- Solana dominance has rebounded from the 2.1%–2.4% demand zone, now sitting at 2.56% after repeated tests.

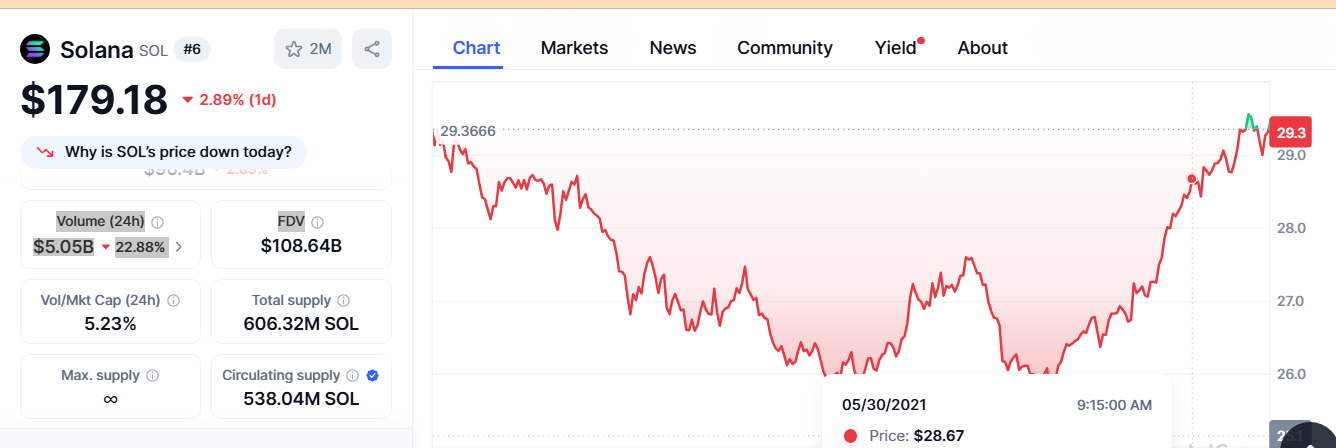

- Price trades at $178.87 with defined support at $178.77 and resistance at $184.70, forming a narrow trading range.

- Trading volume fell 22.93% to $5.05B, while market cap declined 3.03% to $96.42B, showing reduced activity despite stable dominance.

Solana’s market dominance has rebounded from the 2.1%–2.4% demand block after several months of testing this zone. Current dominance stands at 2.56%, reflecting a recent recovery from lower levels. This movement occurs as Solana’s price trades at $179.18, recording a 2.89% decline in the last 24 hours. Despite the pullback, dominance trends show potential strength if the 3% threshold is reclaimed, which previously acted as a pivotal level.

Source: CoinMarketCap

Source: CoinMarketCap

The connection between dominance and price remains notable. Solana’s market cap now sits at $96.42 billion after a 3.03% daily decline, while 24-hour trading volume has dropped by 22.93% to $5.05 billion. This volume decrease follows a broader market slowdown, but Solana’s ability to hold near critical dominance levels introduces an important technical observation.

Key Support and Resistance Levels in Focus

Support remains concentrated near $178.77, a level that has been tested repeatedly in recent sessions. The proximity of this support to current price levels creates a tightly defined range for traders. Resistance is currently positioned at $184.70, establishing the upper boundary Solana must surpass to regain stronger upside momentum.

Notably, the demand zone for dominance between 2.1% and 2.4% continues to act as a foundation. This range has contained multiple retests since early 2025. A sustained rebound from this zone could position Solana to test the 3% dominance mark, which has historically preceded extended moves.

The correlation between dominance and price further aligns with these levels. While price has softened, dominance remains stable, suggesting the market is holding relative strength in this metric despite declining spot prices.

Solana Dominance Rebounds as Key Levels Define Next Market

Solana’s fully diluted valuation currently stands at $108.66 billion, placing it among the leading layer-1 assets. The dominance recovery adds context to the broader market picture, especially with capital flows consolidating in defined ranges. As a result, monitoring dominance levels may remain critical for understanding Solana’s next directional phase.

Furthermore, the chart data emphasizes a clear rebound off the highlighted demand block. If Solana maintains this zone , dominance could build a stronger base for a potential upward test toward 3%. However, short-term trading conditions remain tied to price support at $178.77 and the resistance threshold of $184.70. As these levels compress, upcoming sessions may determine whether Solana’s dominance continues stabilizing within its historical range or advances to test higher territory.