ZORA Shows Signs of Exhaustion After All-Time High as Bears Eye a Reversal

After a strong rally in July, Solana's momentum is waning as the price drops and network activity slows. August may bring further challenges unless sentiment improves.

ZORA’s price performance has taken a bearish turn in the past 24 hours, slipping further from its new all-time high of $0.105.

The downturn follows a reduction in whale activity and a modest rise in exchange inflows, signaling the start of a profit-taking cycle.

ZORA Whales Exit as Token Nears Peak — Is a Correction Coming?

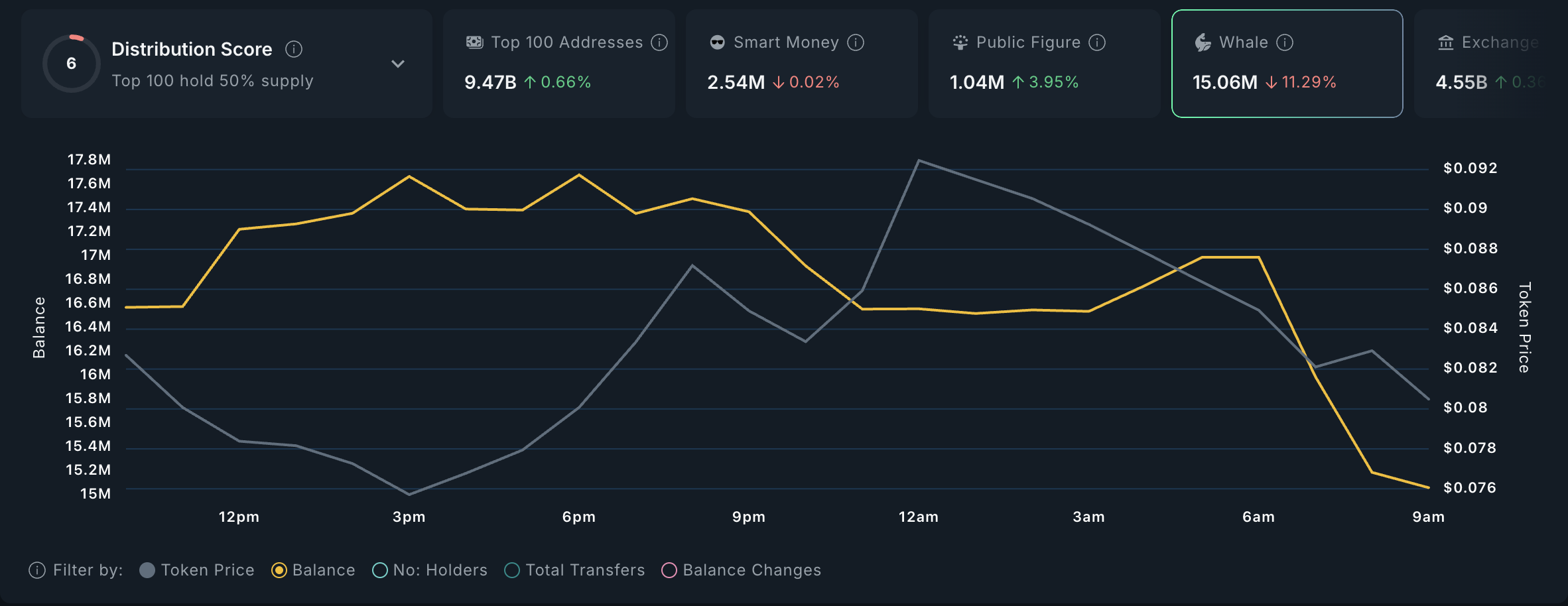

Data from Nansen reveals a sharp decline in ZORA’s large holder activity over the past 24 hours.

According to the on-chain data provider, the balance held by high-value wallets—those holding over $1 million worth of ZORA—has dropped by nearly 11% in a single day, signaling a notable shift among key stakeholders.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZORA Whale Activity. Source:

Nansen

ZORA Whale Activity. Source:

Nansen

The sudden pullback comes after ZORA’s rally to its all-time high of $0.105. With rising market volatility and uncertainty creeping into the broader altcoin space, whales appear to be trimming their exposure while the token’s price remains high.

This wave of profit-taking from whales could also set off a domino effect among retail traders. With confidence in the short-term trend weakening, smaller holders may be inclined to follow suit, worsening the downward pressure on ZORA’s price.

