FOMC Report Causes Bitcoin Dip: Will Sell-Side Pressure Drag Prices Lower?

Bitcoin faces potential downward pressure after a brief dip following the FOMC report. A recovery above $120,000 is crucial for pushing toward new highs, while a drop below $117,261 could signal further losses.

Bitcoin’s price has been rangebound for the last few days, consolidated between $117,261 and $120,000. However, recent market conditions and external influences, such as the Federal Open Market Committee (FOMC) meeting on Wednesday, caused a temporary decline.

As of now, Bitcoin is priced at $118,419, slightly recovering after dipping to $115,700. Despite this recovery, Bitcoin’s path remains uncertain, owing to factors such as sell-side pressure.

Bitcoin is Showing Signs of a Decline Ahead

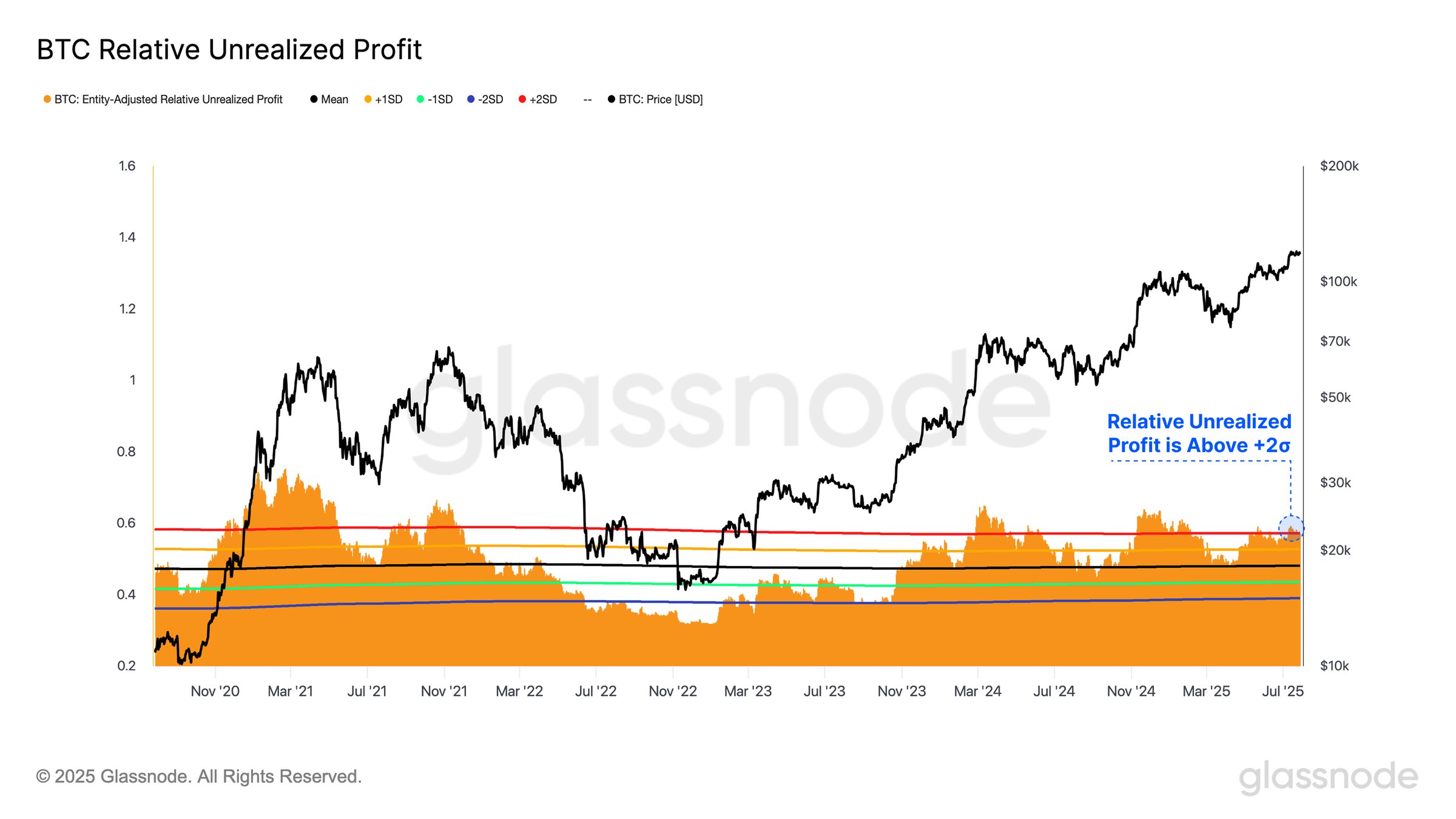

The Relative Unrealized Profit (RUP) has recently broken above the +2σ band, a level often associated with euphoric market phases. Historically, this setup has preceded market tops, signaling a latent sell-side pressure that could eventually drag prices lower.

