Analysts Predict the Next Wave of Capital Flow Into Altcoin/ETH Pairs

Market analysts predict that capital will rotate into altcoin/ETH pairs later in 2025, as ETH gains momentum and altcoin ratios signal rising investor interest. Understanding this timing may offer traders an edge in capturing dual profits.

Altcoin/ETH trading pairs can offer traders opportunities to earn dual profits. They can increase their ETH holdings and wait for ETH’s price to rise, thereby achieving double returns.

However, this strategy isn’t easy. Determining when capital will flow into altcoin/ETH pairs is the most difficult part. Below are some notable insights from market analysts.

Signs That Capital May Soon Flow into Altcoins

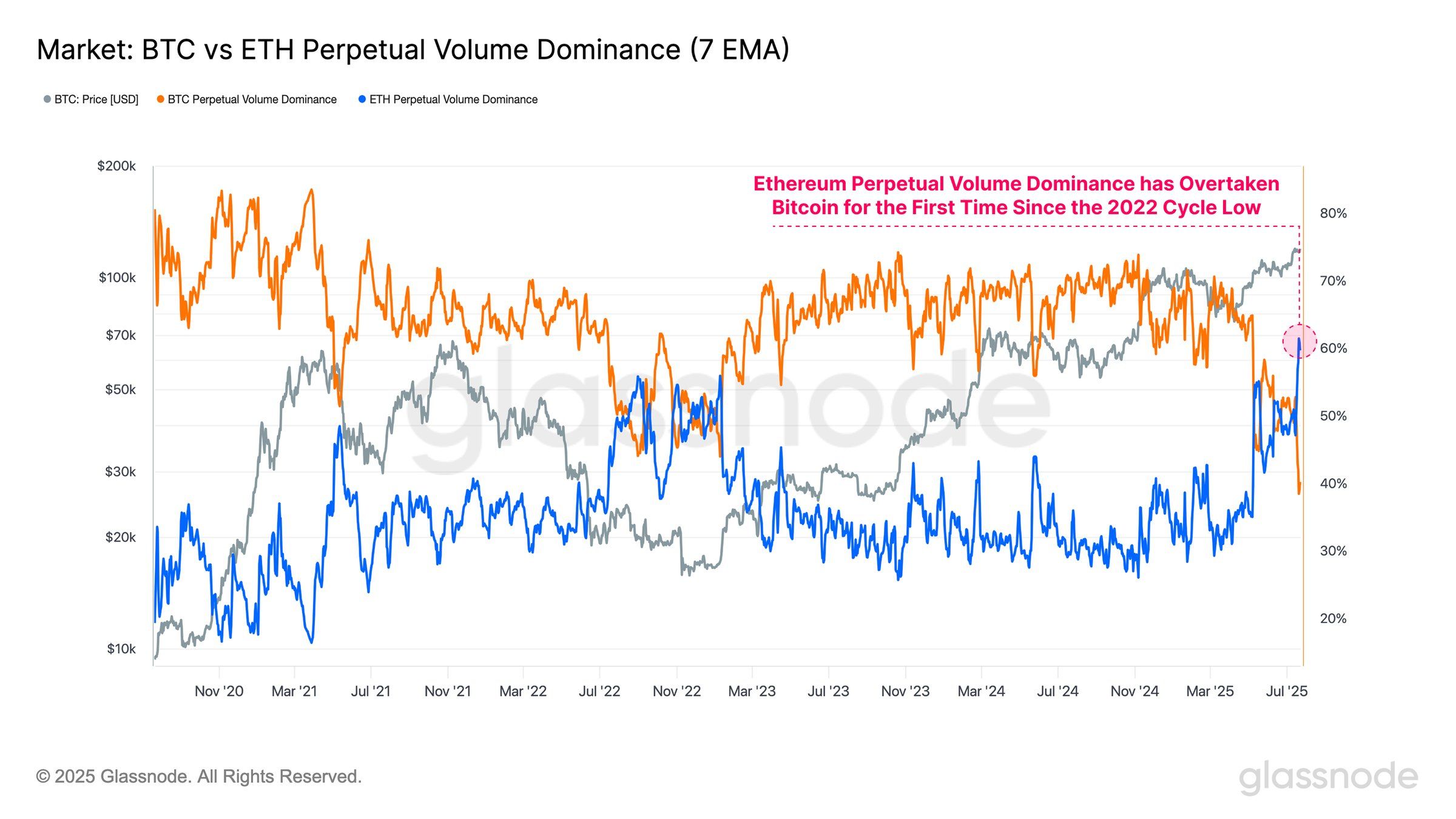

Ethereum’s perpetual volume dominance recently surpassed Bitcoin’s for the first time since the cycle low in 2022. This marks the largest recorded volume skew in favor of ETH.

BTC vs ETH Perpetual Volume Dominance. Source:

Glassnode

BTC vs ETH Perpetual Volume Dominance. Source:

Glassnode

ETH accounted for more than 60% of perpetual volume by the end of July. This indicates that traders are now trading ETH more actively than BTC.

According to Glassnode, this shift also points to a growing speculative interest in the altcoin sector.

“This shift confirms a meaningful rotation of speculative interest toward the altcoin sector,” Glassnode reported.

Glassnode’s view aligns with the recent opinions of several market analysts. They believe the market is currently in Phase 2 (capital flowing into ETH) and is preparing to enter Phase 3 (capital moving into other altcoins).

When Should Investors Pay Attention to Altcoin/ETH?

When investors buy ETH and wait for profits, they look for opportunities in underperforming Altcoin/ETH pairs instead of simply holding ETH.

The main concern is that these pairs come with double risk. The first is a drop in ETH’s price. The second is a sell-off in the altcoin/ETH pair, which can lead to double losses. However, with proper timing, investors can earn double gains from both sides.

By observing the performance of altcoin market cap (TOTAL3 – excluding BTC and ETH) relative to ETH, well-known market analyst Benjamin Cowen noted that Altcoin/ETH pairs have dropped an average of 40% since the 2025 peak.