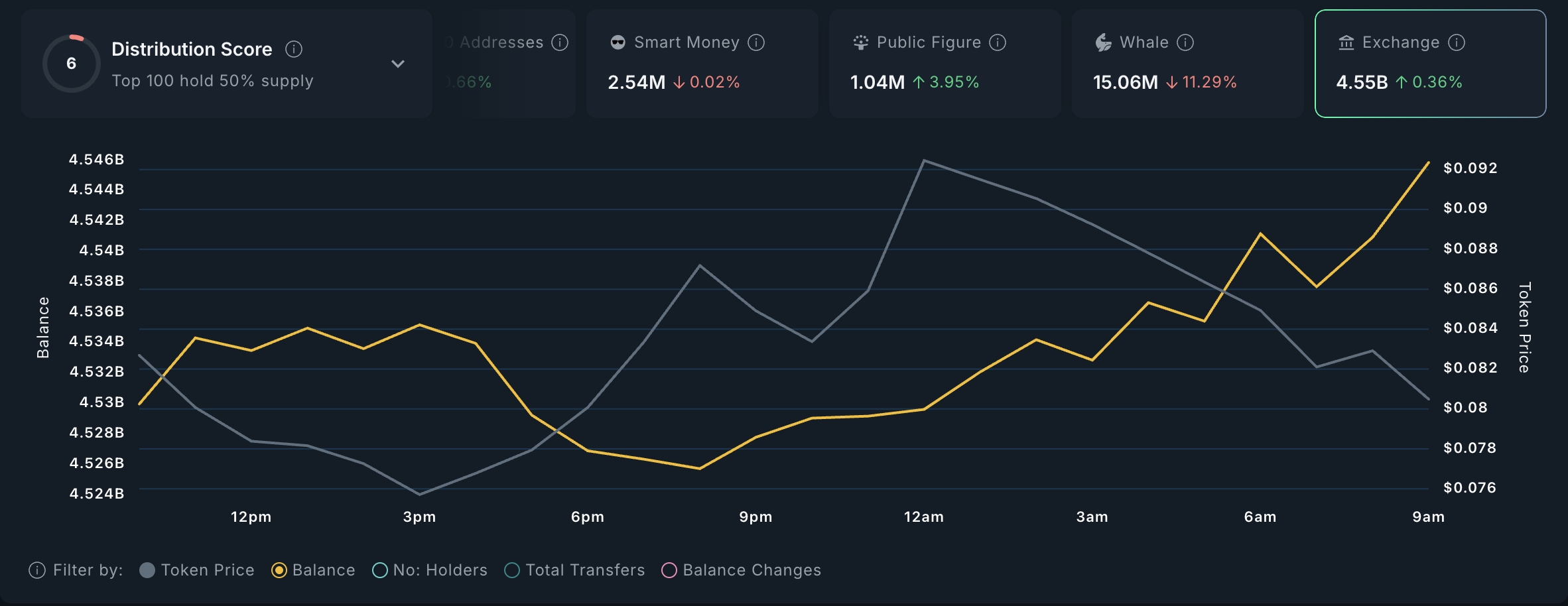

Furthermore, ZORA has noted a modest 0.36% uptick in its holdings across exchanges over the past day. This suggests a rise in the number of tokens sent to trading platforms since ZORA recorded an all-time high.

ZORA Exchange Activity. Source:

Nansen

ZORA Exchange Activity. Source:

Nansen

When an asset’s exchange inflow spikes, it is often a sign that holders are preparing to sell. The rising inflow combined with the dip in whale activity and declining buy-side momentum adds to bearish pressure, increasing the likelihood of a ZORA price correction in the short term.