The current state of the RUP indicates that a pullback may be likely in the coming days, potentially pushing Bitcoin’s price out of its consolidation range. Given past patterns, a shift toward selling could result in further downward pressure.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Unrealized Profit Source:

Bitcoin Unrealized Profit Source:

Bitcoin Unrealized Profit Source:

Bitcoin Unrealized Profit Source:

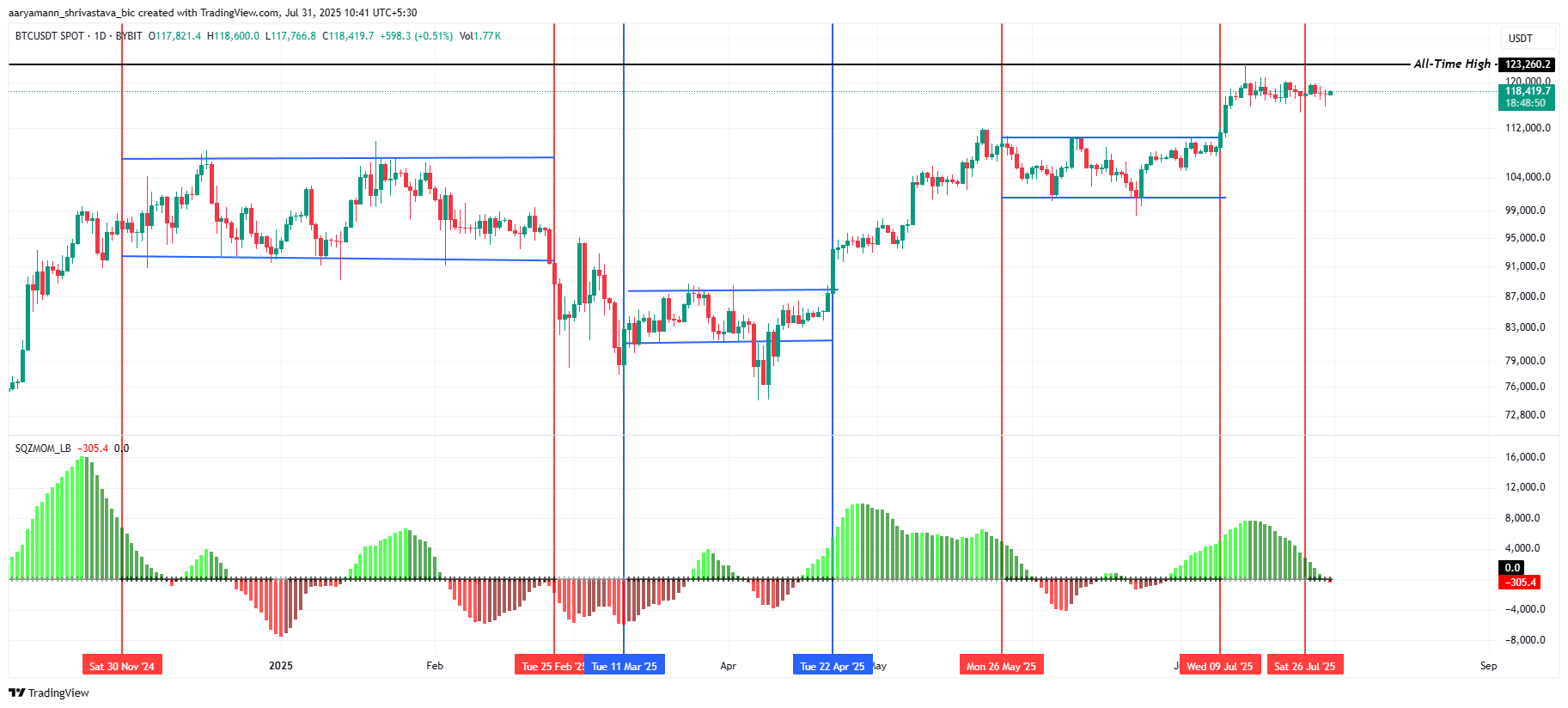

The Squeeze Momentum Indicator (SMI) is signaling that Bitcoin is entering a consolidation phase. Historically, these periods of consolidation, where price movement becomes more limited, have preceded significant price moves once the squeeze is released.

As the squeeze continues to build, Bitcoin’s price is poised for a sharp move in one direction. If the broader market remains bearish, Bitcoin could see a sharp decline, particularly if the SMI confirms this negative trend in the coming days.

Bitcoin SQM. Source:

Bitcoin SQM. Source:

Bitcoin SQM. Source:

Bitcoin SQM. Source:

BTC Price Needs To Jump

Bitcoin is currently trading at $118,410, after falling to $115,700 on Wednesday as the FOMC report came out. The market’s response to the Federal Reserve’s decision to keep interest rates unchanged led to BTC’s recovery, but the underlying market conditions still pose risks.

Bitcoin’s price is susceptible to further declines if investors start booking profits, potentially pushing the cryptocurrency below the $117,261 support level. A drop past this support could lead Bitcoin’s price to $115,000 or even lower.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

The only way this bearish outlook would be invalidated is if Bitcoin manages to hold above $120,000 and reclaim $122,000 as support. A surge above these levels would likely provide the momentum needed to push Bitcoin toward new highs. However, until that happens, Bitcoin’s price remains vulnerable to fluctuations and market pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CRP-1 Arrives: A Comprehensive Analysis of Hong Kong's New Crypto Asset Regulations, Reshaping the Crypto Landscape

The Hong Kong Monetary Authority has released a consultation paper, CRP-1 "Crypto Asset Classification," aiming to establish a regulatory framework that balances innovation and risk control. The paper clarifies the definition and classification of crypto assets, as well as regulatory requirements for financial institutions, aligning with international standards set by the BCBS. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

Former BlackRock Executive Joseph Chalom: Why Ethereum Will Reshape Global Finance

Could Ethereum become one of the most strategic assets of the next decade? Why do DATs offer a smarter, higher-yield, and more transparent way to invest in Ethereum?

Bitcoin price gains 8% as September 2025 on track for best in 13 years

Ethereum unstaking queue goes ‘parabolic’: What does it mean for price?