He predicted further declines as long as ETH’s rally continues.

Analyst Colin Talks Crypto shared a similar view but believes that a reversal will come eventually.

“It’s ETH Season. ETH may outperform lower ALTS for a while yet. If I were to take a guess, I’d say the path will go something like this, down to the lower trend line. When this line drops it means ALTs lose value relatively to ETH. Only in the very final stage of the bull run do ALTs perform better than both ETH and BTC,” Colin Talks Crypto predicted.

Altcoin Market Cap (TOTAL3) vs ETH. Source:

Colin Talks Crypto

Altcoin Market Cap (TOTAL3) vs ETH. Source:

Colin Talks Crypto

This analysis suggests that the golden time to trade Altcoin/ETH pairs could fall in the year’s final quarter. However, along the way, there may be short-term recoveries in these pairs. Several other analysts agree with this view.

Analyst Rekt Fencer also relied on the above chart and offered a more specific scenario: when ETH reaches $7,000–$8,000, rotate into Altcoin/ETH pairs to maximize returns.

Everyone is obsessed with ALTS/BTC.The chart you should ACTUALLY be watching is ALTS/ETH.It's at a make or break level right now.Alts don't run unless ETH leads the way.So for now the best play is to hold $ETH itself.And when it gets to $7-8k, rotate into alts. pic.twitter.com/pFl6Qbita9

— Rekt Fencer (@rektfencer) July 27, 2025

However, by monitoring the ratio of the OTHERS market cap (excluding the top 10) to ETH, one might spot earlier signs.

Altcoin Market Cap (OTHERS) vs ETH. Source:

TradingView

Altcoin Market Cap (OTHERS) vs ETH. Source:

TradingView

This ratio has risen from 0.21 to 0.27 over the past month, indicating that altcoins outside the top 10 are beginning to outperform ETH. This reflects investor sentiment shifting toward mid-cap and low-cap opportunities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price taps $117K as traders brace for Fed rate cuts

Bitcoin slips below $115K after Fed implements quarter-point interest rate cut

AiCoin Daily Report (September 16)

Is Ethereum Currently Undervalued At $4,700? NVT Reading Suggests So As New Crypto Shines Alongside ETH