ZORA Weakens as Sellers Take the Lead

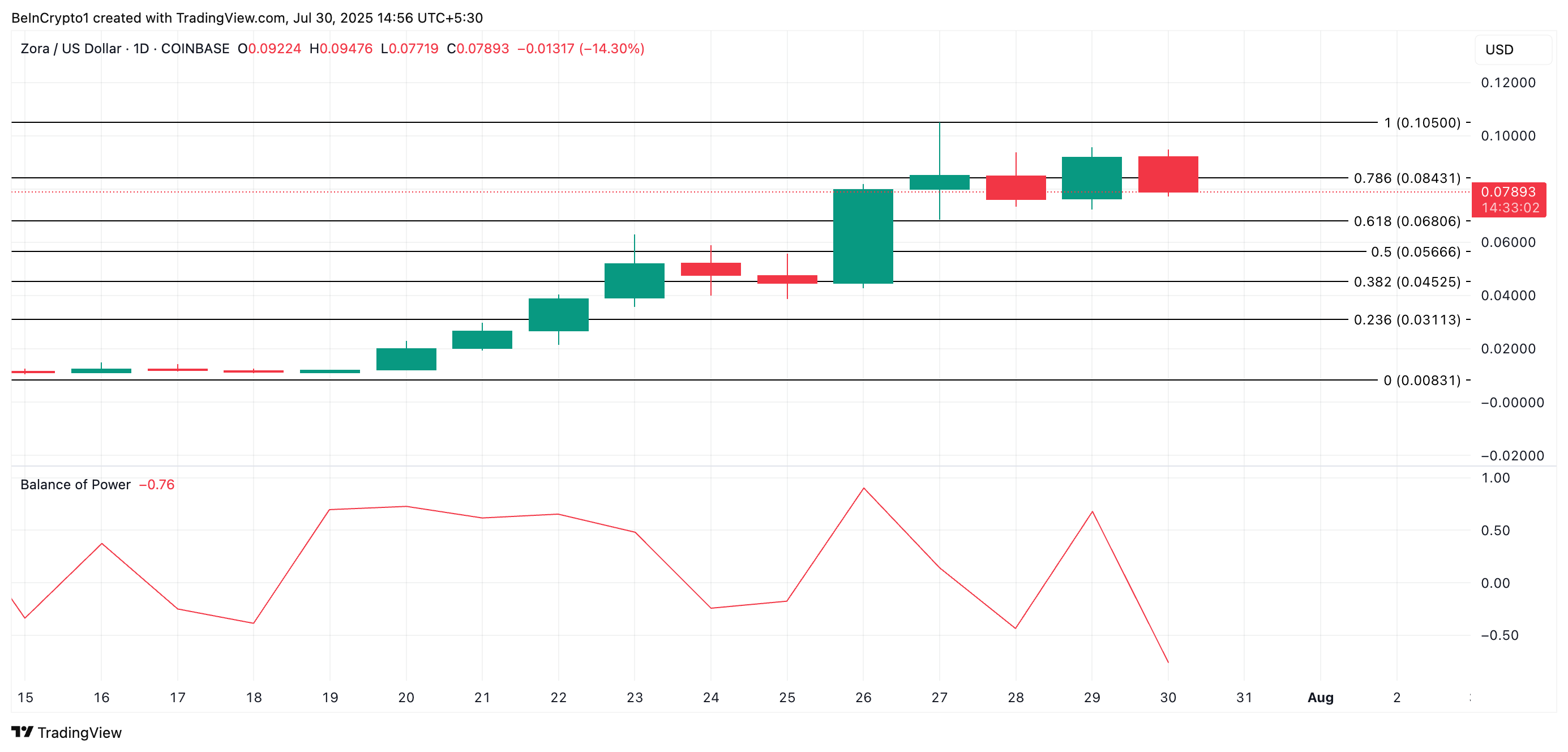

From a technical perspective, ZORA’s Balance of Power (BoP) indicator is negative at press time, highlighting the clear decline in buying pressure. At press time, the momentum indicator, which measures buying and selling pressures, is at -0.76

This suggests that the bulls are losing control, and sellers are beginning to dictate market direction.

If this continues, ZORA’s price could plummet to $0.068.

ZORA Price Analysis. Source:

TradingView

ZORA Price Analysis. Source:

TradingView

On the other hand, a rise in buy-side strength could trigger a breach of the resistance at $0.084 and a rally back to $0.105.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.

JPMorgan Chase issues Galaxy short-term bonds on Solana network

The three giants collectively bet on Abu Dhabi, making it the "crypto capital"

As stablecoin giants and the world's largest exchange simultaneously secure ADGM licenses, Abu Dhabi is rapidly emerging from a Middle Eastern financial hub into a new global center for institutional-grade crypto settlement and regulation.

Bitcoin liquidity has been reshaped. Which new market indicators should we focus on?

Currently, the largest holders of bitcoin have shifted from whales to publicly listed companies and compliant funds. The selling pressure has changed from retail investors' reactions to the market to capital impact from institutions.