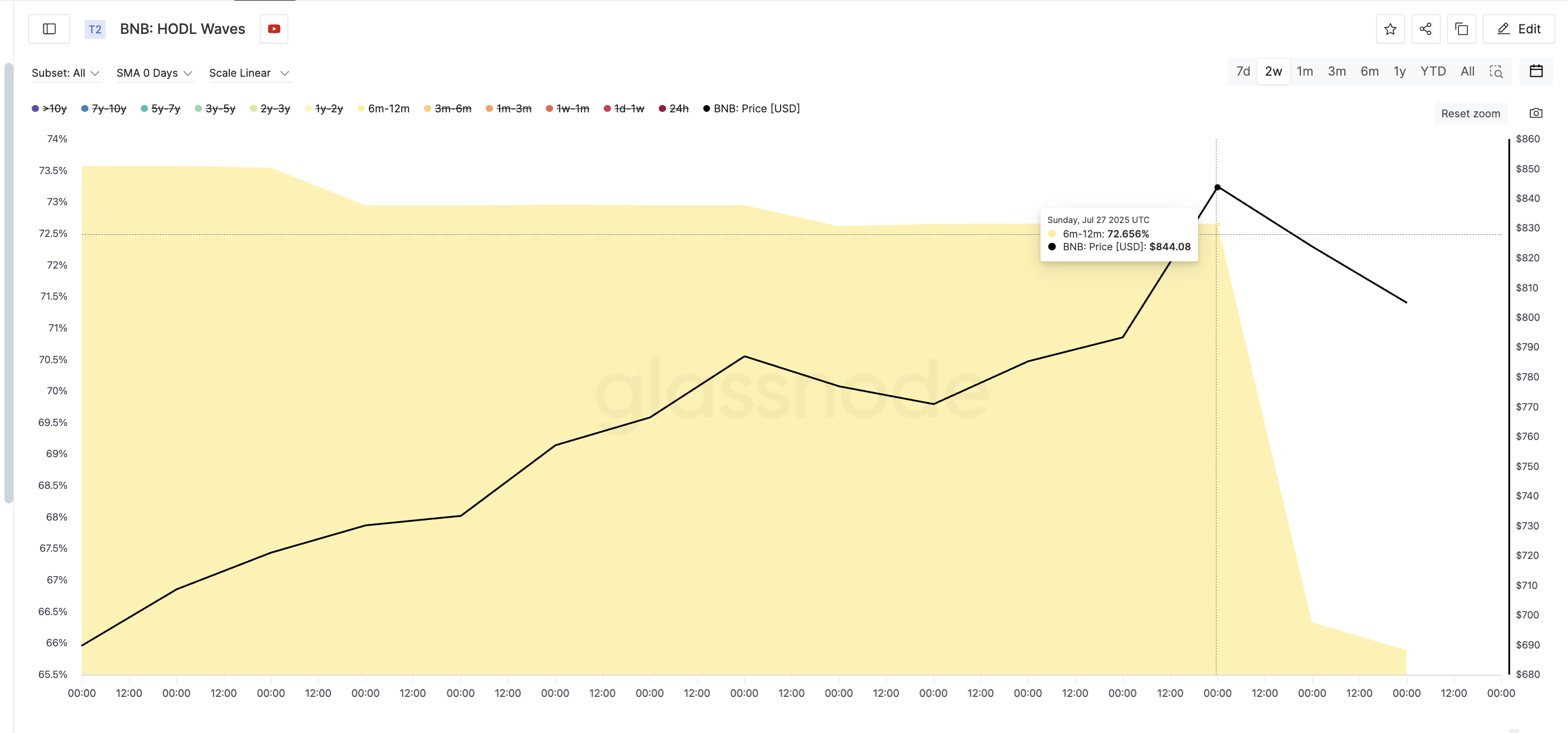

When coins are held for 6–12 months, this group usually acts as steady hands, helping sustain a trend. But in the past three days, the HODL wave for this cohort dropped sharply, from 72.65% of supply on July 27 to just 65.88% at the time of writing.

BNB price and shrinking HODL wave:

Glassnode

BNB price and shrinking HODL wave:

Glassnode

This shift is significant because it shows that mid-term holders are distributing, locking in profits after the record peak. With fewer of these conviction-driven wallets holding supply, there’s less buffer against selling pressure, making it harder for the BNB price to launch a clean move toward a new all-time high.

HODL waves track how long coins stay in wallets. A shrinking wave in the mid-term bracket often signals weakening market conviction.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

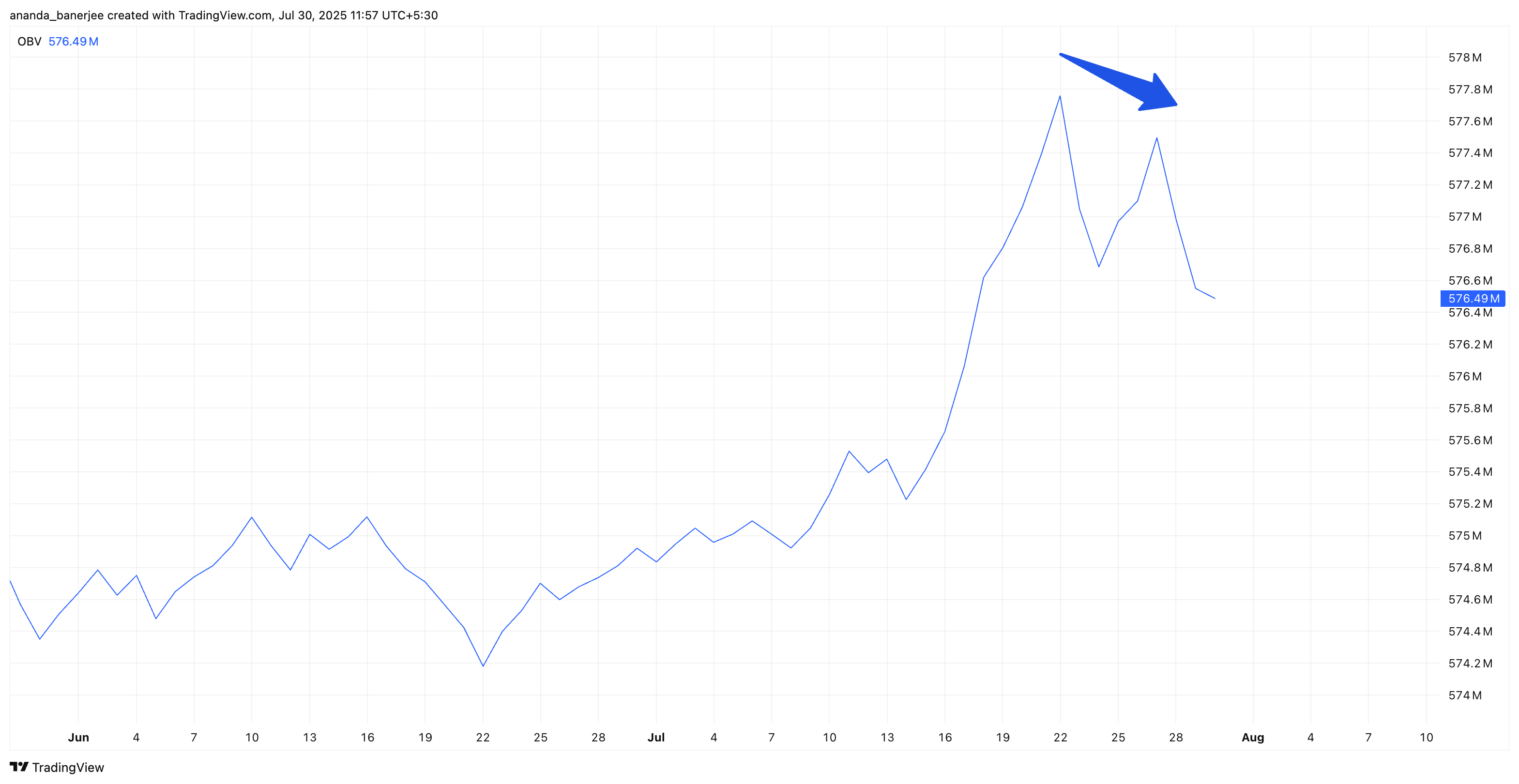

OBV Momentum Falters, Early Bearish Signal Forms

The On-Balance Volume (OBV) on the daily timeframe is printing lower highs, showing that buying pressure is not keeping pace with price attempts near $800. Weakening OBV after an all-time high often points to rallies losing depth, as fewer buyers step in to push the move further.

Weakening on balance volume:

Weakening on balance volume:

To validate this, the 2-hour chart, an early momentum timeframe, shows the 20-period EMA (Exponential Moving Average) or the red line converging toward a bearish cross below the 50-period EMA (orange line).

This type of setup frequently precedes broader trend reversals, appearing on lower timeframes before the daily chart reflects the weakness. The BNB price might correct further if the bearish “death” crossover takes place.

2-Hour BNB price action and looming crossover risk:

2-Hour BNB price action and looming crossover risk:

Combined, shrinking HODL waves and falling OBV suggest the recent ATH euphoria is fading fast, leaving BNB exposed to another leg lower before a fresh breakout can materialize.

OBV measures cumulative trading volume flow — when it trends lower as price holds up, it often signals weakening demand.

BNB Price Levels: Bulls Need to Regain Key Zones

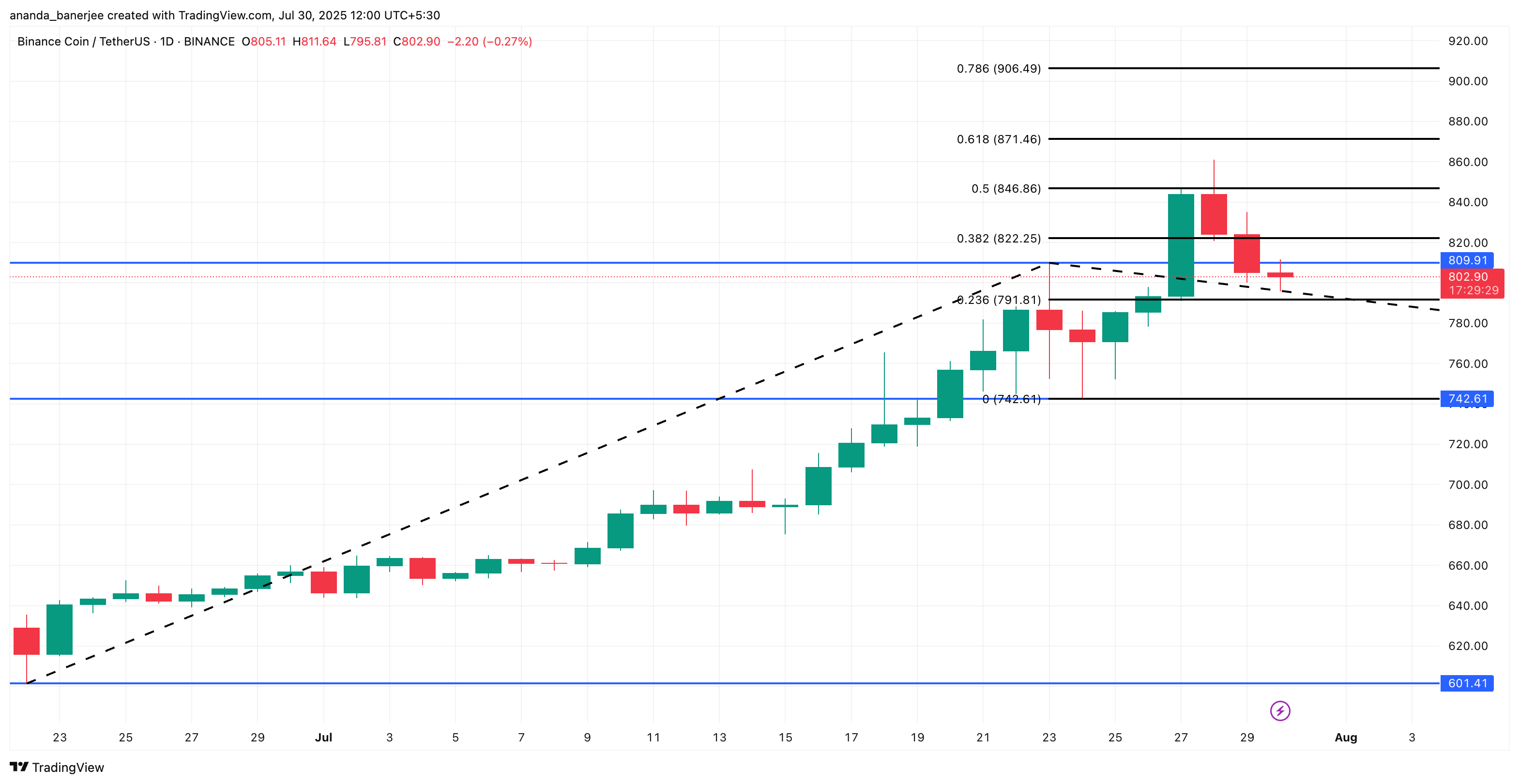

BNB’s broader trend is still intact, which is why trend-based Fibonacci extension levels are used instead of retracement. They map how far the rally could stretch if momentum returns.

BNB price analysis:

BNB price analysis:

For now, the price faces:

- Resistance: $822 remains a firm ceiling. Breaking above it opens a retest of the all-time high, with possible extension toward $871.

- Support: $791 is holding the line. If it gives way, there’s room to fall toward $742 ( almost 7% lower) with little in the way of support below.

Bulls must reclaim $871, turning it into support, to scrap the short-term bearish setup and reignite all-time high hopes.

BNB’s sharp retreat from record highs doesn’t kill the bigger uptrend, but with mid-term holders selling, volume fading, and bearish signals emerging on lower timeframes, a quick new all-time high might take some time to surface.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interop roadmap "accelerates": After the Fusaka upgrade, Ethereum interoperability may reach a key milestone

a16z "Big Ideas for 2026: Part Two"

Software has eaten the world. Now, it will drive the world forward.

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.